Self-Direction Guidance for Providers March 10, 2022

Page 1 of 66

Self-Direction Guidance for Providers March 10, 2022

Page 2 of 66

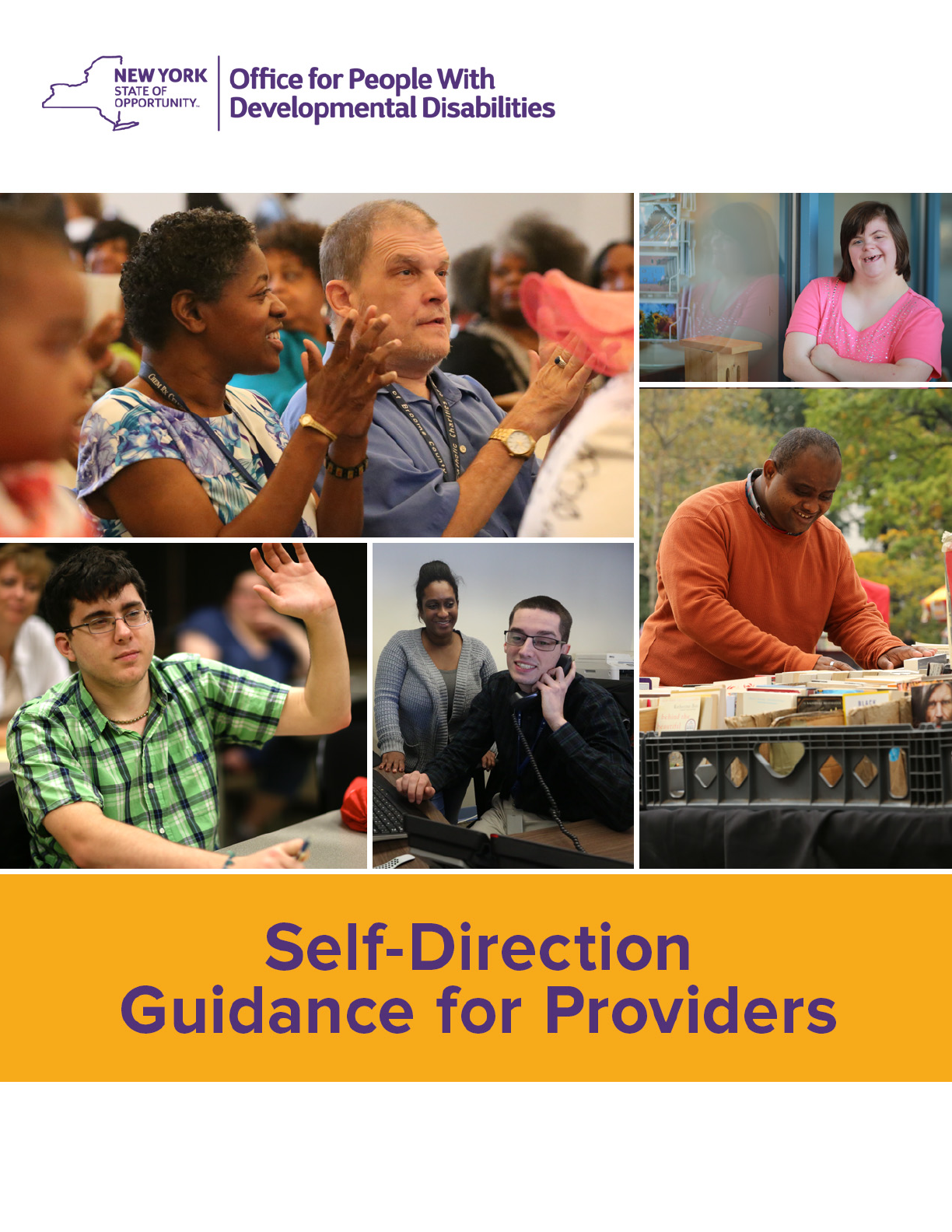

Self-Direction Guidance for Providers

March 10, 2022

TABLE OF CONTENTS

PART 1 – KEY CONCEPTS OF SELF-DIRECTION

INTRODUCTION

Purpose of the Self-Direction Guidance for Providers 8

What is Self-Direction? 8

CHAPTER 1

SELF-DIRECTION AUTHORITIES

Employer Authority 9

Budget Authority 9

CHAPTER 2

STAFF OPTIONS IN SELF-DIRECTION

Agency Supported Self-Directed Services 10

Self-Hired Staffing 10

Direct Provider Purchased Services 11

CHAPTER 3

SELF-DIRECTION BUDGET

OPWDD Issued Budget 12

Personal Resource Account 12

100% State Paid Services 12

Budget Review Process 12

Annual Effective Dates 13

Retroactive Amendments 13

Continuity of Care Provisions 13

Self-Direction Budgets for Children 13

Self-Direction Guidance for Providers March 10, 2022

Page 3 of 66

PART 2 - OVERVIEW OF SELF-DIRECTION SERVICES

CHAPTER 4

SUPPORT BROKERAGE

Start-Up Brokerage 17

Brokerage in Settings that Prevent Enrollment in the HCBS Waiver 17

Support Broker Authorization….…………………………………………………17

Support Brokerage Coverage 18

Parents and Other Unpaid Support Brokers 18

CHAPTER 5

FISCAL INTERMEDIARY

Services that Require a Fiscal Intermediary 20

Reimbursement for Prepaid Goods and Services 20

Services Delivered by Other Agencies………………………………………….21

CHAPTER 6

LIVE-IN CAREGIVER

Payment Standards 22

CHAPTER 7

INDIVIDUAL DIRECTED GOODS AND SERVICES (IDGS)

Community Classes 24

Transportation 24

Camp 25

Paid Neighbor 26

Staffing Support…………………………………………………………………...26

Health Club/ Organizational Membership………………………………………26

IDGS Billing 27

Self-Direction Guidance for Providers March 10, 2022

Page 4 of 66

CHAPTER 8

OTHER THAN PERSONAL SERVICES (OTPS)

OTPS Categories 29

Items Excluded from OTPS 30

OTPS Billing……………………………………………………………………….30

CHAPTER 9

SUPPORTED EMPLOYMENT, COMMUNITY HABILITATION AND RESPITE

Direct Provider Purchased and Agency Supported 32

Self-Hired Staff 32

Hiring Family Members 33

CHAPTER 10

FAMILY REIMBURSED RESPITE

Payment Standards 34

CHAPTER 11

FAMILY SUPPORT SERVICES ………………………………………………..35

CHAPTER 12

HOUSING SUBSIDY

Restrictions 36

CHAPTER 13

SHARED LIVING ARRANGEMENTS…………………………………………..37

CHAPTER 14

OUT-OF-STATE AND OUT-OF-COUNTRY SERVICES……………………..40

Self-Direction Guidance for Providers March 10, 2022

Page 5 of 66

PART 3 – SELF-HIRED FRINGE BENEFIT BUDGETING AND BILLING

CHAPTER 15

FRINGE BENEFIT BUDGETING AND BILLING OVERVIEW

Terms 42

Types of Self-Hired Staff 43

CHAPTER 16

ACCOUNTING INDIRECT EMPLOYMENT COSTS

Direct Accounting Method 44

Fringe Rate Method 44

CHAPTER 17

CHARGING STAFF TRAINING EXPENSES IN SELF-HIRED SERVICES

On The Job Training 46

Fiscal Intermediary Directed General Employee Orientation, Refresher,

and Classroom/Seminar Training 47

Person/Family-Directed Special Employee Training 48

Training Reimbursement as an Employee Benefit 49

CHAPTER 18

PREPARING CLAIMS TO MEDICAID FOR SELF-HIRED SERVICES

Service Unit Claiming 50

Amount Charged 50

Multi-Day Versus Single-Day Claiming 50

Reimbursement Rate Cap Logic 51

Self-Direction Guidance for Providers March 10, 2022

Page 6 of 66

CHAPTER 19

GUIDANCE ON OVERNIGHT SUPPORTS

Paid Neighbor 52

Personal Care 52

Respite 52

Community Habilitation 52

ATTACHMENTS

Attachment A: Self-Direction Budget Types

Attachment B: Personal Resource Account

Attachment C: Budget Review Procedure

Attachment D: Continuity of Care

Attachment E: Support Broker Training Policy

Attachment F: Live-in Caregiver Maximum Reimbursement Levels

Attachment G: List of Applicable Administrative Memoranda

Self-Direction Guidance for Providers March 10, 2022

Page 7 of 66

Self-Direction

Guidance for Providers

Part 1

Key Concepts of Self-Direction

Self-Direction Guidance for Providers March 10, 2022

Page 8 of 66

INTRODUCTION

Purpose of the Self-Direction Guidance for Providers

NYS OPWDD is committed to helping people with Intellectual and Developmental

Disabilities (I/DD) have as much control as possible over how they receive their

supports and services. Self-Directed services offer the greatest amount of control in

how, where and by whom services are provided. OPWDD has a broad range of

options available for Self-Direction. A person can choose to develop a plan that is

customized in a way that best meets their interests and needs.

The Self-Direction Guidance for Providers is predominantly meant for Providers and

Brokers. This document broadly defines the policy guidance for Self-Direction and

provides an overview of Self-Direction authority and staffing options, the services

available to self-direct, and information on budgeting and billing for Self-Directed

services. This document is technical in nature and is meant to provide detailed

direction on issues that emerge for people who self-direct their services and the

providers (Fiscal Intermediaries/ Brokers) who work with them to implement a self-

directed plan.

The Self-Direction Guidance for Providers does not replace OPWDD Administrative

Memoranda (see Attachment G) for Self-Directed services. Providers must comply

with the payment standards and service documentation requirements as described

in the applicable Administrative Memoranda (ADMs) for services that are self-

directed.

What is Self-Direction?

Self-Determination is the philosophy that all people have the freedom to develop

their own life plan. Self-Direction is based on the underlying principles of self-

determination, person-centered planning and practices.

Self-Direction is the practice of empowering people with developmental

disabilities to manage the supports and services they receive, determine who

provides the supports, and how and where they are provided. In Self-Direction

the person with developmental disabilities chooses the mix of supports and

services that work best for them, how and when they are provided, and the

staff and/or organizations that provide them.

The Self-Direction participant accepts responsibility for co-management of their

supports and services. The amount of responsibility varies depending on the level of

authority the participant chooses to exercise.

Self-Direction Guidance for Providers March 10, 2022

Page 9 of 66

CHAPTER 1 SELF DIRECTION AUTHORITIES

Authority is a term used by the Centers for Medicaid and Medicare Services (CMS) to

describe the control that a person receiving services uses when they choose to self-

direct their services. Participants have a range of options for choosing the level of Self-

Direction authority that they wish to have. There are two types of Self-Direction

authority: Employer Authority and Budget Authority. A person may choose to have

either one or both types of authority.

Employer Authority

The person hires, schedules and supervises the staff who support them. They

determine the activities that will be supported and the way that support will be

provided. Services are provided to the person by agency staff under a co-

employment model. In a co-employment model, the person can choose to hire staff,

train staff regarding their interests, monitor and provide feedback to staff, and end

staff services if they are not consistent with the person’s expectations. If a person

chooses to self-hire their staff, they gain Budget Authority and determine the

compensation of those staff.

Budget Authority

The person who is self-directing with Budget Authority must work within a Personal

Resource Account (PRA) and develop a Self-Direction Budget. The person makes

choices about the goods and services he/she wishes to receive and selects who is

paid to provide them or how they are purchased. A person who maintains Budget

Authority and works within a PRA may access needed goods or services through

Individual Directed Goods and Services (IDGS). A Fiscal Intermediary (FI) works

with the person to complete billing and payment for goods and services identified in

the Budget. Attachment C includes a description of services that must be included in

a person’s Self-Direction Budget. A person who chooses to have Budget Authority

can receive and budget for services that are Agency Supported, Self-Hired, or Direct

Provider Purchased. Budget types are described in Attachment A.

Self-Direction Guidance for Providers March 10, 2022

Page 10 of 66

CHAPTER 2 STAFF OPTIONS IN SELF-DIRECTION

A person who chooses Self-Direction has three options for selecting the staff who will

work with them:

Agency Supported Self-Directed Services

The person and agency have a Memorandum of Understanding (MOU) that

describes the person’s authority to hire staff, train staff regarding their interests,

monitor and provide feedback to staff, and end the employee’s services if they are

not consistent with the person’s expectations. The person does not have the

authority to set the staff salary in this model and the provider is paid at the provider’s

rate for the service, which includes the administrative and clinical components of the

service. The provider bills eMedNY directly for these services. If a person chooses to

have only Agency Supported Self-Directed Services, a Self-Direction Budget and

Personal Resource Account are not needed.

Community Habilitation, Supported Employment (SEMP) and Respite can be

self-directed by the participant using Employer Authority in the Agency

Supported Self-Directed Services model.

Self-Hired Staffing

The person who is self-directing determines the compensation of the staff who

delivers services to them. Services must be planned for and budgeted within a

Personal Resource Account (PRA). A Fiscal Intermediary (FI) works with the person

to implement Human Resource (HR) activities and to complete billing and payment

of the services. The person and the FI have a Memorandum of Understanding

(MOU) that describes the person’s authority to hire staff, train staff regarding their

interests, monitor and provide feedback to staff, and end the employee’s services if

they are not consistent with the person’s expectations. The amount that is billed to

eMedNY for self-hired Community Habilitation, Supported Employment and Respite

cannot exceed the amount a provider would be paid for the same service or the

OPWDD established rates for the service, whichever applies.

A person can choose to self-hire staff to deliver the following types of Home and

Community Based Services (HCBS) waiver services: Community Habilitation,

Supported Employment, and Respite.

Self-Direction Guidance for Providers March 10, 2022

Page 11 of 66

Direct Provider Purchased Services

A person who is self-directing can choose to purchase some services directly from a

provider agency. For these Direct Provider Purchased services, the person does not

have the authority to set the staff salary and the person chooses to let the provider

manage the staff. The provider is paid at the provider’s rate for the service, which

includes the administrative and clinical components of the service. The provider bills

eMedNY directly for these services. If a person is self-directing other services with

budget authority, the agency that provides the Direct Provider Purchased Service is

responsible for ensuring that the service is utilized within the PRA, as identified in

the Self-Direction Budget. This needs to be addressed during the planning process

and reflected in the Budget accordingly.

Supported Employment, Community Habilitation, and Respite may be Direct

Provider Purchased, Self-Hired, or Agency Supported. Group Day Habilitation

Services, Prevocational Services and Pathway to Employment are available only

as Direct Provider Purchased Services.

Self-Direction Guidance for Providers March 10, 2022

Page 12 of 66

CHAPTER 3 SELF-DIRECTION BUDGET

OPWDD Issued Budget

People who self-direct with budget authority must use the OPWDD issued Self-

Direction Budget. The Self-Direction Budget must be completed when a person

chooses to have Budget Authority and chooses services that have Budget Authority

associated with them. Only the budget issued by OPWDD will be accepted for

processing and approval by OPWDD.

Personal Resource Account

The Self-Direction Budget cannot exceed a person’s Personal Resource Account

(PRA). Based on the OPWDD Approved Needs Assessment Tool, the PRA

establishes cost parameters for individualized budgets based on need profiles and

comparable costs associated with supporting similarly profiled people with

developmental disabilities in other models of support. See attachment B.

100% State Paid Services

When a person has a Self-Direction Budget and receives the services listed below,

such services must be included in the Self-Direction Budget and counted against the

PRA (see Attachment C for more information):

• Family Reimbursed Respite (FRR)

• Family Support Services (FSS)

• Other Than Personal Services (OTPS)

• Housing subsidy/Individual Supports and Services (ISS)

• Assistive Supports

Budget Review Process

-See Attachment C for the Self-Direction Budget Review Procedure

Self-Direction Guidance for Providers March 10, 2022

Page 13 of 66

Annual Effective Dates

Budget Annual Effective Dates are fixed dates that establish the year in which a

person’s Budget is in operation. A person’s total annual expenditures for services in

their Self-Direction Budget may not exceed their PRA during any year a Budget is in

effect. The anniversary of the Budget Annual Effective Date is that date when this

annual spending cap resets. Budget Annual Effective Dates do not change when

Budgets are amended, unless the Budget type changes between “Other than

Residential,” “Residential Only” or “Both.”

Retroactive Amendments

Self-Direction Budgets may be revised proactively to accommodate the participant’s

changing needs. Full Amendments to Self-Direction Budgets are not made

retroactively. However, Cost Neutral Budget Amendments may be approved by the

Development Disabilities Regional Office retroactive to the beginning of the month

prior to the month it is approved.

Continuity of Care Provisions

Continuity of Care Provisions are not applicable to Self-Direction Budgets developed

on and after 10/1/2014. On and after 10/1/2014, OPWDD will not approve increases

or cost neutral changes to Continuity of Care Provisions found in existing Self-

Direction Budgets; OPWDD will only approve decreases to such provisions. More

information on Continuity of Care can be found in Attachment D.

Self-Direction Budgets for Children

Approval of a Self-Direction Budget is contingent on the participant’s enrollment in

the HCBS waiver. Enrollment in the waiver requires the identification of a need for

ongoing waiver services that is not available through other sources.

For children under the age of four, it is expected that Early Intervention (EI) services

would meet their needs and waiver services cannot be duplicative of services

available through EI. Children receiving EI services would not be authorized for the

HCBS waiver and, therefore, would not be eligible for self-directed services without

clinical justification.

For children who are at least four years of age and younger than seven years of age,

it would be unusual for Community Habilitation to be justified as typical supports

come from family and school. Social skill building can often be achieved through

FSS programs. This age group is typically more appropriate for respite and FSS

support use. If the family, Support Broker, and Care Manager (CM) determine that

Community Habilitation is appropriate for a child in this age range, clear age

Self-Direction Guidance for Providers March 10, 2022

Page 14 of 66

appropriate habilitative goals and outcomes must be included within the child’s Staff

Action Plan and would be subject to audit protocols for the waiver service.

For all children who are eligible to receive service from the State Department of

Education (SED), those services must be utilized before self-directed services. Self-

directed services cannot be duplicative, nor can they overlap with SED services. The

schedule for waiver service must not overlap with the planned schedule for

educational instruction. If a child is homeschooled, the times when the

homeschooling actually takes place can be considered, instead of standard school

hours, as the times when SED services are occurring.

Self-Directed services are not available for children who live in a certified setting and

receive SED services. As the SED services are expected to cover their service

needs during the day and the certified setting is responsible for evening, nights and

weekends, they are considered to have all of their service needs met.

Self-Direction Guidance for Providers March 10, 2022

Page 15 of 66

Self-Direction

Guidance for Providers

Part 2

Overview of Self-Direction Services

Self-Direction Guidance for Providers March 10, 2022

Page 16 of 66

CHAPTER 4 SUPPORT BROKERAGE

When a person chooses to take on Budget Authority, Support Brokerage services

support the person-centered planning process by assisting the person to develop a

Circle of Support and complete a Self-Direction Budget for his/her services. The Broker

may also provide training and support to the person to help him/her gain the skills and

competencies he/she needs to manage self-directed services. If a participant has

chosen self-hired Community Habilitation or Supported Employment services, Support

Brokerage Services include completing and updating Staff Action plans for these

services.

A person’s Support Broker cannot provide them any other HCBS waiver service, and

cannot be the person’s Care Manager (CM). A Care Manager will assist the person

participating in Self-Direction, as Self-Direction is part of the HCBS waiver.

Support Brokerage services must be established based on an agreement between the

participant and the Broker. Hourly fees are negotiated between the participant and the

Broker and should be commensurate with the level of training and experience of the

Broker. The maximum fee that can be considered for delivering Support Broker

services is $40 per hour. Self-Direction participants and Brokers can agree to a fee that

is less than this amount. The hourly fees reflected on the Support Broker Agreement

and the Self-Direction Budget must be the same.

The participant and his/her Circle of Support make decisions about the best use of the

Support Broker as a resource within the person’s Self-Direction Budget to ensure

appropriate support and achievement of valued outcomes.

For the Broker Training Policy, see Attachment E.

Self-Direction Guidance for Providers March 10, 2022

Page 17 of 66

Start-Up Brokerage

Start-up Brokerage services are provided to assist a Self-Direction participant in

developing his/her initial Self-Direction Budget, with reimbursement capped at

$2,400.

A person who received Start-Up Brokerage may budget for this again after one

year has passed if the person has not received any self-directed services in that

year. Self-directed services are those that would be billed by an FI, except for

Community Transition Services. In this scenario, the $2,400 cap would reset. A

second Start-Up Brokerage expense is not available to participants who have

received self-directed services and are changing FI agencies.

Brokerage in Settings that Prevent Enrollment in the HCBS Waiver

Home and Community Based Services (HCBS) Waiver Support Brokerage services

are not available to people who reside in the following settings that are non-HCBS

Waiver eligible: Intermediate Care Facilities, Nursing Homes, Residential Schools,

and Developmental Centers. For people who are seeking to transition out of these

settings and into self-directed services within the community, Start-Up Brokerage

services up to $2400 can be funded with 100% State funds.

OPWDD expects that these State funds are used exclusively to develop the Self-

Direction Budget with Start-Up Brokerage services. The person must be enrolled into

the HCBS Waiver Brokerage service in order to receive ongoing Brokerage services

after completion of the Self-Direction Budget.

Support Broker Authorization

Prospective Support Brokers must complete an OPWDD approved curriculum

utilizing trainers, or a training method, approved by OPWDD. Support Brokers who

demonstrate that they meet OPWDD training requirements will be listed in a

centralized authorization record and recognized as “Authorized”. While authorization

demonstrates the Support Broker’s adherence to OPWDD standards, it does not

demonstrate adherence to background check and other billing standards.

For Support Brokers to maintain their authorization, they must adhere to training and

authorization standards. Each year, Support Brokers must be reauthorized if they

intend to continue providing services. The Support Broker is responsible for

obtaining authorization on or before July 31st prior to the expiration of the

authorization year. To be reauthorized, the Support Broker must demonstrate that

(s)he has completed the OPWDD Mandatory Training and obtained twelve (12) or

Self-Direction Guidance for Providers March 10, 2022

Page 18 of 66

more hours of Yearly Professional Training during the authorization year. If

circumstances warrant, and there is a substantiated complaint (or complaints) of

requisite severity, OPWDD will engage the Support Broker in corrective action,

including placing limitations on the Support Broker’s caseload, the imposition of

additional training standards, the revocation of the Support Broker’s authorization

based on the circumstances, or take additional actions as appropriate.

ADM 2019-05R describes the Support Broker Authorization standards required to

meet billing, programmatic, and documentary requirements referenced in ADM-

#2019-06.

Support Brokerage Coverage

To maintain good continuity of care, it is best for one Broker to work with and

support the participant. However, if the Broker chooses to delegate documentation

to another qualified Broker or if a backup Broker is designated to attend meetings in

rare circumstances when the primary Broker is unable to attend, this needs to be

outlined in the agreement between the primary Broker and the participant. Any

backup Broker must meet all the same qualifications as the regular Broker as

described in ADMs #2019-05 and #2019-06.

Parents and Other Unpaid Support Brokers

Participants can choose to have their parent fill the role of the Support Broker, but a

parent cannot be paid for Support Broker services delivered to their own child.

Detailed information regarding family members delivering services can be found in

Chapter 9, Hiring Family Members section.

When participants choose to act as their own Support Broker, or have a parent or

other person fulfill the Support Broker role in an unpaid capacity, the person acting

as Support Broker must complete the Initial Broker Training Requirements, as

outlined in Attachment E. Self-Direction Budgets may be denied approval unless it is

established that there is someone to fulfill the role of the Support Broker who has

taken the required training.

A Broker Agreement should be completed when a participant chooses to have a

parent or other person fulfill the Support Broker role in an unpaid capacity. A

completed Broker Agreement ensures that the participant and the person they chose

to act as a Broker have a clear understanding of the roles and responsibilities for the

person acting as a Support Broker.

Parents and others who act as a person’s Support Broker in an unpaid capacity are

not generating any billing for Support Broker services. As such, they are not subject

to the payment and service documentation requirements outlined in Administrative

Self-Direction Guidance for Providers March 10, 2022

Page 19 of 66

Memorandum #2019-06 regarding Service Documentation for Support Brokerage

Services.

Unpaid Support Broker Services do not generate any billing and there is no impact

on a participant’s PRA. Therefore, the unpaid Support Broker should not be reflected

on the person’s Self-Direction Budget. When the Support Broker is unpaid, the

Support Broker service item on the Demographics tab of the Budget should be

answered as “No.”

ADM #2019-06 describes the service, programmatic and payment standards and

service documentation requirements for Support Brokerage Services.

Self-Direction Guidance for Providers March 10, 2022

Page 20 of 66

CHAPTER 5 FISCAL INTERMEDIARY

Fiscal Intermediary Services (FI Services) are HCBS Waiver services that include tasks

performed by a Fiscal Intermediary (FI) which support a participant who self directs an

individualized budget. Such tasks include billing and payment of approved goods and

services, fiscal accounting and reporting, Medicaid and corporate compliance, and

general administrative supports. The FI performs the initial review of the budgets/budget

amendments, is the employer of record for staff hired by the participant, and is

responsible for ensuring that applicable labor laws (including those related to minimum

wage and overtime) are followed. These staff are referred to as “self-hired staff.”

Services that Require a Fiscal Intermediary

A participant must choose an FI to handle billing for any of the following services:

• Individual Directed Goods and Services (IDGS)

• Live-in Caregiver (LIC)

• Support Brokerage Services

• Community Transition Services (CTS)

• Other Than Personal Services (OTPS)

• Housing Subsidy

• Any self-hired staff for Community Habilitation (CH), Supported Employment

(SEMP), and/or Respite

Reimbursement for Prepaid Goods and Services

In some circumstances, FIs may be asked to pay for an item or service before it is

received or delivered. Camp deposits and pre-payments are one potential example.

Annual memberships are another. FIs may elect to reimburse the participant/family,

immediately, or pay for the cost of pre-paid goods and services, directly. However,

the FI must wait until the service is “complete” before claiming reimbursement to

Medicaid. Each FI has the right to develop policies and procedures that define and

limit its financial risk regarding IDGS purchases, especially when the risk of

immediately reimbursing (“floating”) a pre-paid service becomes significant or

substantial. Such policies must be made known in advance to those impacted and

be applied fairly and equitably across all people served by the FI. For example, the

FI’s policy could require that it will accept full financial risk and that it may never

subsequently receive reimbursement (if the camper does not actually attend camp).

Self-Direction Guidance for Providers March 10, 2022

Page 21 of 66

Services Delivered by Other Agencies

When participants with Budget Authority receive Agency Supported or Direct

Provider Purchased services delivered by agencies other than the FI, these services

must be included in the Self-Direction Budgets, where applicable. The FI will require

utilization information for services delivered by other agencies to be reflected in the

person’s monthly expenditure reports. Rate information can be found on the

Department of Health website:

(http://health.ny.gov/health_care/medicaid/rates/mental_hygiene/index.htm)

ADM #2019-07 describes the payment standards and service documentation

requirements for Fiscal Intermediary Services.

Self-Direction Guidance for Providers March 10, 2022

Page 22 of 66

CHAPTER 6 LIVE-IN CAREGIVER

Live-in Caregiver is an HCBS Waiver service that utilizes an unrelated care provider

who resides in the same household as the waiver participant and provides as-needed

supports to address the participant's physical, social, or emotional needs so that the

participant can live safely and successfully in his or her own home.

The Live-in Caregiver must not be related to the participant by blood or marriage

to any degree.

The Live-in Caregiver must go through any required background check(s)

performed by the FI before they can begin services.

Payment Standards

Payment for this service will cover the additional costs of room and board incurred

by the waiver participant and reasonably attributed to the Live-in Caregiver. Room

and board includes rent, utilities and food. Payment may not be made directly to the

LIC. The FI will transfer the amount of reimbursement to the individual or the

property owner and utility companies, as specified in the agreement between the

individual and the FI.

The participant must reside in his/her own home or a leased residence. Payment will

not be made when the participant lives in the caregiver's home, in a residence that is

owned or leased by the provider of Medicaid services, in a Family Care home, or in

any other residential arrangement where the participant is not directly responsible for

the residence. Maximum Live-in Caregiver amounts can be found in

Attachment F at the end of this guidance.

ADM #2016-03 describes the payment standards and service documentation

requirements for Live-in Caregiver Services.

Self-Direction Guidance for Providers March 10, 2022

Page 23 of 66

CHAPTER 7 INDIVIDUAL DIRECTED GOODS AND SERVICES (IDGS)

Participants who choose to self-direct their services and take on Budget Authority may

receive IDGS as a waiver service. Individual Directed Goods and Services (IDGS) are

services, equipment or supplies not otherwise provided through OPWDD’s HCBS

waiver or through the Medicaid State Plan that address an identified need in a

participant’s service plan. Self-Direction funds cannot be used to purchase an IDGS

service that is available under the State Plan. Total IDGS expenditures are limited to

$32,000 annually or the person’s PRA, whichever is less. Further detail is included in

the IDGS Definitions Chart (link found in Attachment G).

Participants may manage their IDGS, as described in their Individualized

Service Plan and Self-Direction Budget, to fully purchase or contribute towards

the purchase of items or services which meet all of the following criteria:

1. Are related to a need or goal identified in the person-centered care

plan/Individualized Service Plan;

2. Are for the purpose of increasing independence or substituting for human

assistance, to the extent the expenditures would otherwise be made for

human assistance;

3. Promote opportunities for community living and inclusion and/or increase

the participant’s safety and independence in his/her home environment;

4. Are able to be accommodated without compromising the participant’s health

or safety;

5. Are provided to, or directed exclusively toward, the benefit of the

participant.

In addition to these requirements, the IDGS chart lists additional criteria that must be

met for specific categories of IDGS.

Self-Direction Guidance for Providers March 10, 2022

Page 24 of 66

Community Classes

Self-directed supports through IDGS offer great opportunities for people with

developmental disabilities to purchase community based classes that teach a

subject, are open to the public, and result in active engagement and participation in

integrated community settings.

Each of the following are excluded from being funded with the IDGS as a

Community Class:

• Classes that duplicate any Medicaid State Plan or HCBS Waiver service or

are conducted by an entity that delivers such services;

• Classes where participation is restricted solely to people with

intellectual/developmental disabilities (I/DD);

• Classes where there are not established published fees;

• Classes that are credit bearing for matriculating students;

• Classes in a setting accessed only by people with I/DD (not including paid

staff support), including all certified settings; and

• Classes that do not adhere to the standards identified in the broader IDGS

rules and standards (e.g. experimental therapies).

Participation in specialized classes that take special needs, such as physical

limitations or beginner level learning, into consideration are appropriate as long as

those specialized classes are open to the broader public.

Private classes and lessons are allowable as long as they relate to an integration

goal and the lessons are not taking place privately for the purpose of segregating the

participant.

Transportation

When a person needs transportation to/from a service-related activity, IDGS can be

used to reimburse service related mileage, or pay for public transportation. In order

to be reimbursable under IDGS, however, transportation costs and mileage must be

related to a Medicaid reimbursable service within the Self-Direction Budget.

Additionally, Transportation in IDGS is only available for those services that do not

have transportation built into the fee and/or are not covered by the State Plan.

Transportation related to IDGS services or those delivered by Self-Hired staff would

be considered allowable reimbursable costs.

Self-Direction Guidance for Providers March 10, 2022

Page 25 of 66

Camp

For a person who has Budget Authority, Camp programs may be funded using

IDGS. Reimbursement from Medicaid is not available until after a person has

attended the camp. When a camp deposit or prepayment is made, but the person

never attends camp, no service has been rendered to the person and, therefore, no

reimbursement may be claimed from Medicaid. Medicaid does not reimburse

services that are not rendered. If the FI or the family made a non-refundable deposit

or prepayment, whoever made the payment to the camp accepted the financial risk.

When a camp deposit or prepayment is made, and the person arrives at camp,

participates in some programs, but leaves camp early, then the terms of the camp’s

policy should be consulted. If there is opportunity to request a partial refund, such

refund should be requested. If there is a strict no-refund policy, the full cost of the

service term may be submitted to Medicaid as long as it does not exceed one

month. The maximum service term Medicaid reimburses is one month. Since most

camps have terms measured in weeks, it is unlikely that the FI (or family) would be

left with an unreimbursed liability. However, if a participant were to enroll at a camp

that demanded prepayment for a full three-month summer term (i.e., June, July, and

August), it is possible that an unreimbursed liability could be generated. The FI

would be forced to break up the camp term into units no greater than a

month. Some service must be delivered in a given month in order to bill a service

unit for that month. Therefore, if a camper were to leave in the second week of June

and not return, the FI (or family) could be left with an unreimbursed liability for two-

thirds of the total cost of the camp.

IDGS Camp Reimbursement is available for Camps that are not funded as

Medicaid Waiver Respite Camps. Self-Direction participants can choose to

attend Waiver Respite funded Camps. However, those camps must be

included in their Self-Direction Budget as Direct Provider Purchased Respite.

IDGS funds may not be used for camps that are outside New York State, as

these camps are not issued a permit by New York State.

Self-Direction Guidance for Providers March 10, 2022

Page 26 of 66

Paid Neighbor

The Paid Neighbor stipend is paid to a neighbor to serve as an “on-call” support. A

Paid Neighbor is someone who should be available to respond when needed.

Proximity in relation to the needs of the participant should be considered when hiring

a Paid Neighbor, and be based upon the participant’s likely need for a particular

response time. In no case should a Paid Neighbor live with the participant nor should

a Paid Neighbor be more than 30 minutes from the participant.

The Paid Neighbor cannot be a “family member” of the Self-Direction

participant. See Chapter 9 “Hiring Family Members” Section for more

details.

Staffing Support

Staffing Support cannot deliver services that would duplicate FI services or Broker

responsibilities as related to development of the SD plan. The staffing support role

can only include tasks in the spectrum of, “Assistance with scheduling self-hired staff

and with assisting the person to complete staffing related paperwork.”

The person who provides Self-Directed Staffing Support through IDGS may be

someone who provides self-hired CH, Respite or SEMP services to that participant

or other participants, however, they cannot be otherwise employed by a not for profit

agency. The billing must reflect what service is being provided. The documentation

and time tracked should reflect what service the staff is providing at the time, either

Community Habilitation/Respite/SEMP or Staffing Support.

Health Club/Organizational Memberships

Funding for a gym or health club may be reimbursed through IDGS in the self-

directed plan for reasons of health and fitness or community integration. A person

may have multiple memberships to health clubs. Memberships are for the individual

only. Family or staff memberships cannot be reimbursed with IDGS funding. The

club/organization must offer open enrollment to the public and the reimbursed fee

must be the same as the published membership duties/fees.

A Self-Direction Participant’s activity fees, expenses (such as related supplies) and

meals are explicitly prohibited from IDGS funding. The following chart is provided to

assist with establishing the difference between reimbursable memberships and non-

reimbursable activity fees/expenses:

Self-Direction Guidance for Providers March 10, 2022

Page 27 of 66

Organizational Memberships

(Reimbursable as Memberships)

Ski club membership dues

Museum or zoo membership

Softball league fees

Pony Club membership

Girl Scout/Boy Scout dues

Membership dues for a Bowling

League

Community group membership fees

(e.g., 4-H, Kiwanis, Elks)

Activity Fees/Expenses

(Not Reimbursable as Memberships)

Ski resort lift tickets and equipment rental

Tickets or season passes to a water park

Tickets to a baseball game

Horseback riding helmet

Scout uniform and trip expenses

Bowling shoe rental fee

Group shopping discounts (Wholesale

“club” memberships, farm shares)

Online dating websites

IDGS Billing

For Medicaid billing purposes, the reported date of service (DOS) for IDGS should

be the date that funds are paid out by the Fiscal Intermediary, or the date that the

good or service is actually received by the participant, whichever is later.

IDGS is a Medicaid program that reimburses costs already incurred for goods and

services. Reimbursement may be made to the person/designee who made the

qualifying purchase. A good or service can also be purchased directly from a vendor

by the FI on behalf of the person who self-directs. Medicaid rules generally require a

service to happen prior to billing. For IDGS the “service” constitutes both the

person’s receipt of the reimbursable item and the FI’s reimbursement or direct

purchase.

For some IDGS categories (e.g., mileage reimbursement under “Transportation”),

the payment is made by the FI after the service is delivered. In this scenario, the

date of service would be the date that the FI issued the reimbursement. However,

sometimes an FI will choose to reimburse an item or service that has not yet been

delivered (for example, deposits or payments made in advance for camp). Generally,

Medicaid does not reimburse services or items before they are delivered and, in

terms of services, before the service is “complete.” In this scenario, the DOS would

be the date of the last day that the participant attended the camp. The time limits for

billing Medicaid do not start until the DOS. If the FI has not made the

reimbursement, the DOS has not occurred. This should not be construed to indicate

Self-Direction Guidance for Providers March 10, 2022

Page 28 of 66

that there is an unlimited “begin” date for reimbursements to be submitted by the FI.

Good judgement and business practices should be applied to individual scenarios,

but in general a reimbursement should never qualify if the item/service was

purchased prior to the approval of the person’s SD budget.

In scenarios where a person is participating in a service funded by IDGS that spans

more than one month, the FI may bill for an appropriate prorated portion of the cost,

using the last day of the service month as the billing date of service. For example, a

person is attending camp that runs from July 1 through August 31 and the cost of the

camp is $1,000. The FI may submit a claim for half the reimbursement on July 31 in

the amount of $500 and the remaining $500 balance would be submitted with an

August 31 date of service.

When a Self-Direction participant’s IDGS service provider demands substantial

“deposits” or “pre-payment” months in advance of actual service delivery, the FI

should follow its own established policies as explained in Chapter 5 Fiscal

Intermediary.

IDGS is billed to Medicaid in $10 increments. Each unit must be for $10 and

there will be no rounding up. A maximum of 99 units may be billed to Medicaid

on a given date of service. This limits billing to $990 per date of service for

IDGS. In instances where the FI has receipts and documentation

substantiating allowable expenditures beyond the daily billing limit of $990,

eMedNY can be billed using consecutive dates of service. For example, if

receipts and documentation substantiate $1,500 in qualified IDGS

reimbursement, an FI may submit one claim for 99 units totaling $990 on a

given date of service and submit an additional claim for the remaining balance

of 51 units totaling $510 on the next date of service.

ADM #2015-05 describes the payment standards and service documentation

requirements for Individual Directed Goods and Services.

Self-Direction Guidance for Providers March 10, 2022

Page 29 of 66

CHAPTER 8 OTHER THAN PERSONAL SERVICES (OTPS)

People who are self-directing their services with Budget Authority may elect to use up to

$3,000 in 100% state funding for items that are not Medicaid-fundable. This budget

category is called “Other Than Personal Services” or OTPS.

For any item or service to be approved for OTPS funding in any category, it

must pass ALL of the following four tests:

1. Be related to a valued outcome in the person’s plan

2. Increase the person’s independence and/or health and safety

3. Not be an OTPS excluded item (see page 29 of the SD Guidance)

4. Not be funded through any other source

Other resources (including community based and Medicaid funded) must be explored

and exhausted prior to utilizing state OTPS funds for the purchase of such items. For

example, cell phones are often made available to people who have Social Security

eligibility.

OTPS Categories

The OTPS section of the budget is limited to the following categories of supports:

• Phone service – cell and/or land line*

• Internet* (in instances where a participant has a cable package, OTPS can be

used for phone and internet only, but not the cable portion)

• Software related to the person’s disability

• Staff activity fees ( self-hired staff only) to cover meals, admissions, fees,

transportation or other costs incurred by staff when providing support to the self-

directing person in activities that support a valued outcome

• Staff advertising/recruitment costs

• Cost associated with staff time for planning or training meetings where such

costs exceed the hourly limits of the service

• Personal Use Transportation

• Clothing* (capped at $250)

• Board Stipend* (must first request and be denied for food stamps, or approved,

but not sufficient to cover needs)

• Utilities*

• Other goods and services that increase independence

• Other goods and services related to health and safety

Self-Direction Guidance for Providers March 10, 2022

Page 30 of 66

* In general, landline, internet, clothing, utilities, and board stipend expenses are not

reimbursable in OTPS for children under 18 years old where parents are responsible for

these costs. Exceptions may be granted by the Developmental Disability Regional

Office (DDRO) in cases where justification for a specific need is established (e.g., the

family would not otherwise have internet in the home but it is necessary to support a

technology system utilized by the FI and self-hired staff).

.

Items Excluded From OTPS

OTPS cannot be used to pay for certain excluded items. Excluded items include, but

are not limited to:

• Medical visit co-pays

• Any expenses related to hospitalization or nursing home stays (including staff or

respite supports or family expenses)

• Any illegal item or activity

• Cable television

• Common household supplies (e.g., paper towels, wipes, soap)

• Treatments that are experimental in nature

• Repairs, like a broken step or railing, as they should be covered under the lease

or are the responsibility of the home owner

• A self-directing person’s activity fees or related supplies for an activity or

community class, even if funded through Individual Directed Goods and Services

• Rental cars (this OTPS exclusion does not apply to vehicles leased in the

participant’s name)

• Vehicle purchases, payments towards a purchased vehicle

• Legal fees

• OTPS cannot be used to apply against housing costs in excess of housing

subsidies. If a person’s rent is in excess of allowable housing subsidies, this will

have to be reimbursed with the person’s or the family’s own resources.

OTPS Billing

Reimbursement may be made to the person/designee who made the qualifying

purchase. A good or service can also be purchased directly from a vendor by the FI on

behalf of the person who self-directs. For OTPS the “service” constitutes both the

person’s receipt of the reimbursable item and the FI’s reimbursement or direct

purchase.

For OTPS the service month is considered instead of the date of service. The service

month will be the month when the good/service was purchased, or reimbursed/direct

purchased by the FI, whichever occurs later. The time limit for vouchering state

payments begins on the last date of the service month.

Self-Direction Guidance for Providers March 10, 2022

Page 31 of 66

This should not be construed to indicate that there is an unlimited “begin” date for

reimbursements to be submitted by the FI. Good judgement and business practices

should be applied to individual scenarios, but in general a reimbursement should never

qualify if the item/service was purchased prior to the approval of the person’s SD

budget.

Self-Direction Guidance for Providers March 10, 2022

Page 32 of 66

CHAPTER 9 SUPPORTED EMPLOYMENT, COMMUNITY HABILITATION

AND RESPITE

The services described in this chapter can be varied in the way in which they are self-

directed. Supported Employment includes both direct and indirect activities associated

with helping a person get a job and gain skills necessary to retain the job. Community

Habilitation is a service delivered in the community (i.e., non‐certified settings) to

facilitate inclusion, integration, and relationship building. Respite is a service that

provides relief to unpaid caregivers who are responsible for the primary care and

support of a person with a developmental disability. The methodology for budgeting

these services depends on the authorities and staffing options chosen by the

participant. Other rules and considerations for these services can be found in the

respective ADMs (see Attachment G)

Direct Provider Purchased and Agency Supported

If a person has a Self-Direction Budget and chooses to receive Direct Provider

Purchased or Agency Supported Community Habilitation, Supported Employment

and/or Respite services, the cost of those services are included in the Self-Direction

Budget and deducted from the person’s PRA.

Self-hired Staff

A person can use self-hired staff to provide Supported Employment, Community

Habilitation and/or Respite with a Self-Directed Budget.

Centers for Medicare and Medicaid Services (CMS) is very clear that within Self-

Direction, a person can hire their own staff to deliver services but the payment

cannot exceed the rate a provider would be paid for the service. Hence:

A person can have self-hired staff persons but payment to the self-hired staff

persons (including all allowable costs that comprise the total employment cost)

cannot exceed the provider rate that would be paid to an agency providing the

same service.

Self-Direction Guidance for Providers March 10, 2022

Page 33 of 66

Hiring Family Members

There are specific restrictions regarding self-hired staff who are related to a Self-

Direction participant. Except where specifically prohibited (e.g., relatives cannot be

hired to deliver Live-In Caregiver or Paid Neighbor services), relatives may be paid

as service providers as long as all of the five following criteria are met:

1. They are at least 18 years of age.

2. They are not the parents, legal guardians, spouses, or adult children

(including sons and daughters-in-law) of the participant.

3. The service is a function not ordinarily performed by a family member.

4. The service is necessary and authorized and would otherwise be provided

by another qualified provider of waiver services.

5. The relative does not reside in the same residence as the participant.

Self-Direction Guidance for Providers March 10, 2022

Page 34 of 66

CHAPTER 10 FAMILY REIMBURSED RESPITE

In addition to, or in lieu of, Respite that is Direct Provider Purchased, Agency

Supported, and Self-Hired, participants in Self-Direction can include Family Reimbursed

Respite (FRR) in their budgets. FRR is paid for with 100% State funds and capped at

$3,000 annually.

Payment Standards

This service is designed to be used as needed, up to the amount budgeted. The

FRR provider and wage do not require prior authorization or approval.

The Fiscal Intermediary may not pay the FRR provider directly. To receive

reimbursement, the Self-Direction participant sends the FI an invoice or statement

specifying the date, times, hours and cost for the FRR utilization.

FRR is a reimbursement service to the family for the expense they incur in being

relieved of their primary caregiver responsibilities. OPWDD is not paying the

person/agency that provides this relief and does not track or regulate who they may

be.

A person who self-directs and receives a Housing Subsidy cannot receive Family

Reimbursed Respite.

For FRR the “service” constitutes both the family incurring the expense and the FI’s

reimbursement.

For FRR the service month is considered instead of the date of service. The service

month will be the month when the family incurred the expense, or is reimbursed by

the FI, whichever occurs later. The time limit for vouchering state payments begins

on the last date of the service month.

This should not be construed to indicate that there is an unlimited “begin” date for

reimbursements to be submitted by the FI. Good judgement and business practices

should be applied to individual scenarios, but in general a reimbursement should

never qualify if the expense was incurred prior to the approval of the person’s SD

budget.

Self-Direction Guidance for Providers March 10, 2022

Page 35 of 66

CHAPTER 11 FAMILY SUPPORT SERVICES

For people who Self-Direct with Budget Authority, Family Support Services (FSS) is a

service that must be included in Self Direction Budgets under Contracted Services. FSS

requires prior authorization from the DDRO and/or FSS Provider, as applicable. These

services are paid for with State funds.

Self-Direction Guidance for Providers March 10, 2022

Page 36 of 66

CHAPTER 12 HOUSING SUBSIDY

Self-Direction participants who choose to live independently, or who share a living

environment and have tenancy rights, may be able to include a Housing Subsidy in their

budgets, funded with 100% State funds. The amount of available Housing Subsidy is

calculated based on a participant’s income and Housing and Community Renewal

(HCR) payment standards. Housing Subsidy follows the same rules as Individual

Supports and Services (ISS).

If an individual qualifies for both Community Transition Services (CTS), and an ISS

Transition Stipend, it is the expectation that the CTS funding be maximized before

requesting funding through an ISS transition stipend. If an individual receives the

maximum payment through CTS, they can only request the difference between the

maximum ISS transition stipend and the amount reimbursed through CTS.

Restrictions

Housing Subsidy is restricted to participants in Self-Direction who are at least 18

years old. The rental lease or mortgage must be in the name of the person who is

self-directing, or the person who is self-directing must have clear tenancy rights in a

shared living environment.

A person who self-directs and receives a Housing Subsidy cannot receive Family

Supports and Services (FSS) nor Family Reimbursed Respite (FRR).

Self-Direction Guidance for Providers March 10, 2022

Page 37 of 66

CHAPTER 13 SHARED LIVING ARRANGEMENTS

The following policy applies to all individuals who Self-Direct with Budget Authority.

Furthermore, the guidance below is applicable to all services/supports that are included

within an individual’s Self-Direction budget regardless of the funding source (i.e.,

Medicaid versus 100% State funded).

An individual enrolled in Self-Direction may choose to live in a shared living

arrangement with other individuals enrolled in the Self-Direction program. These shared

living arrangements may include the sharing of staff or the cost of other routine

household expenses (e.g., rent/mortgage expenses). No more than four (4) individuals

in a shared living arrangement may share staffing supports.

OPWDD Administrative Directive Memorandum (ADM) #2015-01, Service

Documentation for Community Habilitation Services Provided to Individuals Residing in

Certified and Non-Certified Locations and 14 NYCRR Subpart 635-10.5 describes the

limitation of the staff to individual ratio for each service session. A Community

Habilitation service session may include a maximum of four (4) individuals per one staff

person. Therefore, if a group of individuals would like to share staffing to provide

Community Habilitation supports throughout a given day within a shared living

arrangement, the maximum number of individuals who engage in shared staffing

arrangements is four (4) individuals (or less) per staff person.

Community Habilitation services are reimbursed via a fee schedule. The fee schedule

describes the appropriate fee to be billed based on the staff to individual ratio during the

service session as follows:

• Individuals living in non-certified settings with self-hired or agency supported

staff:

o One staff to one individual; or

o One staff to group of two to four individuals.

• Individuals living in non-certified settings with direct provider purchased staff:

o One staff to one individual;

o One staff to two individuals; or

o One staff to three or four individuals.

Shared staffing arrangements must be billed based on the number of hours that staff

are providing services to individuals and the number of individuals who engage in

shared staffing who reside in a shared living arrangement (whether a single residence

or apartment complex). For example, if a group of four individuals engage in shared

self-hired staffing in a non-certified living arrangement, Community Habilitation supports

Self-Direction Guidance for Providers March 10, 2022

Page 38 of 66

provided throughout the day would be billed at the group fee schedule. The Community

Habilitation fee schedule is available on the Department of Health Mental Hygiene Rate

Setting website at:

https://www.health.ny.gov/health_care/medicaid/rates/mental_hygiene/.

Example

An example of a Community Habilitation schedule for a group of four (4)

individuals who are engaging in shared staffing and live together in one non-

certified apartment may include the following ‘shifts’ for their self-hired staff:

• Staffing support hours from 12am-6am.

• Staffing support hours from 6am-12pm.

• Staffing support hours from 12pm-6pm.

• Staffing support hours from 6pm-12am.

In this example, twenty-four (24) hours of Community Habilitation services would

be billed at the group rate code for each person.

Example

An example of a Community Habilitation schedule for two individuals who live in

a non-certified living arrangement comprised of separate apartments who choose

to share self-hired staffing supports to deliver Community Habilitation services,

but the staff person does not simultaneously deliver services to both individuals

may include:

• Individual A: Staffing support hours from 8:00am-12pm

• Individual B: Staffing support hours from 12pm-2pm

In this example, Individual A would claim four (4) staffing support hours at the

one staff to one individual fee. Individual B would claim two (2) staffing support

hours at the one staff to one individual fee.

Additionally, when using a shared staffing arrangement, individuals and providers must

continue to follow the Guidance on Overnight Supports from Chapter 18 of this manual.

In situations where individuals would like to use Self-Direction funding resources for

expenses related to their shared living arrangement, funds must be allocated

individually from each person’s budget consistent with existing budget methodologies.

For example, three (3) individuals share a non-certified residence. The rent for the

residence is $1,500 a month. Each individual would be responsible for contributing a

proportional share of the rent costs consistent with existing methodologies, up to a

maximum of $500 per individual per month.

Self-Direction Guidance for Providers March 10, 2022

Page 39 of 66

In all of the situations described above, an agreement must be reached between all

participating parties when staffing supports, or other Self-Direction resources are being

shared. Individuals and their Fiscal Intermediaries (FIs) will need to work cooperatively

to determine proportional contributions for shared expenses. Payment arrangements

will also need to be specified in the agreements between each individual and their FI.

The terms of these agreements must be provided in each individual’s care planning

record.

Self-Direction Guidance for Providers March 10, 2022

Page 40 of 66

CHAPTER 14 OUT-OF-STATE- and OUT-OF-COUNTRY-SERVICES

Self-directed services delivered outside of New York State must adhere to the

requirements in ADM 2019-02R: Permissible Out-of-State or Country Home and

Community-Based Services (HCBS) Waiver Services Delivery.

Self-Direction Guidance for Providers March 10, 2022

Page 41 of 66

Self-Direction

Guidance for Providers

Part 3

Self-Hired Fringe Benefit

Budgeting and Billing

Self-Direction Guidance for Providers March 10, 2022

Page 42 of 66

CHAPTER 15 FRINGE BENEFIT BUDGETING AND BILLING OVERVIEW

Part 3 provides guidance on claiming self-hired services to Medicaid. Topics

discussed include distinctions between work hours and billable hours and between

wage rates and reimbursement rates, types of self-hired staff, accounting for indirect

costs associated with self-hired employees, and issues related to the processing

logic in Medicaid for self-hired services.

Terms

Understanding the distinctions between these terms is essential to ensure correct

budgeting and claiming for self-hired services.

Work Hours: The actual hours worked by the employee. Per federal and state

labor law, employees must be paid for all hours they are "suffered or permitted to

work."

Wage Rate: The standard rate of pay per hour worked as negotiated by the

participant/family and the self-hired employee. Nonstandard wage rates may

apply in special circumstances (e.g., "overtime" pay).

Billable Hours: The subset of work hours spent by the employee on billable

service activities, as described and defined in OPWDD regulation and

administrative memoranda.

Indirect Employment Cost: Expenses of employment other than wage costs,

including the employer-paid portions of employee benefits, payroll taxes, etc.

Total Employment Cost: Employee wages for hours worked plus indirect

expenses related to the employment of the self-hired worker.

Effective Reimbursement Rate: Total employment costs for the service period

claimed divided by the billable service hours delivered and documented during

the same service period.

Self-Direction Guidance for Providers March 10, 2022

Page 43 of 66

Types of Self-Hired Staff

Employees: The participant and the FI share responsibilities as "co-employer"

of self-hired employees. FIs should permit the participant broad leeway to

negotiate the wage rates of self-hired staff, within the reimbursement restrictions

described in Chapter 16. Because the FI is the legal "employer of record," benefit

packages and other terms of employment typically must follow the FI's policies.

In these cases, the participant may not be able to negotiate further. Nearly all

true employees drive indirect costs in addition to their wage payments. These

indirect costs, in addition to the direct wage costs, must be appropriately

accounted and included in the fee billed to Medicaid.

Self-hired staff who perform Community Habilitation, Respite, and Supported

Employment services must be employees of the participant and Fiscal

Intermediary due to the nature of the work performed by such staff.

Contractors: Staff members who perform services at a negotiated payment per

hour of service rendered as outlined in a formal service contract. Some examples

of a self-hired contractor are a clinician, consultant and therapist. Self-hired

contractors may be self-employed (i.e., an "independent contractor") or may be

the formal employees of a staffing agency. In either case, the legal relationship

between the participant and the self-hired contractor is "purchaser-contractor,"

not "employer-employee." The negotiated service rate is considered "payment-in-

full" for services rendered and there are no indirect costs to be reimbursed. There

are no fringe or indirect costs related to these services when self-hired as a

contractor.

Self-Direction Guidance for Providers March 10, 2022

Page 44 of 66

CHAPTER 16 ACCOUNTING INDIRECT EMPLOYMENT COSTS

In addition to wage expenses, there are "indirect" costs associated with self-hired

employees. Indirect costs include mandated expenses such as the employer portion of

payroll taxes, costs associated with workers compensation and unemployment

insurance, and the employer's cost of providing health insurance to eligible employees.

FI agencies often elect to provide additional employee benefits including life insurance,

pension/retirement plan, and paid time off. Indirect employment costs are part of the

total cost of delivering a service and must be properly charged on the service claim in

order to be reimbursed by Medicaid. There are two basic methods for calculating and

charging indirect employment costs to Medicaid:

Direct accounting method

The FI may elect to record and charge indirect employment costs in the precise

month in which they are incurred for the specific self-hired employees in each Self-

Direction Budget. This method is most feasible when the employee benefit package

is sparse and the FI submits reimbursement claims on a monthly billing cycle.

Fringe rate method

As an alternative, the FI may create a separate pooled account to cover indirect

employment expenses across all of the Self-Direction Budgets it administers. This

pooled account/fund should be funded by fixed percentage surcharges on the wages

of self-hired employees, so that each payment of employee wages yields a

corresponding and proportionate payment into the FI's pooled fringe account. In this

case, the fringe would also include shared overtime and travel costs. FIs have

freedom to establish and administer their own fringe benefits programs and it is

expected that these programs may differ substantially between FIs.

The following principles should be adhered to when using the Fringe Rate Method:

1. Uniformity: The fringe program administered by the FI should be uniform

across all Self-Direction Budgets participating within it. At their option, FIs may

offer single or multiple fringe packages. When multiple packages are offered, the

FI may charge differing fringe assessment rates reflecting the cost differences

among the various packages offered. All benefits packages must be potentially

available to all Self-Direction Budgets administered by the FI and the assessment

rate charged for each benefits package offered should be the same for all

participants.

2. Disclosure: The participant should understand what he/she is "buying" for

employees through the fringe assessment. The FI should provide participants

Self-Direction Guidance for Providers March 10, 2022

Page 45 of 66

with a clear, concise, and complete outline of all indirect employment costs and

employee benefits funded under each fringe package(s) offered and the

assessment rate associated with each package.

3. Impact on permissible wage ranges: The impact of fringe assessment rates

on the permissible wage rates that may be negotiated with self-hired employees

should be explained to participants and their brokers.

4. Advance notice of benefit package and fringe assessment rate changes:

FI agencies shall give participants with self-hired employees at least two months

prior notice before adjusting benefits packages and/or fringe assessment rates.

The implications of an assessment rate change on the effective budget plan

should be reviewed with the participant. Assessment rates shall not be adjusted

retroactively.

5. No administration charge: Costs associated with the FI's administration of

the fringe benefits pool are included in the FI's monthly fee for FI services.

Fringe assessment rates shall not include any component reimbursing the FI for

its administrative cost and effort in managing the fringe pool account.

6. Management of fringe account balances: The FI is responsible for setting

assessment rates that fully fund all fringe program obligations and permit timely

payment of such obligations.

7. Separate Account: A separate, dedicated account or fund must be

established for the self-hired fringe program. Funds in the pooled fringe account

are only for use in addressing indirect employment costs outlined in the

description provided to Self-Direction participants.

8. Surpluses: Surplus funds in the fringe account should not be transferred or

skimmed to cover other costs, losses, or obligations of the FI agency. When

account balances become excessive, surplus funds should be used to reduce the

fringe assessment percentage.

9. Deficits: If the fringe account is temporarily in deficit, the FI will be expected

to honor any financial obligations on behalf of participating Budgets using its own

operational funds until such time it implements an increase in the fringe

assessment rate.

10. Monitoring by OPWDD: OPWDD may develop procedures and protocol to

monitor pooled fringe accounts for compliance with the above principles. This

may include compliance with requirements for submitting Consolidated Fiscal

Reports (CFRs) and compliance with auditing protocols.

Self-Direction Guidance for Providers March 10, 2022

Page 46 of 66

CHAPTER 17 CHARGING STAFF TRAINING EXPENSES IN SELF-HIRED

SERVICES

The term "training" is a broad term that describes many potential forms of instructing

and teaching employees in the skills, duties, and responsibilities required of their

positions. The following guidelines instruct FIs how to handle various forms of training

when billing self-hired services.

On-The-Job Training: Employee training and orientation at the place of work while

the employee is doing the actual job. Such training focuses on the specific tasks and

responsibilities of employees at the work location and the unique needs of the

particular person served. This instruction may be delivered by the person (and/or

family member or designee), by an experienced employee in concert with the person

(and/or family member or designee), or by a professional trainer or employee trainer.

Billable Charges: Employee time receiving employer-mandated training

typically constitutes "time worked" and should be paid as such. When the

person's current self-hired staff assists in the instruction, that employee must also

be paid for time worked. The total employment cost of all self-hired staff (i.e.,

wages + fringe assessment for both trainee and self-hired employee trainer) may

be included in the billed service charges for that service date. See Chapter 16 for

further information on inclusion of costs in the billable fee.

Billable Service Units: Self-hired employee work time spent entirely on

receiving instruction and orientation does not constitute billable time. Even while

under instruction, time spent delivering respite or habilitation services, is billable.

Remember, however, that a period of service time may be charged only once per

person served. Therefore, when an experienced self-hired employee assists in

delivering instruction to a new self-hired employee, only one of the two worker's

time is countable during the period of instruction, even though the billed charges

that day will include wages and fringe for both workers. See Chapter 16 for

further information on inclusion of costs in the billable fee.

Other Costs: Costs associated with the use of professional or employee trainers

(e.g., a FI employee who is not a member of the person's regular self-hired staff)

should be funded from the FI's monthly administrative fee. Costs associated with

developing, producing, and printing any training aids or instructional materials

shall also be covered by the FI's monthly administrative fee. Such costs may not

be included among the billable charges for the self-hired service itself. Any

training or instruction provided directly by the person receiving services, or

his/her family members or designees, shall be delivered free of any charge to the

State or Medicaid.

Self-Direction Guidance for Providers March 10, 2022

Page 47 of 66

Fiscal Intermediary Directed General Employee Orientation, Refresher, and

Classroom/Seminar Training

This is training and instruction provided to all self-hired staff who are co-employed by

the participant and the FI agency on professional, health, safety, and welfare skills,

procedures, and standards. It includes all direct support professional training

mandated by OPWDD or by the FI agency itself.

Billable Charges: Employee time spent receiving employer-mandated training

typically constitutes "time worked" and should be paid as such. Although

employee training time does not represent billable service time, the employment

costs (wages + fringe assessment) associated with such training do represent a

reimbursable cost of delivering the self-hired service. As such, training-related

employment costs may be included in the billed service charges for the service

date the employee training is attended. If there were no claimable service units

for the person on that particular day (e.g., all of the person's self-hired

community habilitation staff attended training that day, there was no substitute

staff, and, therefore, the person did not receive any billable community

habilitation service units that day), the training-related employment costs may be

added to the regular charges on the next day claimable service units were

delivered. Training should be scheduled and paced to minimize the potential of

exceeding the effective reimbursement rate (ERR) caps (see Chapter 16

Preparing Claims to Medicaid for Self-Hired Services) in any billing cycle.

Billable Service Units: Since the staff receiving training renders no habilitation

or respite services, this form of employee training will not yield billable service

units.

Substitute Staff: During the planning process, the person and their Circle of

Support should determine whether substitute staff will be required when regular

self-hired staff attend training. When substitute staff is required, the cost should

be included in the person's budget. This may be accomplished by either

budgeting additional staff hours for self-hired workers who will cover the trainee's

absence or adding Agency Supported or Direct Provider Purchased services to

the budget.

Other Costs: The FI agency is responsible for all other costs of such training

using funds derived from its monthly administrative fee. This includes the wages,

fees, and/or reimbursed expenses of the trainer or instructor, costs of all

instructional materials and their reproduction, facility costs, lodging, refreshments

and meals. Such costs may not be included among the billable charges for self-

hired service itself.

Self-Direction Guidance for Providers March 10, 2022

Page 48 of 66

Person/Family-Directed Special Employee Training

This is a special required employee training identified by the person (or his/her

family or designee) to address a specific need of the particular person served. It is

not delivered by the person who is self-directing or his/her family members or