Recommendations for Liquidity

Risk Management for Collective

Investment Schemes

Final Report

The Board

OF THE

I

NTERNATIONAL ORGANIZATION OF SECURITIES COMMISSIONS

FR01/2018

FEBRUARY 2018

Copies of publications are available from:

The International Organization of Securities Commissions website www.iosco.org

© International Organization of Securities Commissions 2018. All rights reserved. Brief

excerpts may be reproduced or translated provided the source is stated.

Foreword

In 2013, the Board of the International Organization of Securities Commissions (‘IOSCO’)

published a report which contained Principles of Liquidity Risk Management for Collective

Investment Schemes (‘2013 Liquidity Report’) against which both the industry and authorities

were asked to assess the quality of regulation and industry practices concerning liquidity risk

management of collective investment schemes (‘CIS’).

1

The 2013 Liquidity Report took into account the lessons learned from the financial crisis of

2007-10 and reflected the approach taken by member jurisdictions having responded to those

events. The 2013 Liquidity Report was designed as a practical guide for authorities and

industry practitioners and focused, for the most part, on the liquidity risk management of

open-ended CIS.

2

They were addressed to the entity / entities responsible for the overall

operation of the CIS. It was recognised that implementation may vary from jurisdiction-to-

jurisdiction, depending on local conditions and circumstances.

Since then, IOSCO has actively engaged with the Financial Stability Board (‘FSB’) in their

analysis of the potential systemic risks arising in relation to the liquidity risk management of

CIS, among other matters. The FSB, on January 12 2017, issued recommendations to address

structural vulnerabilities from asset management activities that could potentially present

financial stability risks.

3

Eight of its nine recommendations relating to liquidity are

addressed to IOSCO.

4

In addition, a number of member jurisdictions have conducted further

significant work either on updating their own regulatory framework or guidance with regard

to liquidity risk management of CIS.

5

1

IOSCO, Principles of Liquidity Risk Management for Collective Investment Schemes, Final Report, Report of the

Board of IOSCO, March 2013, available at: https://www.iosco.org/library/pubdocs/pdf/IOSCOPD405.pdf

2

By open-ended CIS, in this document we mean a registered/authorised/public CIS which provides redemption

rights to its investors from its assets, based on the net asset value of the CIS, on a regular periodic basis during its

lifetime - in many cases on a daily basis, although this can be less frequently.

3

FSB, Policy Recommendations to Address Structural Vulnerabilities from Asset Management Activities (‘FSB

Policy Recommendations’), January 12, 2017, available at:

http://www.fsb.org/wp-content/uploads/FSB-Policy-Recommendations-on-Asset-Management-Structural-

Vulnerabilities.pdf.

4

The seven recommendations relevant to liquidity are Recommendations 2-8 of the FSB Policy Recommendations.

Regarding Recommendation 1 of the FSB Policy Recommendations, please see the IOSCO June 2016 Statement

on ‘Priorities Regarding Data Gaps in the Asset Management Industry’, available at:

https://www.iosco.org/library/pubdocs/pdf/IOSCOPD533.pdf

5

See for example:

• Financial Conduct Authority, Liquidity Management for Investment Firms: Good Practice, Feb 2016, available

at: https://www.fca.org.uk/news/liquidity-management-for-investment-firms-good-practice

• French AMF, Guide to the Use of Stress Tests as Part of Risk Management within Asset Management Companies,

Aug 2016, available at:

http://www.amf-

france.org/en_US/Publications/Guides/Professionnels?docId=workspace%3A%2F%2FSpacesStore%2F8e10f441-

056c-4809-9881-36c23a292200

• French AMF, Public consultation by the AMF on the terms for implementing gates in UCITS and AIFs, Dec

2016, available at:

http://www.amf-france.org/en_US/Publications/Consultations-

%20publiques/Archives.html?docId=workspace%3A%2F%2FSpacesStore%2F49e6bd83-3397-4ae4-bcc7-

35975b6e9dcc

• Hong Kong SFC, Circular to Management Companies of SFC-authorised Funds on Liquidity Risk Management,

July 2016, available at: http://www.sfc.hk/edistributionWeb/gateway/EN/circular/doc?refNo=16EC29

Reducing systemic risk is one of IOSCO’s three objectives of securities regulation. It forms

part of IOSCO’s work to develop, implement and promote adherence to internationally

recognised and consistent standards of regulation, oversight and enforcement. Principle

Six of the IOSCO Principles and Objectives states that each regulator should “… have or

contribute to a process to monitor, mitigate and manage systemic risk, appropriate to its

mandate.”

This final report follows, and builds on, the publication of CR04/2017 Consultation on CIS

Liquidity Risk Management Recommendations on 6 July 2017. It constitutes the final step in

IOSCO’s response to the liquidity risk management recommendations that the FSB has turned

to IOSCO to provide further guidance on.

To this end, IOSCO has built further on the overall approach previously set out in the 2013

Liquidity Report, taking into account the feedback received during consultation and the

financial stability focus emphasised in the FSB Recommendations, together with investor

protection considerations. In this document on Recommendations for Liquidity Risk

Management for Collective Investment Schemes (‘2018 Liquidity Recommendations’)

IOSCO re-affirms and enhances the guidance set out in the 2013 Liquidity Report.

Effective liquidity risk management is important to safeguard the interests and protection of

investors, maintain the orderliness and robustness of CIS and markets, and helps reduce

systemic risk, all of which supports financial stability. The revisions to the text supplement the

approach set out in the 2013 Liquidity Report with additional recommendations and more

detailed guidance to uphold these objectives by addressing the particular issues highlighted

in the recommendations of the FSB.

IOSCO expects that securities regulators will actively promote the implementation by

responsible entities of the 2018 Liquidity Recommendations. However, as noted in the 2013

Liquidity Report, when the recommendations are being implemented, they have to be

transposed within the context of the specific legal structures prevailing in each jurisdiction.

Hence, the implementation of the recommendations may vary from jurisdiction-to-

jurisdiction, depending on local conditions and circumstances. Following the adoption of the

recommendations and once a period of time for initial implementation has passed (e.g. 2-3

years), IOSCO intends to assess implementation across the relevant jurisdictions.

• Ontario Securities Commission, OSC Staff Notice 81-727 Report on Staff’s Continuous Disclosure Review of

Mutual Fund Practices Relating to Portfolio Liquidity, June 2015, available at:

http://www.osc.gov.on.ca/documents/en/Securities-Category8/ni_20150625_81-727_portfolio- liquidity.pdf

• Romania ASF, Methodology for the Stress Test on Romanian Open-end and Closed-end Investment Funds, July

2016 (yet to be published)

• US SEC, Investment Company Liquidity Risk Management Programs, Investment Company Act Release No.

32315, Oct. 2016, available at: https://www.sec.gov/rules/final/2016/33-10233.pdf

• US SEC, Investment Company Reporting Modernization, Investment Company Act Release No. 32314, Oct

2016, available at: https://www.sec.gov/rules/final/2016/33-10231.pdf

• US SEC, Investment Company Swing Pricing, Investment Company Act Release No. 32316, Oct 2016, available

at: https://www.sec.gov/rules/final/2016/33-10234.pdf

The consultation closed on 18 September 2017. We received 25 formal responses.

IOSCO simultaneously publishes a final report titled Open-ended Fund Liquidity and Risk

Management – Good Practices and Issues for Consideration (‘Good Practices Document’)

which provides practical information on measures that may be taken to address liquidity risk

management. Topics covered include: ensuring consistency between a fund’s redemption

terms and its investment strategy; liquidity risk management tools; and stress testing. When

implementing the 2018 Liquidity Recommendations, these good practices provide

responsible entities with a useful reference point against which to assess whether their own

practices follow a similar approach, or to the extent that they vary, whether they can achieve

similar outcomes, and furthermore assist with evolving the most effective approach to the

responsible management of liquidity.

Contents

Chapter

Page

1

Why Supplement the 2013 Liquidity Report?

1

2

IOSCO 2018 Liquidity Recommendations

6

Appendix: Consultation Feedback Statement

21

1

Chapter 1: Why Supplement the 2013 Liquidity Report?

1.1 Analysis of Systemic Risks

While IOSCO affirms the overall appropriateness of the 2013 Liquidity Report, it is also part

of the role of IOSCO to continue to identify and respond, as appropriate, to emerging risks. The

environment in which CIS operate can be affected by a number of significant factors driving

change, such as monetary policy, regulatory change, technological change and changes in

market confidence. These factors can impact both market liquidity and the behaviour of investors

in stressed market conditions. A number of these factors may be at work in the current period.

6

Nevertheless, evidence of a sustained effect on current market liquidity is not conclusive, as

outlined by the IOSCO Committee 2 (C2) examination of liquidity in the secondary corporate

bond markets.

7

Market spreads remain healthy and CIS liquidity remains strong. However,

even if such factors have not translated into an evident deterioration in market liquidity, they

are evidence of the constantly changing market environment for which those responsible for

managing CIS must be prepared. Securities regulators should have mechanisms to address, or

contribute to addressing, crisis situations consistent with their jurisdictional, legal and

regulatory framework, having due regard to the costs and benefits of relevant actions.

It is in that wider context that IOSCO has contributed to the work of the FSB in developing

recommendations to address “structural” vulnerabilities from asset management activities. The

fourteen recommendations which the FSB has developed seek to address four potential sources

of systemic risk:

i. liquidity mismatch between fund investments and redemption terms and conditions

for open-ended fund units;

ii.leverage within investment funds;

iii. operational risk and challenges in transferring investment mandates in stressed

conditions; and

iv. securities lending activities of asset managers and funds.

Among these four “structural” vulnerabilities, the FSB has highlighted liquidity mismatch and

leverage as key vulnerabilities. The FSB Recommendations for liquidity mismatch focus on

open-ended funds (public and private, including exchange-traded funds (ETFs), but excluding

money market funds (MMFs)). The 2018 Liquidity Recommendations, like the 2013 Liquidity Report,

continue to apply to open-ended CIS as defined in footnote 2.

6

IMF, Global Financial Stability Report, Chapter 2, ‘Market Liquidity – Resilient or Fleeting?’, Oct 2015, available

at: https://www.imf.org/External/Pubs/FT/GFSR/2015/02/pdf/c2_v2.pdf

7

IOSCO C2 did not find substantial evidence showing that liquidity in the secondary corporate bond markets has

deteriorated markedly from historic norms for non-crisis periods, available at:

https://www.iosco.org/library/pubdocs/pdf/IOSCOPD537.pdf

2

1.2 Responsibilities and Key Challenges for

Responsible Entities

The 2018 Liquidity Recommendations emphasise the importance of ensuring the quality of

day-to-day liquidity management where CIS are designed to have frequent dealing

arrangements. Many of the decisions which responsible entities should take to manage the

liquidity of a CIS appropriately involve the use of tools which are a familiar part of routine

liquidity risk management activities. However, some of the tools which CIS should have

available, referred to here as ‘additional’ liquidity management tools, are more appropriately

used in exceptional circumstances

8

with the characteristics of the CIS, prevailing market

conditions and other relevant circumstances determining which specific tools to employ and

how they should be used in a given situation. This approach acknowledges that there is no ‘one

size fits-all’ solution

9

and responsible entities are expected to exercise their sound professional

judgement in the best interest of investors.

The recommendations are designed to support the effective exercise of that professional

judgement in both stressed and normal market conditions. The recommendations set out an

approach under which responsible entities are expected to monitor and evaluate the underlying

portfolios of their CIS in light of stressed market conditions and other relevant circumstances

in order to determine whether or not to activate additional liquidity tools and, when activated,

the manner (e.g. through a single or a combination of liquidity tool(s)) and timing of

implementation. Appropriate management of CIS liquidity by responsible entities will help

minimise the potential that CIS could transmit stress to the market. In addition, the

recommendations also describe a range of initiatives during both the pre-launch/design phase

of the CIS and the on-going day-to-day operation of the CIS in order that responsible entities

can appropriately manage liquidity and have contingency plans in place to implement the

additional liquidity management tools as needed.

However, IOSCO has also observed three particular challenges for responsible entities

which it considers appropriate to highlight, and which are addressed within the additional

recommendations and guidance:

Firstly, with regard to the pre-launch design process, most open-ended CIS offer regular, if not

daily, dealing. When responsible entities consider daily dealing appropriate, it is particularly

important that other design features of the CIS should be sufficiently robust to ensure

alignment of the daily dealing feature with the liquidity of assets of the CIS.

Secondly, even where a prudent liquidity management strategy is in place, it remains

important to test or otherwise evaluate that liquidity risk management strategy. Stress testing

8

Not all of these additional liquidity management tools are available in all jurisdictions. The FSB, in its final

recommendations, has also encouraged authorities to review their frameworks and consider broadening the range of

additional liquidity tools available to managers. This exercise is under way in a number of jurisdictions. Where this

is a matter for legislators rather than for securities regulators, all relevant authorities should stand ready to advise

legislators with regard to the merits and risks of the different additional liquidity management tools that might be

allowed.

9

IOSCO 2018 FR02/2018 ‘Open-ended Fund Liquidity and Risk Management – Good Practices and Issues for

Consideration’.

3

recommendations or similar evaluations can be particularly useful to a CIS in evaluating its

liquidity risk, its capacity to respond to liquidity risks (particularly in difficult market

conditions), as well as validating and supporting a good liquidity risk management

strategy.

Thirdly, under certain circumstances, CIS may be allowed to limit redemption rights or

otherwise manage the consequences of redemptions, if permitted by applicable law and

regulation, by the use of various additional liquidity management tools. However, an ability

to limit, defer or suspend redemption rights, if permitted by applicable law and regulation,

should not be seen as freeing the responsible entities from their duty to endeavour faithfully

to meet redemption demand in an orderly fashion. Such additional liquidity management tools

may be relied on in liquidity management planning, but only in instances of stressed market

conditions where to do otherwise could lead to management of the CIS which is not in the

best interest of investors or lead to undermining of the investment strategy. Where there is an

expectation that additional liquidity management tools can be proportionate to deal with

stressed market conditions, there should also be a strong level of assurance that the CIS can

actually implement such options in an orderly, prompt and transparent manner. While the

implementation of additional liquidity management tools may potentially pose reputational

risk to the responsible entity or the CIS, such risk can be mitigated through effective investor

communication and putting in place sound contingency plans. Therefore, IOSCO, in

producing additional recommendations and guidance around additional liquidity management

tools, is encouraging securities regulators to promote clear decision-making processes and

planning for CIS implementation of such tools. Ultimately, IOSCO wishes to remind entities

that good communication in liquidity issues with their respective regulators is essential.

1.3 Securities Markets Regulator Engagement

10

The 2018 Liquidity Recommendations are addressed to the responsible entities who manage

liquidity risk in all phases of the lifecycle of a CIS (please see recommendations 3 and 4). The

primary responsibility for appropriately designing the features of new CIS, effectively

managing liquidity risk and then deciding whether to use liquidity management tools rests with

the responsible entity, exercising independent judgment based on the individual circumstances

facing a fund (recommendation 17). It is the duty of responsible entities to ensure that securities

regulators are kept appropriately informed of their actions and, unless otherwise provided by

applicable regulation, they should not rely on approval from securities regulators before

making their decisions. However, securities regulators should consider communicating more

closely with the relevant responsible entities and issuing guidance where appropriate to ensure

investors are protected and for financial stability reasons

11

. Situations may however arise, for

example market dislocation or widespread stress events, where the responsible entity is not

best placed to make that determination. In such instances, there may be a need for securities

regulators to issue some form of guidance tailored to the specific circumstances for example,

issuing guidance to specific funds. As a last resort, securities regulators should consider the use

10

By Securities Markets Regulator or Securities Regulator, this report means the authorities which are empowered to

authorise, supervise and/or enforce against relevant rules and legislation relating to the operation of CIS or their

managers in their respective jurisdictions.

11

FSB recommendation 2.

4

of exceptional tools, considering the costs and benefits of such action from a financial stability

perspective.

12

Authorisation and supervisory models legitimately vary around the globe, as do relevant

markets, and so there is no ‘one size fits all’ approach to implementing appropriate liquidity

management regulation and oversight of responsible entities. Securities regulators fulfil a key

role throughout the entire life cycle of a CIS. They put in place appropriate regulatory

requirements for responsible entities and conduct appropriate oversight of responsible entities’

liquidity risk management processes, in both normal and stressed market conditions,

encouraging dialogue with entities about it. This applies not only to the ways responsible

entities put the recommendations into operation, but also how they ensure they – as responsible

entities – function in a robust and credible manner on an on-going basis (see recommendations

12 and 14). In particular, securities regulators that authorise or license CIS and/or their

responsible entities should focus on the recommendations relevant to the pre-launch/design

phase of the life of a CIS to the extent consistent with local law, as part of the authorisation

process. For example, they should, consistently with their overall approach to the authorisation

of CIS, consider the proposed inter-relationship between the asset types, the dealing and notice

arrangements and disclosure arrangements included in the design of the CIS.

13

However, there are a number of useful approaches which securities regulators may consider in

conducting appropriate supervision of ongoing compliance by CIS and/or responsible entities

to the matters covered by these recommendations. Securities regulators may wish to collect

appropriate information to monitor the responsible entities and/or CIS in a manner consistent

with their supervisory model.

14

They may also expect that responsible entities should be able

to demonstrate, when requested, how they periodically test contingency plans, including

whether additional liquidity management tools can be activated and used in a prompt and

orderly manner. Where securities regulators have concerns relating to the performance of

liquidity assessments by responsible entities, it is for example expected that they would take

appropriate supervisory action, so that responsible entities address deficiencies in their

processes for liquidity assessments.

As noted above, securities regulators

15

should consider providing appropriate guidance which

could include, for example, guidance or assistance to the market as a whole, to individual

responsible entities or to sub-sectors of CIS as appropriate on the use of additional liquidity

risk management tools and issues to consider in such circumstances. Such guidance may be

provided in advance of potential stressed market conditions to help improve contingency

planning. In exceptional circumstances such as an unpredictable widespread stress or market

dislocation, securities regulators should consider whether to provide specific guidance to

selected market participants based on specific facts and concerns taking into account cost and

benefits of such action. Most likely this will take the form of enhanced engagement with market

12

FSB recommendation 4.

13

FSB recommendation 3.

14

In line with the FSB’s January 2017 Policy Recommendations recommendation 1, IOSCO C5 plans to review and

report on relevant data collection and reporting by securities regulators.

15

Consistent with the regulatory and supervisory framework of each jurisdiction.

5

participants (e.g., daily communication, increased data reporting, firm-specific discussions on

possible tools), particularly if faced with increasing systemic risks.

16

Some securities regulators have powers to intervene with a view to supporting orderly market

functioning. They can do so by directing the use of some additional liquidity management tools

(usually the suspension of redemptions). In practice, the use of this power has been rarely

deemed to be necessary. There can be a risk of moral hazard, namely the incentive to take

responsibility which should be on individual responsible entities could be diminished in

situations where those responsible entities foresee that the securities regulator is likely to

intervene. Notably, where predictability is provided around the exercise of such suspension

decisions, this could in fact act as a catalyst to exacerbate stress or its transmission. There may

also be potential spill-over effects and other possible unintended consequences that should be

carefully considered before exercising any direct intervention power which involves requiring

CIS to suspend redemptions.

On the other hand, the availability of these tools can be beneficial. Indeed, deployed

appropriately, their use or possible use, can create a sense of constructive ambiguity amongst

individual market participants which can help to encourage better market discipline in stressed

situations.

Where the use of such powers is under consideration, there should be coordination as

appropriate amongst authorities (securities regulators, central banks, macro-prudential

authorities and micro-prudential authorities) domestically and / or with fellow competent

authorities in other jurisdictions (for example in the event of cross-border considerations).

These activities by securities regulators should support the desired outcomes of investor

protection, market integrity and financial stability from the application of these

recommendations that all CIS have manageable dealing frequencies, effective liquidity

management strategies and robust contingency plans.

16

FSB recommendation 8.

6

Chapter 2: IOSCO 2018 Liquidity Recommendations

This chapter sets out the final IOSCO 2018 Liquidity Recommendations after careful

evaluation of the responses to the July 2017 Consultation Report. These recommendations

replace the liquidity risk management framework contained in the 2013 Liquidity Report. To

this end, IOSCO has built on that previous framework by re-affirming and enhancing its

previous guidance and supplementing it through additional recommendations.

The CIS Design Process Recommendations

Recommendation 1

The responsible entity should draw up an effective liquidity risk management process,

compliant with local jurisdictional liquidity requirements

The liquidity risk management process, and its operation, is the fundamental basis of liquidity

control within the CIS. The remainder of this section expands on some of the factors that must

be taken into account as part of this process. The liquidity risk management process forms one

part of the broader total risk management process. Risk management generally relies on strong

and effective governance.

Some jurisdictions have an explicit definition of liquidity and set requirements on the “amount”

of liquidity certain types of, or all, CIS must have at all times (for example, by a hard

requirement on the percentage of the CIS that must be held in liquid instruments; or in the

case of certain money market CIS, indirectly through detailed rules on what type of instrument

and the proportions that can be held by the CIS).

When considering creating a new CIS, the responsible entity must be able to (demonstrate

that they can) comply with the relevant explicit or principles-based local liquidity

requirements that will apply to the CIS.

17

The liquidity risk management process, while proportionate, needs to be able to be effective

in varied market conditions. Where the CIS is likely to be at a greater risk of liquidity

problems, the responsible entity should construct (and perform) a more rigorous liquidity risk

management process. Examples of CIS in this category include, but are not limited to, those

with a high proportion of illiquid assets and/or a narrow investor base.

The responsible entity should fully consider the liquidity of the types of instruments in which

the CIS’s assets will be invested, at an appropriate level of granularity,

18

and should seek to

ensure that, taking account of the CIS’s portfolio as a whole, these are consistent with the

CIS’s ability to comply with its redemption obligations or other liabilities.

17

The remainder of the recommendations in this document should be interpreted in that context. For example, in the

case where a certain percentage of the CIS’s assets must be kept in certain types of liquid instruments, the responsible

entity’s systems should be appropriate to ensure that percentage is adhered to at all times.

18

Consideration at the level of the asset class may not be sufficiently granular - for example, some equities can be

liquid and some illiquid.

7

A responsible entity does not need to construct a new process for each new CIS if it

already operates a CIS with similar characteristics. However, it must ensure the process

remains appropriate and relevant and sufficiently bespoke for any other CIS it is used for.

Recommendation 2

The responsible entity should set appropriate liquidity thresholds which are proportionate

to the redemption obligations and liabilities of the CIS

The responsible entity should set appropriate internal definitions and thresholds for the CIS’s

liquidity, which are in line with the principle of fair treatment of investors and the CIS’s

investment strategy. The thresholds should act as a signal to the responsible entity to carry out

more extensive in-depth, quantitative and/or qualitative liquidity analysis as part of the risk

management process (with the intention that the responsible entity would then take appropriate

remedial steps if the analysis revealed vulnerabilities).

For example, a daily dealing CIS would be expected to have stricter liquidity requirements than

a CIS sold on the basis that investors would not be expected to redeem before a set period expired;

or a CIS that invested predominantly in real estate but promised frequent redemption rights to its

investors might consider it appropriate to hold a relatively large stock of more liquid assets (which

could be related to real estate) as well, because of the expected length of time it would take to

dispose of physical properties in order to meet redemption requests.

A responsible entity could place stricter internal thresholds on liquidity than its local regulatory

requirements.

It should be remembered that investor redemptions are not the only source of liquidity demand on

a CIS (for example, margin calls from derivative counterparties).

Recommendation 3

The responsible entity should carefully determine a suitable dealing frequency for units in the

CIS

Where there is not a specified local requirement, the responsible entity should ensure that they

set a dealing frequency for units in the CIS which is realistic and appropriate for its investment

objectives and approach, taking account of its liquidity risk management process, and allowing

redemptions to be processed effectively.

Deciding that a CIS should be open-ended and the terms on which it is open-ended (to the extent

the applicable law and regulation allows such discretion) is a significant design decision to be

made. Often responsible entities may be subject to market pressure to provide very frequent

dealing options when designing open-ended CIS even when they wish to invest in assets which

are, or are likely to become, less liquid. Responsible entities should give due consideration to

the structure of the fund and the appropriateness of, for example, the dealing frequency having

regard to the target investor base, the investment strategy and objectives and also the expected

liquidity of the assets. The investment strategy and objectives should be designed to give strong

assurance that redemptions can be met in both normal and reasonably foreseeable (i.e. extreme

but plausible) stressed market conditions.

8

The ability to gain certain tax treatment for a CIS, or to access a wider market for distribution,

should not lead responsible entities to set a more frequent dealing frequency for units in the CIS

than is appropriate.

Recommendation 4

The responsible entity should ensure that the CIS’ dealing (subscription and redemption)

arrangements are appropriate for its investment strategy and underlying assets throughout the

entire product life cycle, starting at the product design phase

The initial design of a CIS presents an opportunity to put arrangements in place to underpin

effective liquidity risk management. CIS should be designed to meet their redemption

obligations. If those obligations cannot be met in a particular situation, then it must be managed

in a prudent and orderly fashion which is in the best interest of investors.

As part of the initial design process for open-ended CIS, a documented assessment should be

conducted of the liquidity risks likely to face the CIS, having regard to its proposed investment

strategy, its target investors (as available to the responsible entity) and the assets and

instruments it is intended to invest in. The assessment should set out why the relevant design

features of the proposed CIS constitute an appropriate structure within which to manage

liquidity risk in both normal and reasonably foreseeable stressed market conditions.

19

This

should include consideration as to the quality of information about the investor base which is

made available by different distribution channels for the CIS.

Given the importance of design decisions, the assessment should be subject to an internal

approval process at an appropriate senior management and/or board level within the responsible

entity where it can be reviewed and updated on an ongoing basis from both portfolio

management and risk management perspectives. Such reviews should consider that the aim is

to protect investors, maintain market integrity and thereby, as a consequence, promote financial

stability.

Liquidity Risk Management Practices – Liabilities

There should be due regard in the design process, based on market knowledge and other

information reasonably available to the responsible entities, to the likely risk appetite of the

investors a CIS is designed to target and in line with the underlying investment mandate. As

such, responsible entities should seek to engage with constituent elements of the distribution

chain to take reasonable steps to improve their understanding of the underlying type of

investors and the behavioural characteristics associated with such relevant types of investors.

Liquidity Risk Management Practices – Assets

In carrying out the design phase process, there should be due regard to the current and historical

liquidity of the assets and instruments to be invested in, and where applicable, to the impact of

limits which could be set, including limits on illiquid assets, concentration of assets, individual

19

In particular, having open-ended structures, especially those offering frequent (e.g. daily) redemptions for CIS

investing in illiquid assets such as infrastructure or real estate, would need a justification through such documented

assessment. For further details, please see boxes 1 and 3 of the ‘Open-ended Fund Liquidity and Risk Management

– Good Practices and Issues for Consideration’, January 2018 at:

http://www.iosco.org/library/pubdocs/pdf/IOSCOPD589.pdf

9

counterparty risk, CIS size, trading, limits on time allowed to correct unintended limit breaches

and any other limits which could be imposed.

Depending on local law and regulation, responsible entities may also be required to consider

the appropriateness of additional liquidity management tools during the design and

authorisation process. This may, for example, be required by rules set out in regulatory

frameworks or as part of an authorisations process which may consider the appropriateness of

liquidity arrangements.

Liquidity Risk Redemption-constraining ‘Additional Liquidity Management Tools’

Having completed the design phase analysis of liquidity of the proposed assets, the

characteristics of target investors and the features of every-day liquidity management practices,

(for example, monitoring levels of subscriptions and redemptions), the responsible entity

should consider in the design of the CIS an appropriate range of additional liquidity

management tools to help manage redemptions in stressed market conditions (particularly

those that could lead to severe market dislocation) or instances of unusually high redemptions,

if not already required to in the circumstances outlined above. Such tools should be designed to

operate in the best interests of investors within the CIS, taking into account the nature of the

assets and its investor base. All such tools are subject to applicable laws and regulations.

Where securities regulators have concerns that appropriate consideration may not have been

given to these factors they should, where allowed by local law and regulation, exercise their

regulatory powers to seek to ensure all reasonable steps are taken by responsible entities to

remedy the situation.

The responsible entity should consider the appropriateness of tools and additional measures for

their CIS, taking into account the nature of assets held by the CIS and its investor base.

Tools and additional measures should only be used where fair treatment of investors is not

compromised, and where permitted by the law and regulation applicable to the CIS.

Examples of tools which may be permissible in certain jurisdictions would include: exit

charges, limited redemption restrictions, gates, dilution levies, in specie transfers,

20

lock-up

periods, side letters which limit redemption rights or notice periods. Some of these tools (e.g.

notice periods) may be built-in to the CIS’s dealing policy, but others may be contingent (e.g.

a limit to redemptions met the same day only if redemption requests exceed a certain percentage

of the NAV).

Additional measures include side pockets

21

or suspensions. CIS’s should not be managed in

such a way that the investment strategy relies on the availability of these measures, should

liquidity problems be experienced.

20

Retail investors should generally not be required to accept in specie transfers when they wish to redeem part or all

of their investments. As a good practice, the responsible entity should only offer investors redemptions in specie

where the institutional investor has consented to this arrangement. See “IOSCO Good Practices on the Termination

of Collective Investment Funds Final Report” Nov. 2017, available at:

http://www.iosco.org/library/pubdocs/pdf/IOSCOPD588.pdf

21

In some jurisdictions, side pockets may be considered to be ‘normal tools’ rather than ‘additional measures’ for

certain types of CIS. Their creation and use in this manner is generally not suitable for CIS offered to retail investors

because illiquid or hard to value assets are not normally suitable for retail investors.

10

Recommendation 5

The responsible entity should consider liquidity aspects related to its proposed distribution

channels

The responsible entity should consider how the planned marketing and distribution of the CIS

are likely to affect its liquidity. This should also include consideration of market conditions

when forecasting their expectations for the volume, type and distribution of investors, as well

as the effectiveness of individual distribution channels.

In some jurisdictions, it is common for investors to hold their investments through aggregated

nominee accounts, making it more difficult for the responsible entity to be fully aware of the

make-up of the underlying investor base (for example, a holding of one million units in an

aggregated account could represent a small number of investors each with large individual

holdings, or many more investors each with a smaller number of units). In this situation

a responsible entity should take all reasonable steps to obtain investor concentration

information from nominees to assist its liquidity management (for example, via contractual

arrangements).

Recommendation 6

The responsible entity should ensure that it will have access to, or can effectively estimate,

relevant information for liquidity management

The responsible entity should consider its information needs in order to effectively manage

liquidity risk in the CIS, and whether it will be able to access that information during the

life of the CIS. For example, where the CIS plans to invest in other CIS the responsible

entity should be satisfied that it can obtain information about the underlying CISs’

approaches to liquidity management and any other pertinent factors such as potential

redemption restrictions used by the underlying CISs.

Recommendation 7

The responsible entity should ensure that liquidity risk and its liquidity risk management

process are effectively disclosed to investors and prospective investors

As part of the disclosures in a CIS’s offering documents

22

about the risks involved in investing

in the CIS, there should be a proportionate and appropriate explanation of liquidity risk. This

should include an explanation of why and in what circumstances it might crystallise; its

significance and potential impact on the CIS and its unit-holders, and a summary of the process

by which the responsible entity aims to mitigate the risk.

For example, disclosure of what actions the responsible entity would take in the event of a

liquidity problem would be useful information. The explanation should set out clearly how the

investor could be affected. In some jurisdictions large unit-holder concentration risk may have

to be disclosed.

22

The term ‘offering documents’ here refers to documents that are freely available to investors.

11

Explanation of any tools or additional measures that could affect redemption rights (see

Recommendation 17) should be included in the CIS’s offering documents. The explanation

should include what the tool or measure is, what effect its use will have on CIS

liquidity/investor redemption rights and examples of when the tool or measure might be applied

(if it is of a contingent nature). A responsible entity must take care to ensure that these

descriptions are clear and comprehensible to investors.

The responsible entity must not consider disclosure of liquidity risk, and information about its

liquidity risk management process, to be a substitute for the actual operation of an effective

policy.

The relevant disclosures concerning liquidity of the CIS should be properly designed taking

into account the nature of the assets the CIS intends to invest in and the degree of sophistication

of the investor profile.

Basic day-to-day liquidity information (for example, the dealing frequency of the CIS and how

to buy/sell units) should be disclosed to investors.

Disclosures concerning liquidity have the potential to provide investors with information to

determine whether their liquidity risk appetite matches the liquidity risk profile of the CIS. In

particular, such disclosure is most likely to be beneficial where the CIS is invested in assets or

instruments which have a record of significantly varying liquidity across the financial cycle or

where there is insufficient historical evidence

23

to assess whether liquidity will vary

significantly across the financial cycle.

Additional disclosure requirements to investors should include one or more of the following:

•

A commitment in the initial offering documentation to provide to investors on a

periodic basis and where appropriate, on an aggregate basis, information regarding

the investment portfolios of the CIS that may allow investors to assess the

liquidity risk attached to the CIS e.g. holdings of various asset classes/types of

securities, detailed holdings of individual securities;

•

Disclosure in the CIS offering documents of the general approach the CIS will take

in dealing with situations where it is under liquidity pressure from a heightened

level of net redemption requests.

The disclosure of the liquidity of assets to investors may be transparently done by profiling

the actual or projected asset portfolio/asset class(es) which the CIS is currently or expected

to invest in. At the time of the launch of the CIS, disclosure of liquidity in the offering

documents can be focused on the types of prospective assets targeted by the investment

strategy. Thereafter it can be disclosed or reported based on the actual investment strategy

and/or assets and instruments held by the CIS. While disclosure regarding liquidity should

be balanced against maintaining the confidentiality of market strategies where this is in the

23

For example, where a particular asset has only come into existence in recent times, and therefore does not provide a

sufficient period of historical evidence. A further example includes where an asset is primarily traded off market, and

thus does not provide sufficient historical evidence of performance.

12

interests of investors, sufficient detail should be disclosed to make investors aware of material

liquidity risks. Disclosures should be proportionate to their risks.

Where additional liquidity management tools (see Recommendation 17) are included in

the design of a CIS, the details of how such liquidity management tools would operate

and what the activation of such tools would mean for investors should be readily accessible

and set out clearly and appropriately for potential investors.

Day-to-day Liquidity Management Recommendations

Recommendation 8

The responsible entity’s liquidity risk management process must be supported by strong and

effective governance

Governance is of paramount importance for an effective liquidity risk management process,

as even the most sophisticated liquidity modelling and perfectly predicted cash flows can be

made redundant by the lack of effective oversight or controls to deal with the information

produced.

While governance structures for CIS differ across jurisdictions and, to an extent, with the

size of the responsible entity, appropriate escalation procedures should be in place if

problems are envisaged or identified.

Governance arrangements should also ensure that risks to the CIS are considered and

managed as a whole (for example, as noted earlier, the inter-relationship between valuation

and liquidity).

Again, related to the particular governance structure and size of the responsible entity, there

should be an appropriate degree of independent oversight involved in reviews of the liquidity

risk management process.

24

Recommendation 9

The responsible entity should effectively perform and maintain its liquidity risk management

process

After a liquidity risk-management process is established pre-launch, it must be effectively

performed and maintained during the life of the CIS. The remainder of the recommendations

in this section set out some of the relevant considerations relating to such performance and

maintenance.

In performing its liquidity risk management process, the responsible entity should take account

of the investment strategy, liquidity profile and redemption policy of the CIS. The liquidity risk

management process must also take account of obligations of the CIS other than investor

redemptions (for example, delivery and payment obligations such as margin calls, obligations

to counterparties and other creditors).

24

This does not mean the responsible entity necessarily has to involve an external party in the review.

13

The liquidity risk management process could be performed as part of the wider risk-

management arrangements adopted by the responsible entity, involving resource from its risk

management and/or compliance functions (where relevant). Risk management and

measurement arrangements that are more adaptive (rather than static) and systems that can

rapidly alter underlying assumptions to reflect current circumstances are likely to be at the

forefront of good liquidity risk management, as are those which utilise a wide range of

information and different perspectives and those which incorporate varied scenario analysis in

their performance.

Regular periodic reviews of the effectiveness of the liquidity risk management process should

be undertaken by the responsible entity and the process should be updated as appropriate. An

additional review and possible updates may also be necessitated by the occurrence of certain

events. For example, if the CIS is to invest in a new type of asset or if the investor profile has

changed materially (from that anticipated) – for example, if a CIS originally expected to have

a large number of retail investors but in fact only attracts a small number of institutional

investors each owning a significant share of the CIS – the policy should be reviewed and

updated, if deemed appropriate.

Recommendation 10

The responsible entity should regularly assess the liquidity of the assets held in the portfolio

The liquidity risk management process should enable the responsible entity to regularly

measure, monitor and manage the CIS’s liquidity. The responsible entity should take into

account the interconnection of liquidity risk with other risk factors such as market risk or

reputational risk.

25

The responsible entity should ensure compliance with defined liquidity limits and the CIS’s

redemption policy, whether these are set by national regulation, set out in the liquidity risk

management process, detailed in the CIS’s documentation or other internal thresholds.

The liquidity assessment of the CIS’s assets should consider obligations to creditors,

counterparties and other third parties. The time to liquidate assets and the price at which

liquidation could be effected should form part of the assessment of asset liquidity, as should

financial settlement lags and the dependence of these on other market risks and factors.

Recommendation 11

The responsible entity should integrate liquidity management in investment decisions

The responsible entity should consider the liquidity of the types of instruments it intends to

purchase or to which the CIS could be exposed,

26

as well as liquidity effects of the investment

25

It is accepted that some risk factors are difficult or impossible to specify quantitatvely.

26

For some derivatives the settlement asset could be less liquid than the derivative, so this should also be considered.

14

techniques/strategies it uses, before transacting;

27

and the impact that the transaction or

techniques/strategies will have on the overall liquidity of the CIS. Responsible entities should

only carry out transactions if the investment or technique/strategy employed does not

compromise the ability of the CIS to comply with its redemption obligations or other liabilities.

The assessment of liquidity risk includes the consideration of the type of asset and where

applicable trading information (for example, volumes, transaction sizes and number of trades,

issue size) as well as an analysis, for each type of asset, of the number of days it would take

the responsible entity to sell the asset without materially moving the market prices.

For OTC securities other information may be more meaningful in delivering comparable

analysis, such as the quantity and quality of secondary market activity, buy/sell spreads and the

sensitivities of the price and spreads.

Liquidity risk management must also consider collateral arrangements (for example, to take

account of the risk of deterioration in the quality of collateral received from a counterparty in

a derivative transaction, if it were to become illiquid). The liquidity “quality” of securities

accepted as collateral should be evaluated on an ongoing basis, in light of collateral

arrangements actually in place (for example, segregation of collateral accounts, unavailability

of collateral for investment purposes, haircut thresholds and so on). With respect to derivative

transactions, the responsible entity should ensure that the quantity of liquid assets is sufficient

to meet settlement of margin calls.

The responsible entity should take exceptional care if utilising tools such as temporary

borrowing to manage liquidity. Not only will the CIS incur a financial cost for this, but if the

temporary borrowing does not solve the problem then the CIS may need to suspend or wind-

up and it will at this point be leveraged, potentially with exacerbated problems.

Investors in the CIS that benefit from the borrowing (by being able to redeem) may not

be the ones paying the costs of it (remaining unit-holders). However, there may be some

cases where inflows can be predicted with some certainty (e.g. if there are substantial

regular monthly contributions into the CIS), which mitigate the risks involved with temporary

borrowing.

Where a CIS is winding-up, the responsible entity should consider liquidity issues, along with

any legal requirements or relevant conditions set out in the CIS’s constituting documents, and

balance the early return of proceeds to investors with the need to secure a fair price for the

CIS’s assets.

Recommendation 12

The liquidity risk management process should facilitate the ability of the responsible

entity to identify an emerging liquidity shortage before it occurs

27

Some investment strategies would preclude detailed analysis before every individual transaction, but application of

the liquidity risk management process should provide reasonable assurance that the investment decisions are

consistent with the CIS’s overall liquidity profile.

15

The liquidity risk management process should aim to assist the responsible entity in

identifying liquidity pressures before they crystallise, thus enabling it to take appropriate

action respecting the principle of fair treatment of investors.

During stressed market conditions, the responsible entity should seek to ensure that the

interests of investors are safeguarded and CIS investors are being treated fairly

28

As such, the

responsible entity should seek to maintain the investment strategy and attempt to maintain

alignment between the funds’ investment strategy and its liquidity profile taking into account

investors’ best interests, including ensuring that remaining investors are not left with a

disproportionate share of potentially illiquid assets. One such step could involve the monitoring

and management of large redemptions by investors which have the potential to reduce the

normal liquidity profile to the extent reasonably practicable.

Retail investors, in particular, will have a general expectation that, in normal circumstances,

the CIS will be able to meet redemption requests on the standard terms set out in its offering

documents. While the use of additional measures may enable a liquidity issue to be

“managed”, by restricting investor redemption rights, it is preferable to avoid this if possible.

Where a responsible entity has a choice as to whether to apply an additional measure – or

a tool - that could affect redemption rights at all, or which of several tools or measures to

apply, it must make this decision in the best interests of unit-holders (see Recommendation 17).

Responsible entities should make best efforts to manage future cash flows so as to assist with

liquidity management (for example, it may be possible to negotiate a pre-notice period with

brokers before changes in margin call formulas become effective, or to negotiate longer periods

for repo agreements).

Recommendation 13

The responsible entity should be able to incorporate relevant data and factors into its

liquidity risk management process in order to create a robust and holistic view of the

possible risks

In performing the liquidity risk management process, the responsible entity should consider

quantitative and qualitative factors to seek to ensure that in all but exceptional circumstances

the CIS can meet its liabilities as they fall due.

Key information should be taken into account which, where known or available or subject to

sensible estimate, could improve the capability to manage liquidity risk. Consistent and verifiable

statistical methods can be used to generate data and scenarios where appropriate – scenarios

can relate to the behaviour of investors and/or the CIS assets.

29

One of the key challenges in liquidity management is taking appropriate account of the

uncertainty in future investor behaviour both in normal market conditions and, in particular,

in stressed markets. The more that a responsible entity knows about its investor base, the

better able it will be to plan for and manage future liquidity needs. While

28

Of relevance is the ‘IOSCO Principles for the Valuation of Collective Investment Schemes’, May 2013, available

at: http://www.iosco.org/library/pubdocs/pdf/IOSCOPD413.pdf

29

For example, the responsible entity may consider whether publicity about the relatively poor performance of a CIS

compared to its peer group might lead to an increase in redemption requests and/or a decrease in new subscriptions.

16

acknowledging that there are operational hurdles

30

that impede responsible entities from

accessing information, such entities should make reasonable efforts to understand their investor

base. This involves at least considering the marketing and distribution channels of the CIS, and

analysing the historical redemption patterns of different types of investors.

As large and unexpected redemptions are a key source of liquidity risk, in combination with

other data, for example historical fund flows, this investor information would allow estimates

of the pattern(s) of subscriptions and redemptions and identification of realistic stress scenarios

when performing the liquidity assessment by the responsible entity, such as a sudden withdrawal

by investors (especially institutional investors) holding a significant portion of the funds to meet

their own liquidity requirements, or a pattern of withdrawal by a category/type of investors to

be identified.

This investor base knowledge could include investor profiles of the various types of investors

which may allow the responsible entity to understand why investors are investing in the CIS,

their risk appetite and in what circumstances they may wish to redeem. The responsible entity

should, where possible, conduct assessments of the characteristics of the investor base in a

CIS, analyse the potential impact that these characteristics have on the level of redemptions

under different scenarios and take this into account in liquidity management for the CIS.

Data on liabilities such as collateral needs and potential margin calls, should be assessed

alongside potential redemption demands.

Where possible, responsible entities should interact with relevant intermediaries to secure pre-

notification about removal from a “best-buy” list or similar.

While ensuring the fair treatment of all investors, and no preferential disclosure to select

investors,

31

a responsible entity could keep up-to-date with investors who have a large unit-

holding in the CIS regarding whether they intend to make significant redemptions. However, this

should be done in a way that avoids any conflicts of interest between the responsible entity and

such investors - that cannot be properly managed - from arising.

Recommendation 14

The responsible entity should conduct ongoing liquidity assessments in different scenarios,

which could include fund level stress testing, in line with regulatory guidance.

Stress testing can assess how the liquidity profile of, or redemption levels of, a CIS can change

when faced with various stressed events and market situations. It is an important component

of a responsible entity’s liquidity risk management process. Stress testing should support

and strengthen the ability of the responsible entities in managing liquidity risk appropriately

in the best interests of investors. Specifically, stress testing can be used by responsible

entities to assess the liquidity characteristics of the CIS’s assets relative to the CIS’s

anticipated redemption flows under stressed market conditions and to tailor the CIS’s asset

composition, liquidity risk management, and contingency planning accordingly. Stress

30

Examples of operational hurdles include third party distribution channels (e.g. use of platforms) and the use of

nominee structures.

31

Certain jurisdictions may permit investment funds to enter into different contractual arrangements with different

investors.

17

testing can enable responsible entities to pre-empt and respond promptly to the threat of a

liquidity or redemption shock.

Given the diversity of the CIS universe, stress testing arrangements, as further set out below,

should be appropriate for the size, investment strategy, underlying assets and investor profile

of the CIS, taking into account other relevant market and regulatory factors.

32

For instance,

fund level stress tests may not be required where this would be disproportionate taking into

account the size, investment strategy, nature of the underlying assets and investor profile of the

CIS.

Stress testing should be supported by strong and effective governance. In particular, the

performance and oversight of stress testing should be sufficiently independent from the portfolio

management function. Responsible entities should maintain appropriate documentation of

stress testing and should be able to provide the relevant information to authorities upon request.

Appropriate stress testing should be carried out based on normal and stressed scenarios (for

example, atypical redemption requests). Scenarios should include backward-looking historical

scenarios and forward looking hypothetical scenarios, and could be based on parameters

calculated using statistical techniques or concrete stress events where appropriate to do so.

Stress testing should be based on reliable and up-to-date information. Stress testing scenarios

should be appropriate to the CIS. For example, the responsible entity could analyse the number

of days that it would take to sell assets and meet liabilities in the stressed scenarios simulated,

taking into account where practical and appropriate the expected behaviour of other market

participants (e.g. the behaviour of other CIS managed by the same responsible entity if the

circumstances are appropriate to do so) in the same conditions, any known inter-fund

relationships such as inter-fund lending arrangements, and any actions the responsible entity

would take (e.g. imposition of contingent liquidity management tools). In respect of

collateral, stress testing could be used to demonstrate that the quantity of liquid assets is

sufficient to meet settlement of margin calls on derivatives positions.

Responsible entities could also conduct stress testing related to other market risks and factors.

For example, it may be appropriate to assess the impact of a credit rating downgrade of a

security held by the CIS as one factor, as such a downgrade can affect the security’s liquidity

and that of the CIS. Reputational risk from a problem with another aspect of the responsible

entity’s business, or problems experienced in a similar CIS run by another entity, could also

cause unexpected redemption requests.

It is also useful to conduct stress tests which start from the assumption that the responsible

entity has been obliged to implement additional liquidity management tools, which then

identifies situations where this might occur, and which works through the consequence of

operating in those situations. This approach has the potential to improve the understanding of

the circumstances in which the CIS may need to resort to additional measures, but it may not

be appropriate for all CIS.

32

For example, stress testing would be more important and relevant to CIS with less liquid underlying assets and open-

ended CIS with daily dealing arrangements.

18

Feedback from any real situations experienced (“back-testing”) should be used to improve the

quality of output from future stress testing.

Stress testing results have the potential to contribute, a s appropriate, into all stages of the

CIS’s product life cycle, including in the product design stage when determining the dealing

and distribution arrangements and asset composition, and in performing investment and

liquidity risk management (e.g. in calibrating holdings of liquid assets and other investments,

and the use of different liquidity risk management tools and contingency planning) on an

ongoing basis. Although it cannot prevail over their best judgement, stress testing can help

support responsible entities when they use their best judgement in reasonably foreseeable

circumstances.

Stress testing should be carried out at a frequency relevant to the specific CIS, especially in

anticipation of reasonably foreseeable stressed market conditions to which the CIS would be

sensitive.

Recommendation 15

The responsible entity should ensure appropriate records are kept, and relevant disclosures

made, relating to the performance of its liquidity risk management process

As part of performing their liquidity risk management process, responsible entities should be

able to demonstrate (to their regulator, for example) that robust liquidity arrangements are in

place and that they work effectively.

In order to support the successful implementation of and adherence to the process it should be

effectively documented and communicated across the responsible entity’s business. Such

documentation should be reviewed as needed, and at least annually in any event. Regular

reporting requirements may require risk disclosures, for example in the CIS’s annual report,

and in some cases it may be appropriate to detail liquidity risks or issues in this context.

Where there has been a material change to liquidity risk either in level (that is, in the markets

relevant to the CIS’s portfolio), the responsible entity’s approach or, for example, if the

responsible entity is planning to introduce a new tool or additional measure (see

Recommendation 4) that could affect redemption rights or change the CIS’s dealing policy, the

responsible entity should inform investors appropriately. In some jurisdictions this may

require (prior) approval by the regulator and/or existing investors.

Where an additional measure is applied (e.g., the imposition of a side pocket), existing and

potential investors must be informed in an appropriate manner, and kept informed over time

(for example, by material on the responsible entity’s website). In some jurisdictions, regulators

must also be informed and/or must approve the application of any such measures (in advance).

Contingency Planning Recommendations

Recommendation 16

The responsible entity should put in place and periodically test contingency plans with

an aim to ensure that any applicable liquidity management tools can be used where

necessary, and if being activated, can be exercised in a prompt and orderly manner.

19

The testing of operational capacity should be such that to the extent possible and on a reasonable

basis, the CIS can use all available liquidity management tools, including in stressed market

conditions, that will allow for the continued orderly management of the CIS and maintain

investor confidence in the management of the CIS.

Having included the appropriate mechanisms in the design of the CIS, the responsible entities

should engage in sufficient contingency planning to ensure that any additional liquidity

management tool that the CIS can use under applicable law and regulation can be exercised

in a prompt and orderly manner. To this end, the responsible entities should plan for such

events having regard to whether:

a) the operational capacity exists to implement and unwind any such tools in a

transparent, fair and orderly manner in the best interest of investors;

b) in those jurisdictions where relevant, the operational capacity continues to exist to

exercise such tools at short notice if required by a relevant authority to do so;

c) the legal basis for the exercise of every tool disclosed in the CIS documentation

continues to be assured by the responsible entity to the satisfaction of the relevant

decision makers of the responsible entity;

d) the escalation process for the implementation of any such tools can be conducted

in a prompt and orderly manner;

e) there continues to be procedural clarity as to who is responsible for initiating

consideration of and deciding on the exercise any such tools;

f) there are policies in place as to when the tools will be actively considered and that

these policies are documented, clear, accessible to relevant responsible entity

decision makers, continue to be aligned with the nature of the CIS and to be

understood clearly by relevant decision makers. These policies should take into

account applicable law and regulation and be sufficiently detailed to make the

governance of and responsibility for the relevant decisions clear;

g) the capacity exists to keep investors and relevant authorities informed promptly of

developments and, if needed in that jurisdiction, all necessary information should

be provided at short notice to seek consent from relevant authorities for the use of such

tools.

Through such a procedure, responsible entities will establish a reasonable level of internal

assurance regarding the policies and procedures in place for triggering and applying such

additional liquidity management tools.”

Recommendation 17

The responsible entity should consider the implementation of additional liquidity

management tools to the extent allowed by local law and regulation, in order to protect

investors from unfair treatment, amongst other things, or prevent the CIS from diverging

significantly from its investment strategy.

Additional liquidity risk management tools, provided that such tools are permitted in the

relevant jurisdiction and contained within the CIS constitutional document, can provide

valuable assistance in the management of stressed market conditions. There are a number

of considerations, related to the specific market conditions and the characteristics of the fund

and its investors, to be taken into account when assessing whether to use these tools.

20

In-kind redemptions and in-specie redemptions facilitate the exit of investors from the

CIS without the responsible entity having to liquidate the assets or to deplete cash held by the

CIS in order to fulfil their redemptions. A key issue when assessing the use of these tools is

the nature of the investors in the CIS, e.g., whether the investors are retail or institutional. The

use of in-kind redemptions and in-specie redemptions may not be practical or appropriate for

retail investors, especially if the assets are considered relatively illiquid (e.g. real estate,

infrastructure).

Anti-dilution levies and swing pricing, where they are available under local law also aim to

ensure that investors remaining in the CIS do not incur the costs of redeeming investors.

These tools may be considered particularly appropriate where the fund invests in assets

where investors may perceive an advantage in redeeming first. By ensuring that costs of

transactions required to meet redemption requests are borne by the redeeming investors,

these tools provide assurance to remaining investors and remove a potential incentive for

investors to redeem. There are a number of factors which the responsible entity should be

mindful of in relation to these tools: what the disclosure should be to investors of the

conditions which would trigger the use of such tools; the complexities in producing a

calculation mechanism; the difficulties in accurately providing for anti-dilution levies to

reflect the market impact of the redemption in the redemption price.

Several additional liquidity management tools have the effect of slowing down the rate at

which requests for redemption are paid and providing flexibility for responsible entities to

complete portfolio sales required to meet these requests. Assessment of which additional tools

are suitable and effective entails consideration of the specific scenario that has led to

stressed market conditions, the degree of visibility the responsible entity has on the time

required to liquidate assets and whether use of the tool is permitted by local law and regulation.

Where the responsible entity is confident that required asset sales can be completed

within a set timeframe, the implementation of extended notice/settlement periods and

variable notice periods could be considered.

Redemption gates and limits on withdrawals have a similar effect of slowing down the rate

of redemptions, while retaining a commitment to meet redemption requests within a certain

timeframe. In cases where stressed markets have resulted in illiquidity and valuation

concerns in specific portfolio assets (e.g. a specific asset class), side-pockets

33

could be

implemented to transfer those assets from the CIS portfolio, although they may not always be

suitable for use in CIS targeting retail investors. Suspension of redemptions is a tool that

provides for a delay in paying out redemptions and limits a run on the CIS. Suspension can be

particularly useful in cases where the responsible entity requires an extended period to

liquidate assets or has limited visibility on the timing of asset sales or is reluctant to accept

a significant discount to normal market prices.

34

Redemption gates and limits on withdrawals

can also be considered for use in these cases.

33

See footnote 21.

34

The IOSCO 2012 Principles on Suspension of Redemptions outline that “The fact of suspension in one CIS, or a

small group of CIS, increases concerns about further suspensions and may thus lead to disinvestments/withdrawals

in other CIS possibly causing further CIS suspensions…. The suspension may not only directly impact the investor

but, depending upon the scale of the CIS, also may have indirect macroeconomic or market-wide implications.”

21

Appendix

Feedback Statement

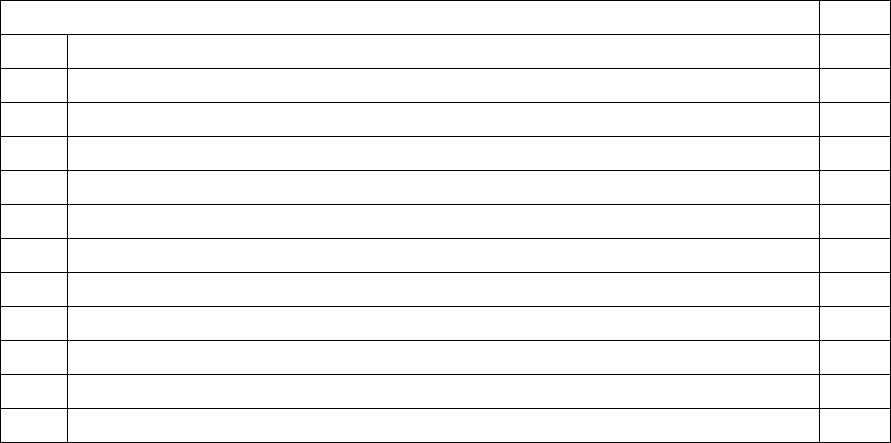

IOSCO Board Consultative Report – CIS Liquidity Risk Management Report

Comments were submitted by the following organisations to the IOSCO Board in respect of

the consultative CIS Liquidity Risk Management Report.

1. AFG

2. Allianz Global Investors

3. Amundi

4. Association of the Luxembourg Fund Industry (ALFI)

5. Barnard, Chris (Individual)

6. BlackRock, Inc

7. BVI

8. CFA Institute

9. CNMV Advisory Committee

10. DST Systems

11. EFAMA

12. German Insurance Association

13. HDFC

14. HSBC Global Asset Management

15. ICI Global

16. ICMA

17. Investment Trusts Association, Japan

18. Irish Funds

19. Reliance Nippon Life Asset Management Limited

20. SIFMA

21. State Street Bank and Trust Company

22. The Investment Association

23. US Chamber of Commerce

24. Vanguard

These comments were taken into account in the preparation of the final recommendations