Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 1/

AMF POSITION/RECOMMENDATION

DOC-2020-03

INFORMATION TO BE PROVIDED BY COLLECTIVE INVESTMENT SCHEMES

INCORPORATING NON-FINANCIAL APPROACHES

Reference texts: Articles L. 533-12, L. 533-22-1 and L. 533-22-2-1 of the Monetary and Financial Code and Articles

411-126 and 421-25 of the AMF General Regulation

1. CONTEXT

Since the start of 2019, the roll-out of non-financial investment management schemes and ranges of funds

incorporating environmental, social and governance criteria has gathered momentum, with announcements along

these lines made by several portfolio asset management companies (“AMCs”). This trend is underpinned by

European regulatory initiatives and by increasing demand from investors, especially retail investors. In this context,

it is necessary for the AMF to clarify its expectations of AMCs to ensure the quality of information provided for

investors and its consistency with the non-financial investment management approaches adopted by fund

managers.

The AMF's approach is guided by the following principles:

- The AMF wants to encourage and support the momentum in favour of sustainable development, while

taking care to ensure the conditions for trust and the emergence of good practices;

- The rapid changes in the industry are taking place in a context that is still not clearly defined and in which

numerous strategies, with more or less significant ambitions, coexist; this variety of approaches may

correspond to diverse expectations and needs on the part of investors. To ensure a good understanding

of the diversity of the product offering and prevent risks of greenwashing in particular for retail clients,

a key issue is the information provided to the investor to evaluate the proposed approach, and whether

it is accurate, clear and not misleading;

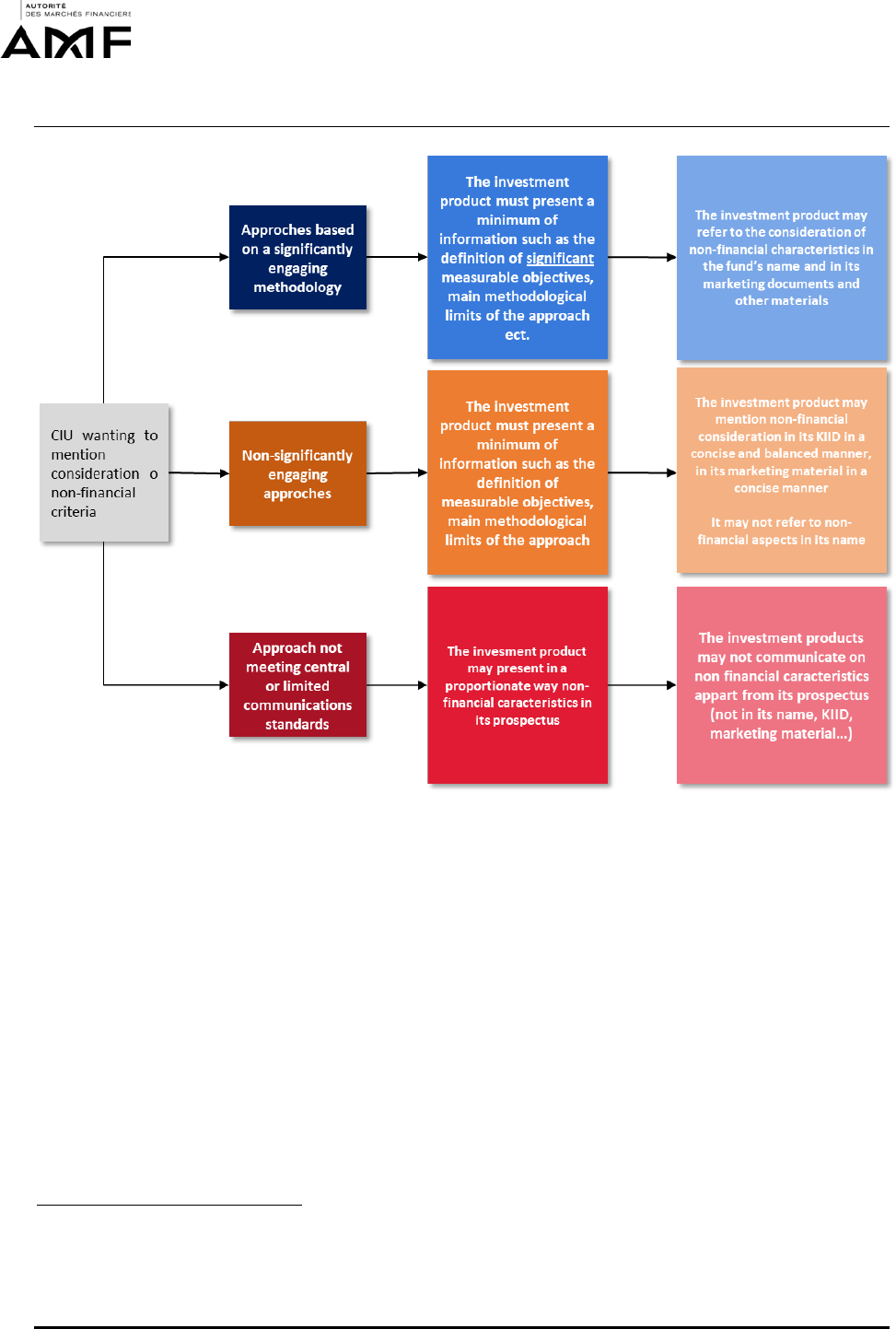

- In response to these risks, the information sent to investors regarding consideration of non-financial

characteristics should be proportionate to the actual consideration of these factors. Accordingly, only the

approaches that are significantly engaging will be able to present non-financial criteria as a key aspect of

product communication, e.g. in their name. Approaches based on a non-significant commitment may also

adopt a “limited communication ” proven that they comply with specific minimum standards -;

In this context, the AMF publishes a policy, defining a number of criteria making it possible to assess the effective

nature of the approaches used. The principle is that the objectives of consideration of non-financial criteria must

be measurable. In the specific case of rating upgrade approaches or approaches based on selectivity in relation to

a benchmark investment universe, the criteria to be allowed to make non-financial characteristics a key aspect of

communication are based notably on the thresholds defined by the French SRI public label. These criteria

correspond to the greatest number of cases of funds wanting to make consideration of non-financial characteristics

a key aspect of their product communication.

At the same time, and to allow smoother changes in fund managers' product ranges, the AMF facilitates the

procedure for product modifications designed to take into account non-financial characteristics by no longer

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 2/20

requiring that this constitute as such a change subject to its authorisation. As such, specific information will have

to be communicated to investors

1

.

This policy applies to the following asset management and distributors of collective investment productsauthorised

for marketing in France to a clientele of retail investors. It applies to:

- asset management companies of French UCITS

2

and French alternative investment funds that can be

marketed to retails investors: general purpose investment funds (FIVG)

3

, private equity funds including

retail private equity investment funds, retail venture capital investment funds and retail local investment

funds, real estate collective investment undertakings (OPCI) and real estate investment companies

(SCPI),

4

employee investment undertakings, funds of alternative funds, and "Other AIFs" when the latter

have at least one non-professional unitholder or shareholder

5

;

- the entities marketing such collective investment products in France, but also UCITS incorporated under

foreign law

6

.

However, this policy is not applicable to French-domiciled collective investment products which are only marketed

abroad and whose subscription and acquisition of units or shares are reserved for non-French-resident investors.

Funds taking into account non-financial characteristics in their investment decision that do not opt for a

significantly engaging methodology will be able to mention it in their communication without making it a key

aspect of communication.

This policy corresponds to a context in which the approaches allowing for these criteria are diverse and changing

over time. It is also designed as a response to a specific context in which numerous fund managers are considering

making changes to existing funds to include consideration of non-financial characteristics. Accordingly, and while

far from exhausting all issues regarding the quality of non-financial information disclosed on these CIUs, this

guidance is characterised by the definition of a set of minimum standards allowing non-financial criteria to be made

a key aspect of product communication or adopt for a limited communication on non-financial criteria. The

compliance to the standards mentioned in this guidance does not imply that the methodology used by the asset

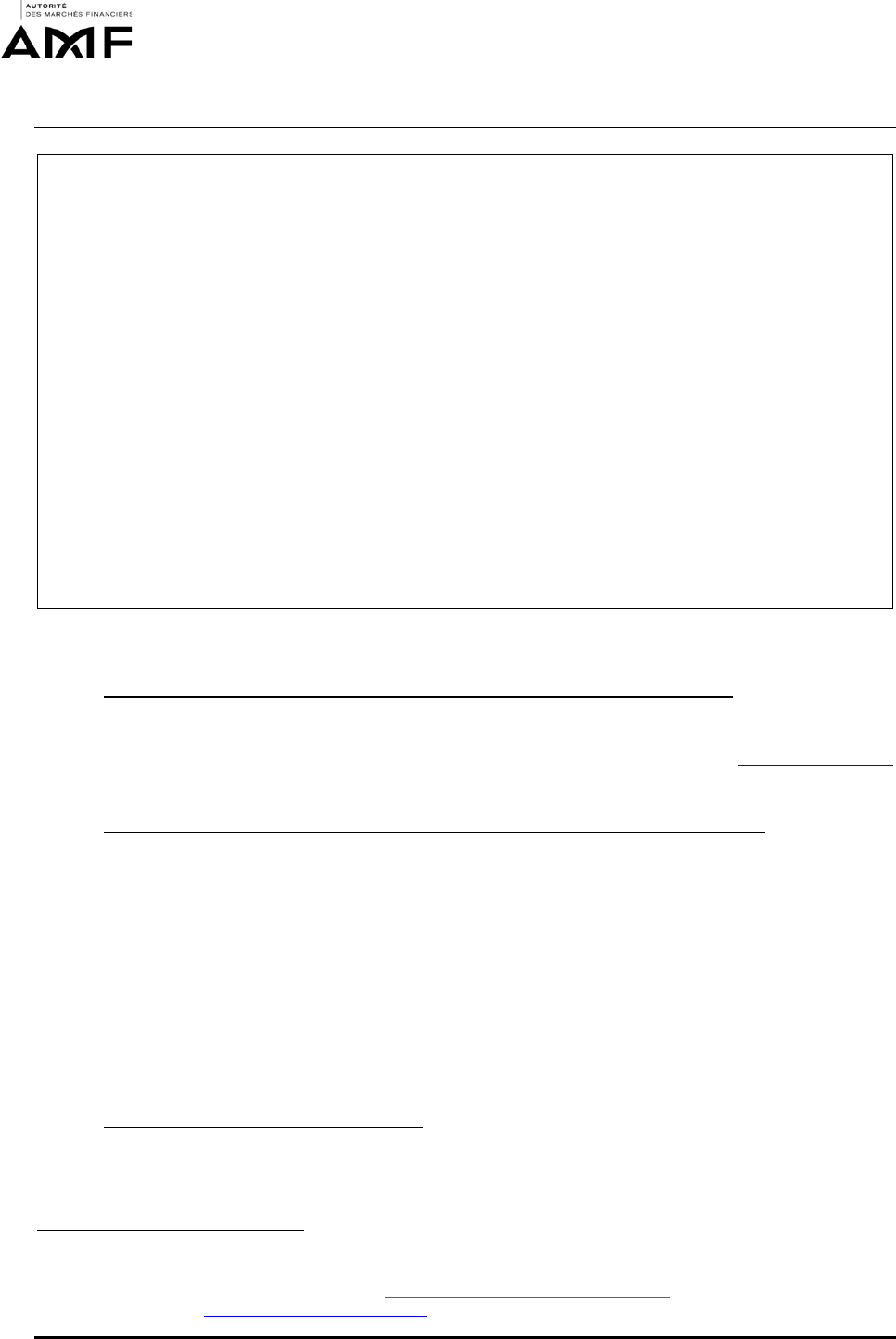

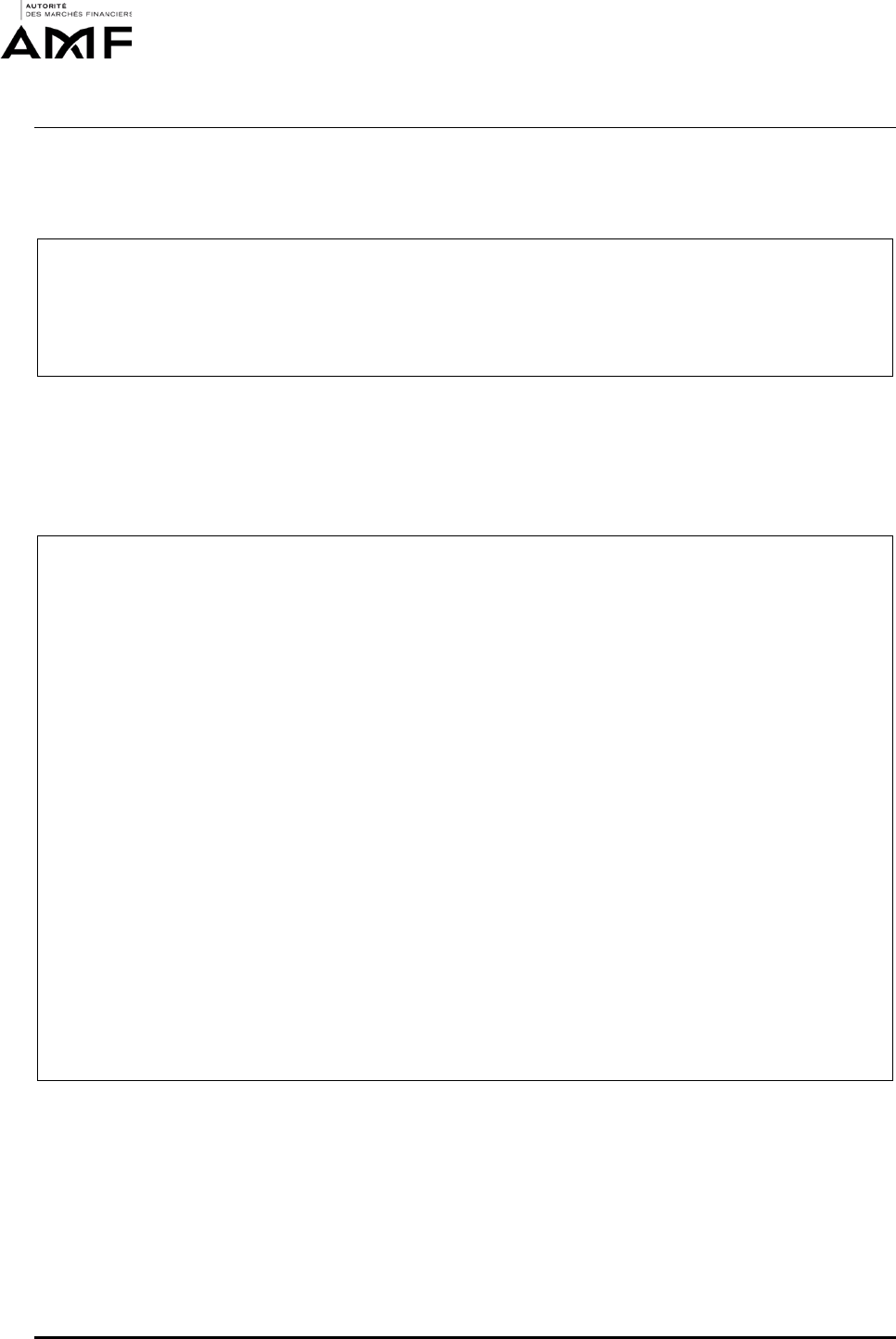

manager has a real impact. These standards can be summarised by the following diagram

7

.

1

For UCITS, retail investment funds (RIF), funds of alternative funds (FAF) real estate undertakings for collective investment (OPCI),

professional real estate collective investment undertakings (OPPCI), private equity funds and employee investment funds (FCPE)

2

With the exception of structured OPCVM mentioned at article R.214-28 of the Financial and Monetary Fund

3

With the exception of structured FIVG mentioned at article R.214-32-39 of the Financial and Monetary Fund

4

For application of the provisions of this policy to SCPIs, the "KIID" refers to the "PRIIPs KID" (Regulation (EU) 2019/2088 of the Parliament and

of the Council of 27 November 2019 on the publication of information regarding sustainability in the financial services sector) and the

prospectus refers to the information prospectus (mentioned in Instruction 2019-04: "Real estate investment companies, forestry investment

companies and forestry investment groups").

5

As defined in III of Article L.214-24 of the Monetary and Financial Code. For the application of this policy to these AIFs, the information

mentioned in the KIID and the prospectus refers to the information documents made available to investors pursuant to Article 3 of Instruction

DOC-2014-02.

6

Via the provisions applicable to UCITS distributors in accordance with the provisions of Article 411-126 of the AMF General Regulation.

7

Excluding feeder funds mentioned in section 7 and structured funds.

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 3/20

This policy could, in particular, be reassessed notably depending on the outcome of the work on the delegated acts

of the "SFDR"

8

. Pursuant to the article 11 of this regulation AMCs and AIFs will be required to disclose periodic

information to assess the extent to which environmental or social characteristics are met

9

or on the sustainability-

related impact of the products

10

. At this stage, this regulation does not determine minimum standards for products

mentioning non-financial criteria.

Moreover, the policy does not cover the general information disclosed by AMCs concerning their responsible

management approach (e.g., involvement in voluntary standards, etc.).

For the purposes of this policy:

- "Regulatory documents" shall be understood as meaning:

o The prospectus and, where applicable, the Key Investor Information Document ("KIID");

o The instruments of incorporation of the CIU (rules or articles of association);

o Any other document disclosed to investors which must be forwarded beforehand to the AMF for

authorisation or the issue of an approval of the CIU's information prospectus.

8

Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on the publication of information regarding

sustainability in the financial services sector (“Sustainable Finance Disclosure Regulation, “SFDR”).

9

For financial products mentioned at the article 8 of this regulation

10

For financial products mentioned at the article 9 of this regulation

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 4/20

- “Marketing materials” shall be understood as meaning any information of a promotional nature sent

directly to potential/existing subscribers, or likely to be passed on by distributors to their clients, either in

writing or verbally.

11

Timing and conditions for the entry into force of the provisions of this policy

The following policy applies with the following timeline

1. Creation of collective investment products, products modifications and notification of cross-border

marketing of a foreign-based UCITS

12

: immediate application.

2. Existing products at the March 11

th

2020: application at the latest on March 10

th

2021. During this

transitional phase, modifications of the products to delete any non-financial reference (e.g. change of

denomination) only requires an information by all means to investors.

3. Creation of collective investment products, products modification and notification to the AMF of cross-

border marketing of a foreign based UCITS between March 12

th

and July 22th 2020: application of the

required modifications at the latest on September 30

th

2020.

2. GENERAL PRINCIPLES OF THE NON-FINANCIAL INFORMATION DISCLOSURE

Faced with the diversity of the non-financial approaches observed and sales pitches used, the AMF has defined

several general principles to define the clear, accurate and non-misleading nature of the information disclosed

13

regarding consideration of non-financial criteria.

Position 1:

The information provided regarding the consideration of non-financial criteria must be proportionate to the

objective and effective impact of the consideration of non-financial criteria in the management of collective

investment products.

The need to have information proportionate to the effective consideration of non-financial criteria in the

management of collective investment products implies a distinction between different degree of communication

on non-financial information and associate different minimum standards. At this point, AMF distinguishes three

levels of communication on non-financial information and defines two related minimum standards.

Degrees of communication on the consideration of non-financial criteria

The following concepts apply without distinction to the various extra-financial characteristics that may be the

subject of a communication: ISR/SRI, ESG integration, responsible, sustainable, responsible, green, ethical,

social, impact, low carbon (non-exhaustive list of terms given as examples) ...

Consideration of extra-financial criteria as a key aspect of communication

Non-financial characteristics are considered a key aspect of communication when they are presented:

- in the name of the collective investment product; or

11

AMF Position-Recommendation DOC-2011-24

12

As mentioned at article L. 214-2-2 of the Monetary and Financial Code

13

Article L. 533-22-2 of the Monetary and Financial Code for French asset management companies and Article 411-126 for UCITS distributors

("accurate, clear and non-misleading" for the latter, applicable by reference to Article 411-132).

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 5/20

- in the KIID; or

- in the marketing materials, apart from a concise mention (cf. infra “limited communication”).

On the contrary, mentioning consideration of non-

financial characteristics only in the prospectus in a

proportionate manner is not considered as presenting them as a key aspect of communication.

Limited communication on non-financial criteria

The communication on the consideration of extra-financial criteria shall be considered as reduced when this

communication is not central and that communication is made :

- in the KIID in a concise and balanced manner on the limits of the consideration of extra-financial criteria

in management and in the section "Other information" within the meaning of the CESR/10-1321

guidelines. Examples of standard phrases are provided in the Annex ;

- in commercial documentation in a concise manner.

Communications on extra-financial criteria

14

in commercial documents shall be concise when they are :

o secondary to the presentation of product characteristics both in terms of breadth and positioning

in the document ;

o neutral (no special emphasis, visuals...) ;

o limited to less than 10% of the volume occupied by the presentation of the product's investment

strategy. This volume can be calculated in number of characters used if the font and format are

comparable to those used for the presentation of the product's investment strategy ".

On the contrary, mentioning the consideration of extra-

financial features only in the prospectus in a

proportionate manner is not considered as a reduced communication on the consideration of extra-financial

criteria.

Thus, any reference to extra-financial features :

- in the denomination is considered as a central communication ;

- in the KIID is considered alternatively as a central or limited

communication depending on the

conciseness, balance and positioning of the communication;

- in the marketing materials is considered alternatively as a central or limited communication according

to the conciseness of the communication;

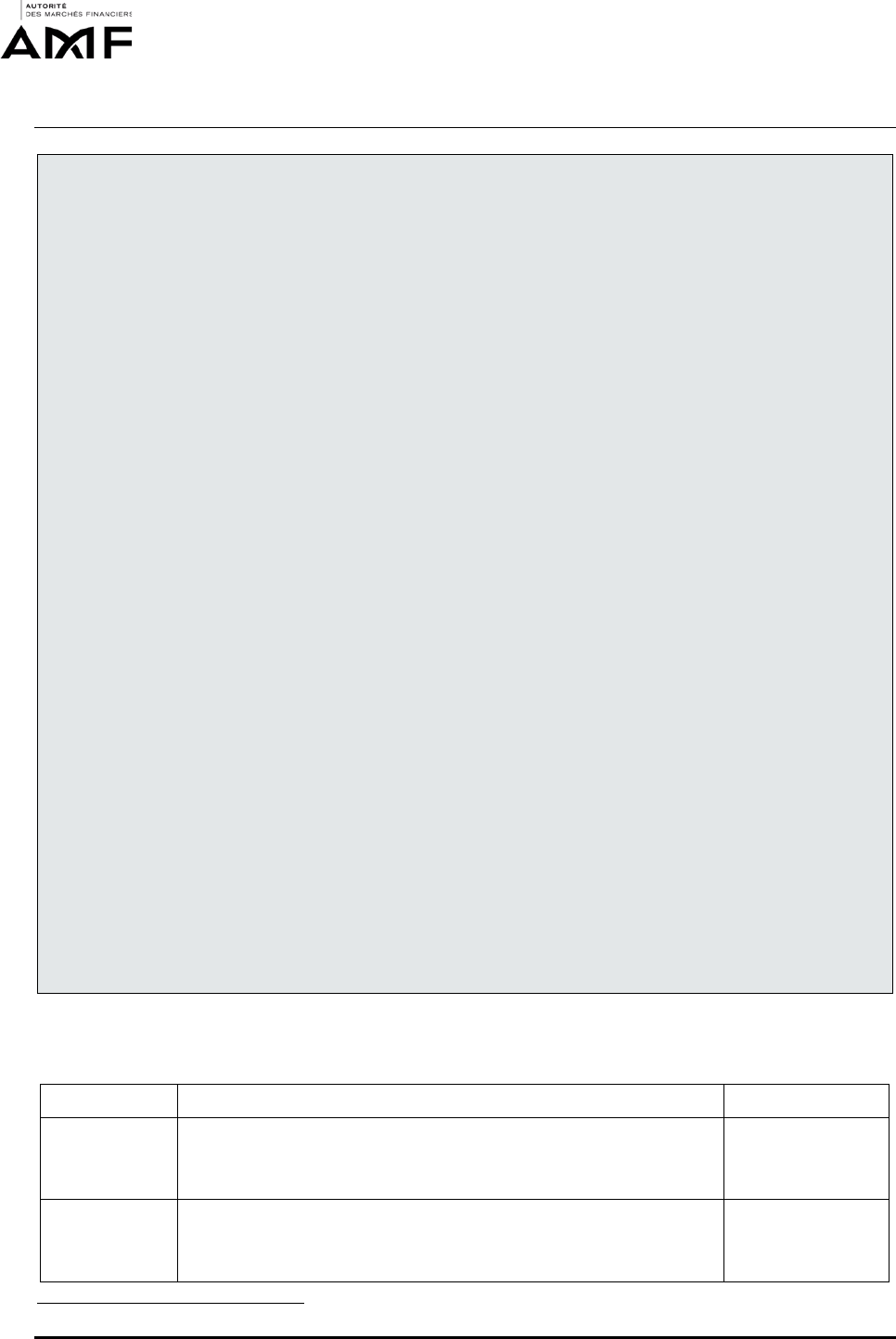

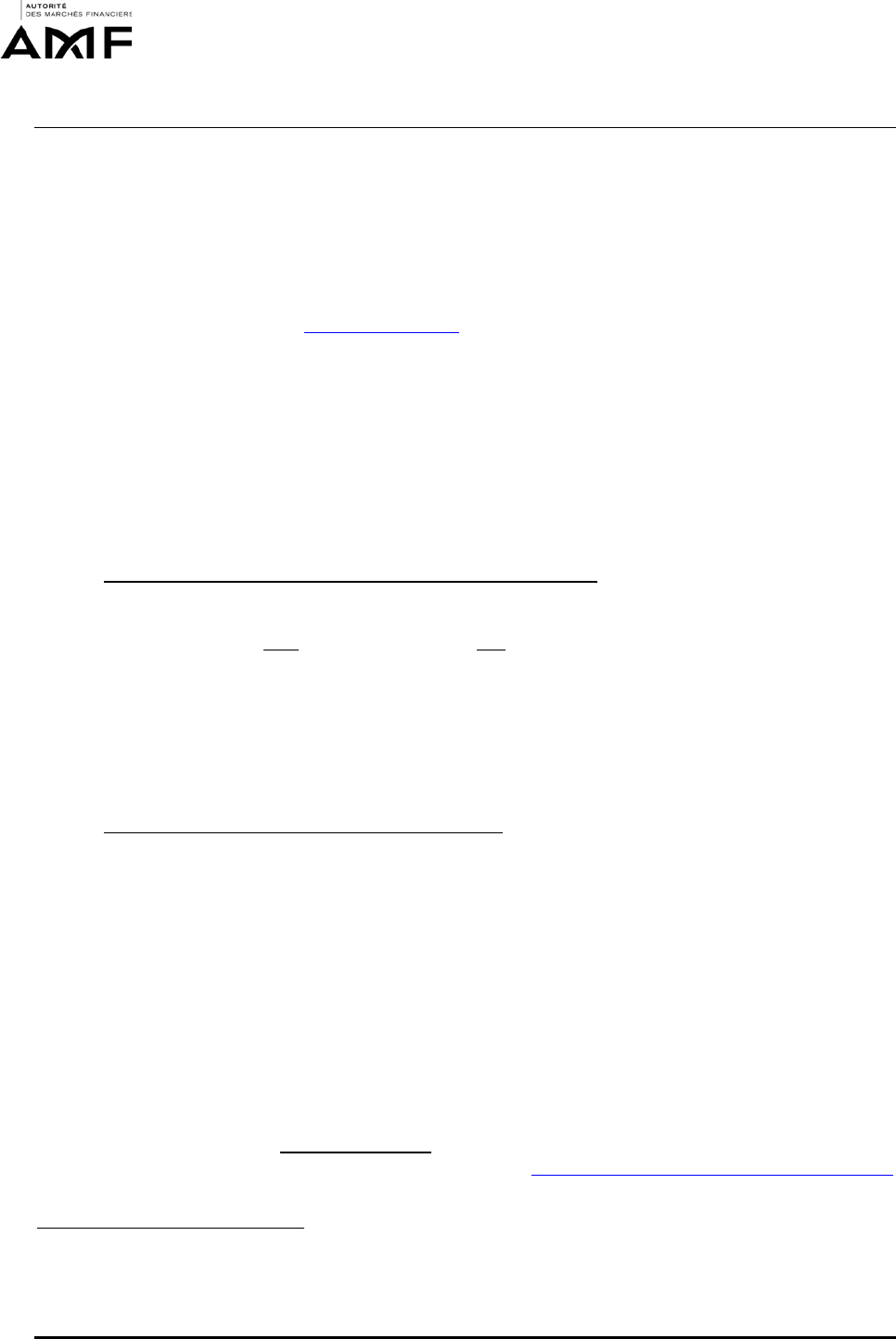

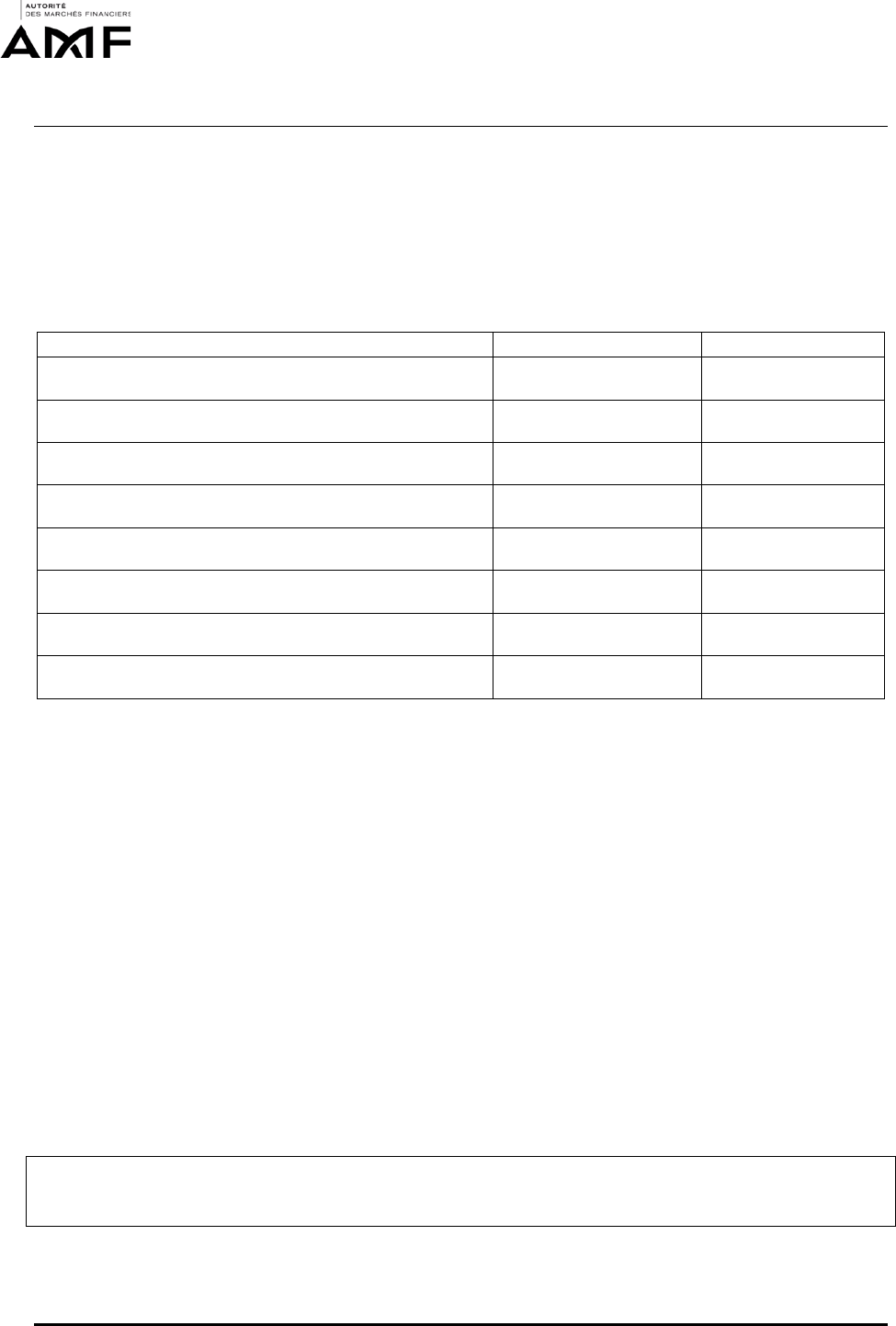

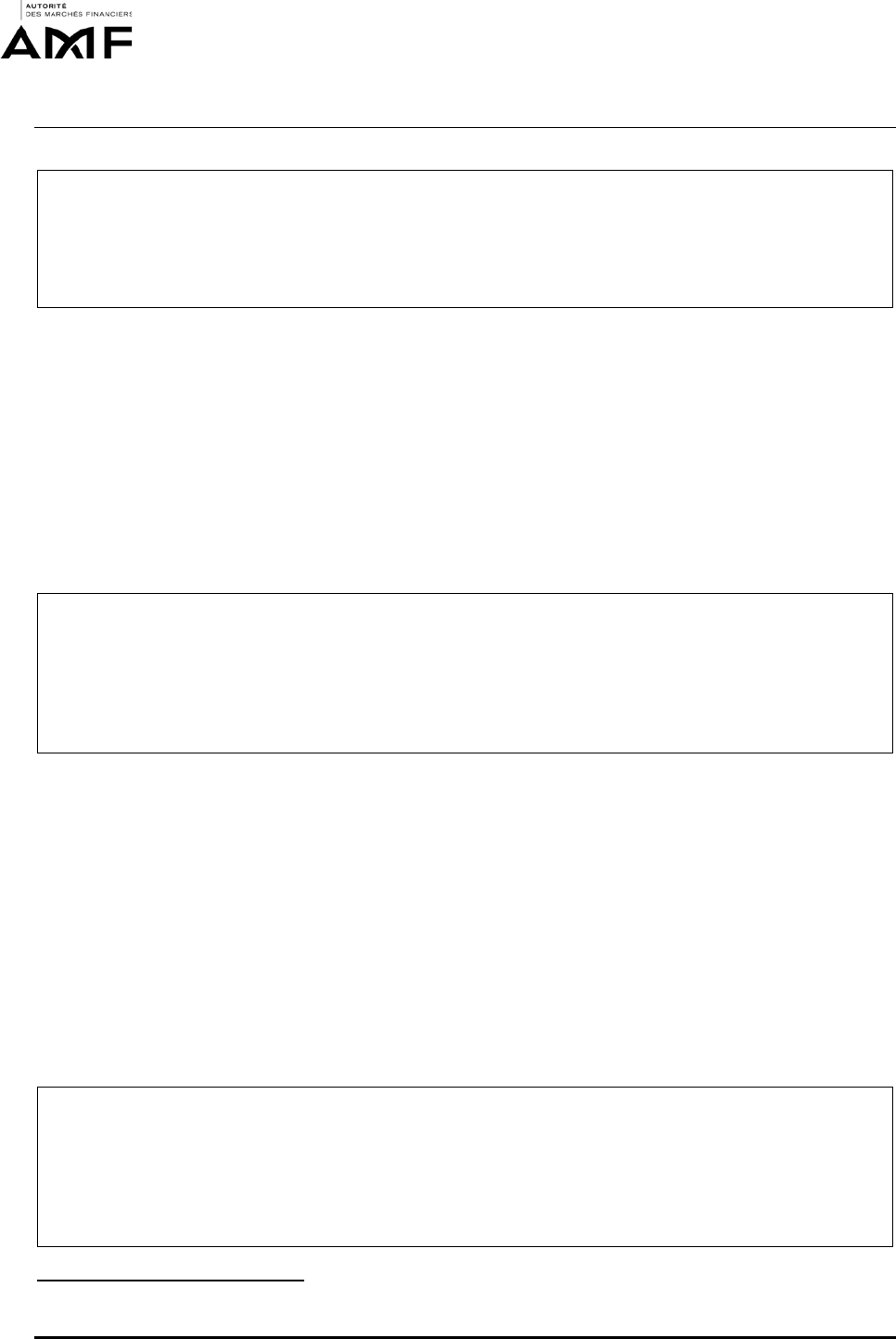

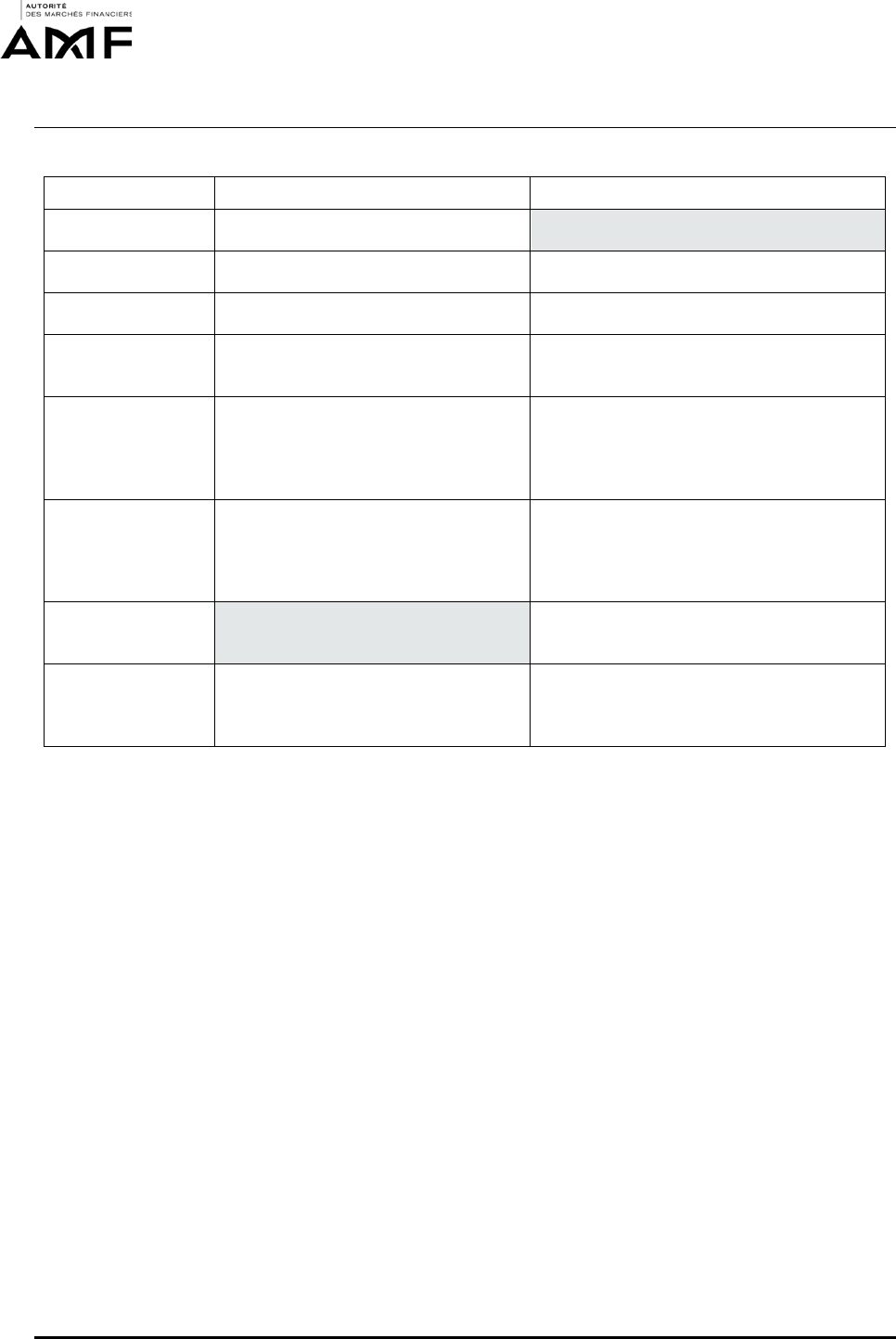

The following table summarizes the different types of communications and the associated minimum standards that

will be further developed in this guidance.

Communication Communication support on the consideration of non-financial criteria Minimum standards

Key

Name

KIID

Marketing materials

Prospectus

Significantly

engaging

Limited

Name : no reference to non-financial aspects

KIID: concise and balanced mention in the "Other information" section

Marketing material : concise mention

Prospectus : proportionate communication

Non-significantly

engaging

14

Including the description of the general framework of the consideration of non-financial criteria by the management company

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 6/20

Limited to

prospectus

Name : no reference to non-financial aspects

KIID: no reference to non-financial aspects

Marketing materials : no reference to non-financial aspects

Prospectus : proportionate communication

Approach not

meeting central or

limited

communication

standards

3. MINIMUM STANDARDS FOR PRESENTING EXTRA-FINANCIAL FEATURES AS A KEY

ELEMENT OF PRODUCT COMMUNICATION

The AMF considers that the scope of products that can present consideration of non-financial characteristics as a

key aspect of their communication should be restricted to collective investment products which adopt a

significantly engaging approach, as defined below.

Position 2:

Only collective investment products which comply with the following characteristics can

15

make non-financial

characteristics a key aspect of communication:

a) the approach adopted is engaging in that it provides in the regulatory documents for measurable objectives

concerning consideration of non-financial criteria;

b) the consideration of non-financial criteria must have a significant impact on the objectives thus defined.

This point is determined as follows:

i) "Rating upgrade" approaches compared to the investable universe

16

:

the rating of the

collective investment product must be higher than the rating of the investment universe after

eliminating at least 20% of the least well-rated securities;

ii) "Selectivity" approaches compared to the investable universe

17

: reduction of the investment

universe by at least 20%.

iii) Approaches for " extra-financial indicator upgrade" in relation to the investable universe

18

(alternative criteria):

a. The average of an extra-financial indicator calculated at portfolio level must be higher

than the average of the investable universe calculated after eliminating at least 20% of

the worst values for this indicator ;

b. The average of an extra-financial indicator calculated at portfolio level is at least 20%

better than that calculated for the investable universe, provided that the dispersion of the

indicator does not make this improvement insignificant.

iv) Other approaches (including the combination of aforementioned approaches): the

management company must be able to demonstrate to the AMF in what way its approach is

significant.

15

These collective investment products are nevertheless not obliged to make consideration of non-financial criteria in their investment policy

a key aspect of their reporting.

16

Approach allowing for non-financial criteria which consists of improving the average non-financial rating of the CIU relative to that of the

investable universe.

17

Approach allowing for non-financial criteria which consists of selecting the best issuers of the investable universe on the basis of their non-

financial rating and/or excluding issuers on the basis of non-financial characteristics.

18

Approach allowing for non-financial criteria which consists of improving the average a financial indicator of the CIU relative to that of the

investable universe

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 7/20

When the approach refers to the investment universe, this approach must be consistent with the

investment universe that would have been selected for a similar fund not presenting non-financial

characteristics, to avoid an "artificial" reduction or improvement in the investment universe.

19

For this

purpose, the composition of this universe should be determined exclusively on the basis of the fund's

strategy and the assets that it is able to select.

c) The non-financial analysis, non-financial indicator or non-financial rating coverage rate must be higher than

90%. This rate may be estimated based either on the number of issuers or the net asset value of the collective

investment product. Regarding this, AMCs must make sure that the proportion of the fund's net assets which is

not analysed or without non-financial indicator remains insignificant.

The quantified standards mentioned in points b)i), b)ii), biii) and c) are calculated, where applicable, to the

exclusion of bonds and other debt securities issued by public or quasi-

public issuers, liquid assets held

accessorily, and solidarity assets.

20

d) In the specific case of approaches making the SRI aspect a key theme of communication, the non-financial

analysis applied to collective investment assets takes into consideration criteria relating to each Environmental,

Social and Governance factor.

In addition, for the indicator-based approaches mentioned in point (b)(iii) wishing

to make SRI a key element of their communication, the collective investment scheme must, on the whole,

analyse non-financial indicators relating to each of the Environmental, Social and Governance factors.

This position calls for several clarifications.

"Rating upgrade" and "selectivity" approaches compared to the investable universe

The SRI label is positioned as a market standard regarding non-financial approaches, leading the AMF to adopt a

meaning of the significantly engaging approach in line with these thresholds taken from the reference document

for the label

21

in order to ensure the clarity and credibility of the approaches adopted.

Approaches for "extra-financial indicator upgrade" in relation to the investable universe

Unlike approaches based on extra-financial ratings that weight several indicators from analyses of the social,

environmental or governance characteristics of companies, these approaches aim to significantly improve an

indicator precisely identified in the fund's legal documentation in relation to the investable universe.

Without this constituting an exhaustive list, the extra-financial indicators are, for example, the following:

- Environmental factor: greenhouse gas emissions, volumes of waste produced or recycled, volumes of

water consumed or recycled, total or renewable energy consumption, etc.

- Social factor: gender equity in the management of the company (share of women in the ExCOM...),

employment rate of people with disabilities, frequency of accidents within the company, overall tax rate...

- Governance factor: number or percentage of independent directors, remuneration policies, etc.

"Other approaches" mentioned in point b)

The point b)iv) of the aforementioned position applies to approaches which might not be "selectivity", "rating

upgrade" or “extra-financial indicator upgrade“ approaches. For example, and without this being exhaustive:

19

For example, combining with a "Europe" fund a "World" investment universe so as to post an artificial improvement made possible by the

selection of non-European issuers which are less well rated from an ESG viewpoint.

20

Securities issued by solidarity companies referred to in Article L. 3332-17-1 of the French Labour Code.

21

Cf. Criteria 3.1 b) and c) of the SRI label reference document on measurement of the implementation of the SRI strategy which provide,

respectively, for a minimum of 90% of coverage for the fund and a 20% reduction in the investment universe.

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 8/20

- Funds of funds wanting to make SRI a key aspect of their communication. The significance of these funds

can, for example, be assessed based on the requirement of a 90% investment in funds themselves having

the SRI label or themselves complying with the constraints applicable to SRI funds in this policy;

- Collective investment schemes wanting to mention in their KIID their contribution to financing of the

energy and ecological transition which are mostly invested in Green Bonds selected on the basis of

compliance with a defined standard such as the Green Bonds Principles of the International Capital Market

Association (ICMA). The significance may, for example, be assessed based on the requirement of 75% of

the assets required by the reference document

for the Greenfin label;

- Best-in-progress approaches in real estate funds aiming to reduce over time the energy consumption of

their portfolio;

- Collective investment scheme may make energy transition a key aspect of their communication when they

plan to invest a significant share of their portfolio in issuers with a majority of their turnover in activities

considered as favourable to this transition (and in ensuring that the portfolio is exempt of issuers having

activities that would significantly harm this objective)

This illustration section, which is non-exhaustive, could undergo regular updates to allow greater predictability

and clarity of the AMF's expectations for market participants.

Simultaneous analysis of the E, S and G pillars for SRI approaches:

Although, historically, there is no regulatory definition of an SRI fund, the French marketplace has gradually

structured its approaches to both Environmental, Social and Governance (ESG) criteria around this concept of

"socially responsible investment".

This distinction made between funds making the "SRI" aspect a key part of their non-financial investment policy

and communication, and those practising ESG integration, i.e. making allowance for the E, S and G factors in a

manner which is not necessarily exhaustive or systematic, is designed first evolution to improve the clarity of

approaches. This could be refined in the future.

Illustration of non-significantly engaging approaches:

In a number of cases, the use of a filter excluding certain sectors of activity cannot be considered sufficient to make

non-financial aspects a key part of product communication, because it cannot be a response to significantly

engaging criteria. The following cases illustrate this situation:

- Funds which exclude certain controversial activities (e.g. tobacco, arms, pornography, etc.) are a priori

excluded from the scope of significantly engaging approaches if no other non-financial criterion

corresponding to the aforementioned characteristics (Position No. 2) is selected for management of the

collective investment product;

- The fact of complying with the obligation introduced by France's ratification of the Ottawa Convention

(1999) and Oslo Convention (2008) by emphasising the exclusion of issuers involved in controversial arms

such as cluster munitions or anti-personnel mines

22

is not considered sufficient to make non-financial

aspects a key part of product communication. Thus, any possible communication on these aspects should

be circumscribed to a mere mention in the prospectus, together with an indication specifying the binding

nature of this exclusion for all French AMCs;

- The exclusion of fiscally non-cooperative countries. The official ministerial decision of 12 February 2010

indicates in its last version dated January 2020, a list of thirteen states and territories including Panama,

22

Act 2010-819 of 20 July 2010 with a view to the elimination of cluster munitions: In France, it "is […] prohibited […] to assist, encourage or

induce anyone to become involved in one [of these] prohibited activities". Moreover, “any deliberate financial assistance, whether direct or

indirect, for the production or trade of cluster munitions would be considered assistance, encouragement or inducement falling under criminal

law”.

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 9/20

Oman and various islands in Pacifica and West Indies

23

. On the face of things, these locations represent a

not very material proportion of the customary investment universes of collective investment schemes;

- The exclusion of companies that have incurred international sanctions or that do not comply with

international regulations regarding work organisation, notably on respect for freedom of association and

collective bargaining rights, and the elimination of forced labour and child labour.

Likewise, the mere fact of mentioning an average ESG rating higher than that of its investment universe without

any other information relating to the extent of the improvement in that rating is not sufficient to make the

consideration of non-financial characteristics a key aspect of communication.

4. MINIMUM STANDARDS FOR A LIMITED COMMUNICATION ON THE CONSIDERATION OF

EXTRA-FINANCIAL CHARACTERISTICS

Position n°2 bis :

Only collective investments which comply with the following characteristics may

24

communicate in a limited

way on the consideration of extra-financial criteria in the management :

a) the approach adopted is engaging to provide measurable objectives for the consideration of extra-financial

criteria in the regulatory documents. In this respect, collective investments describe in their prospectus the

elements indicated in position n°4

25

;

b) if the approach adopted is based on a rating or indicator, the average rating or indicator of the collective

investment must be higher than the average rating or indicator of the investment universe ;;

c) the extra-financial analysis or rating must be higher than:

a. 90% for equities issued by large capitalisation companies whose registered office is located in

"developed" countries, debt securities and money market instruments with an investment grade

credit rating, sovereign debt issued by developed countries ;

b. 75% for equities issued by large capitalisations whose registered office is located in "emerging"

26

countries, equities issued by small and medium capitalisations, debt securities and money market

instruments with a high yield credit rating and sovereign debt issued by "emerging" countries.

These rates may be expressed either in terms of the number of issuers or in terms of the capitalisation of

the net assets of the collective investment. In the event of investment in several categories by the same

fund, the above-mentioned rates apply transparently to each category.

For the purposes of this position, it is considered that small caps are those below €5 billion, mid caps are

those between €5 billion and €10 billion and large caps are those above €10 billion

This approach could be developed in the near future in order to be applied to other asset classes for which

reference to an investable universe may be more difficult to implement (private equity in particular).

23

Full list being: Anguilla, Bahamas, British Virgin Islands, Panama, Seychelles, Vanuatu, Fiji, Guam, American Virgin Islands, Oman, American

Samoa, Samoa and Trinidad and Tobago.

24

However, these collective investments are not obliged to communicate in a reduced way on the consideration of extra-financial criteria in

their management

25

the communication of this information in the DICI would not comply with the requirements of concise and balanced communication.

26

For example based on the definition used by market indices (e.g. MSCI Emerging markets)

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 10/20

5. INVESTOR INFORMATION ON CONSIDERATION OF NON-FINANCIAL CRITERIA

5.1. Publication of information apart from regulatory and marketing documentation

Given the diversity of the non-financial strategies and themes observed during its supervisory assignments, the

AMF stresses the need to describe precisely the characteristics and limits of the approaches implemented. Since

the regulatory and marketing documentation cannot always describe in detail certain specific features of the

consideration of non-financial characteristics in the context of management of a collective investment product, in

line with the aspects discussed above, the AMF issues two recommendations

27

regarding these collective

investment products:

Recommendation 1 applicable to collective investment products making non-financial characteristics a key

aspect of communication

The AMF recommends those collective investment schemes to :

- publish a document explaining the AMC's approach modelled on the Transparency Code

, and

- adhere to a charter, code or label regarding the criteria relating to fulfilment of social, environmental and

governance quality objectives. In the particular case of funds using the SRI indication and marketed as such, it

is recommended that they obtain the SRI label.

5.2. Regulatory documents for collective investment products involving a non-financial

aspect

This section deals with the drafting of regulatory documents for collective investment products making the

consideration of non-financial characteristics a key aspect of communication.

The consideration of non-financial criteria in the investment strategy of a collective investment scheme may be

very different from one asset management company to another. To enable investors to compare the strategies

with one another, the regulatory documents for these collective investment products should indicate a minimum

of information. This key information includes, in particular, information based on the recommendations indicated

in the first AMF report on socially responsible investment in collective investment schemes:

28

It is recommended that all funds implementing strategies with a non-financial focus via significantly engaging

approaches should provide this information which will enable investors to understand how the product works. In

order to keep the information clear and concise, it is possible to make references to other documents (Art. 173

reports, Transparency Code, etc.) presenting the details of the non-financial analysis. These references will aim

solely to specify the methodological approach adopted by means of details that it would be difficult to present in

27

In line with the recommendations already expressed by the AMF in its Position-Recommendation DOC-2011-24 for SRI funds.

28

These recommendations were contained in Position-Recommendations DOC-2011-05 ("A Guide to regulatory documents governing

collective investment undertakings") and DOC-2011-24 ("A Guide to drafting collective investment marketing materials and distributing

collective investments").

Recommendation 2 applicable to collective investment products making non-financial characteristics a key

aspect of communication

The AMF recommends that the regulatory documents for collective investment schemes making consideration

of non-financial criteria a key aspect of their communication should present:

(i) an investment objective describing the non-financial aspect of their management;

(ii) the type(s) of approach practised (best-in-class, best-in-universe, etc.);

(iii) indications regarding the selection and management methods used.

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 11/20

the regulatory documentation of the collective investment scheme (exhaustive list of non-financial criteria, list of

data providers, details of carbon footprint calculation, etc.).

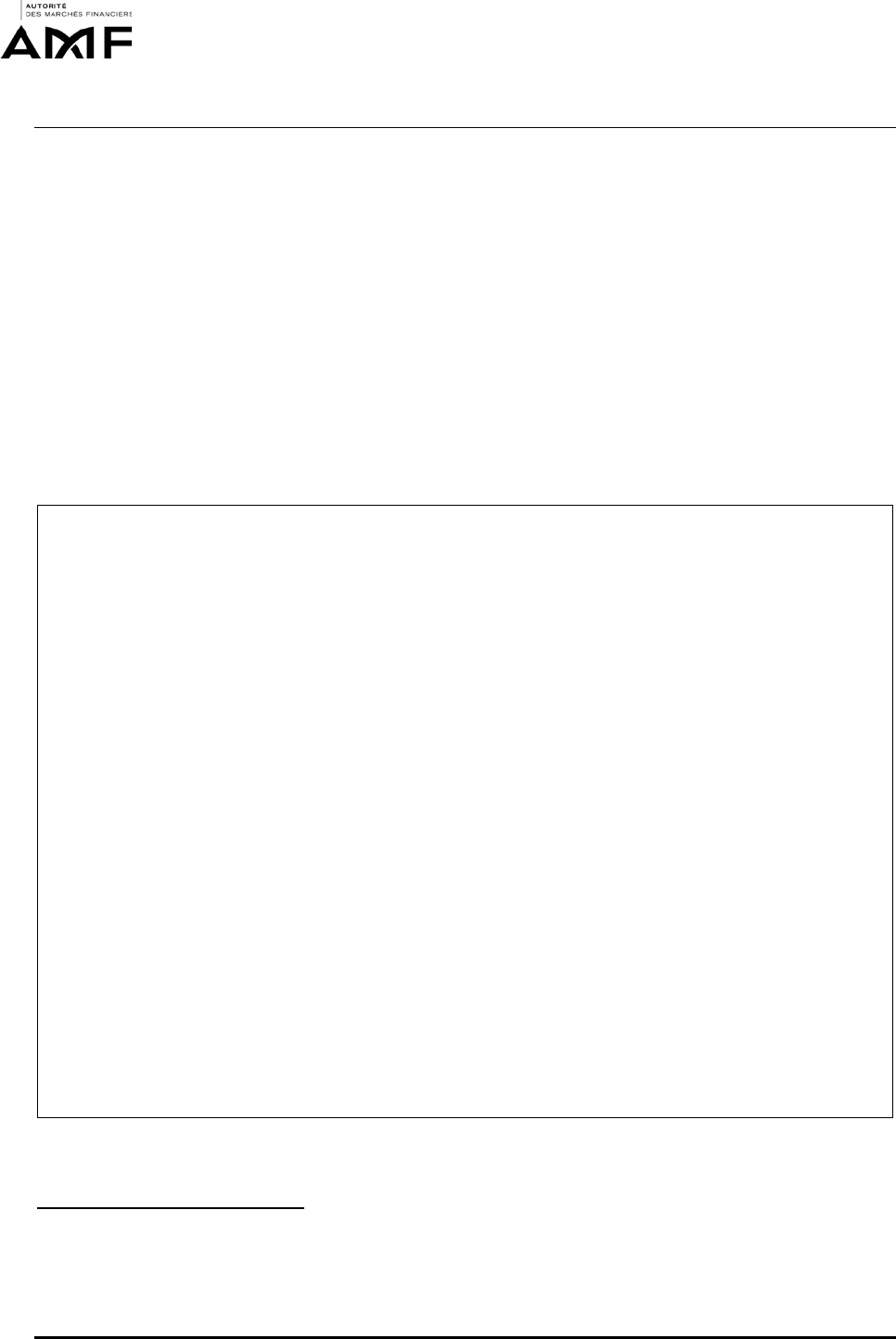

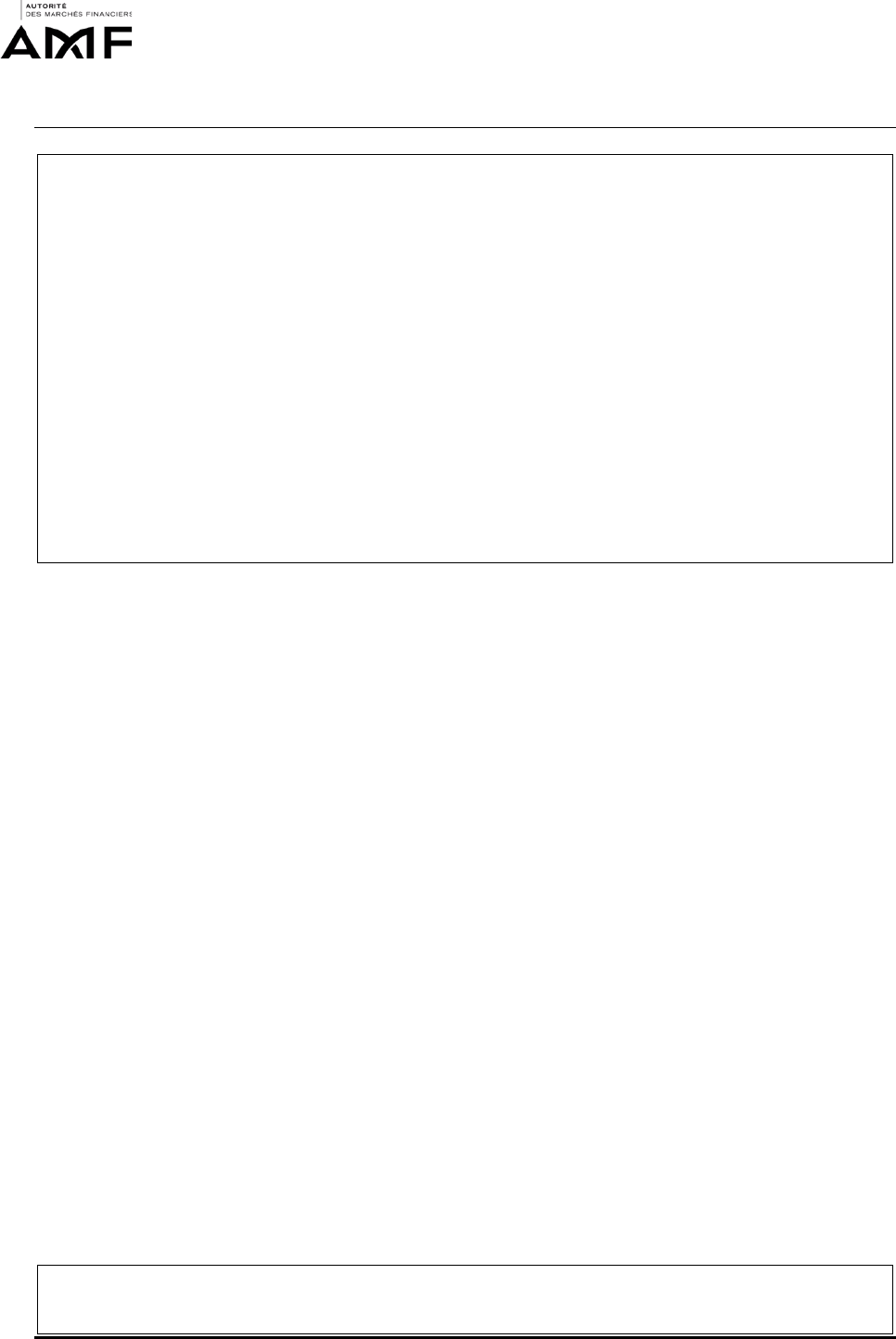

This information is to be presented in the KIIDs and/or prospectuses of collective investment schemes (or "PRIIPS

KIDs" or information prospectus where applicable) and is summarised below before being described in detail later.

Information to be presented in the prospectus may nevertheless appear in the KIID in order to contribute to

suitable information for the unitholders:

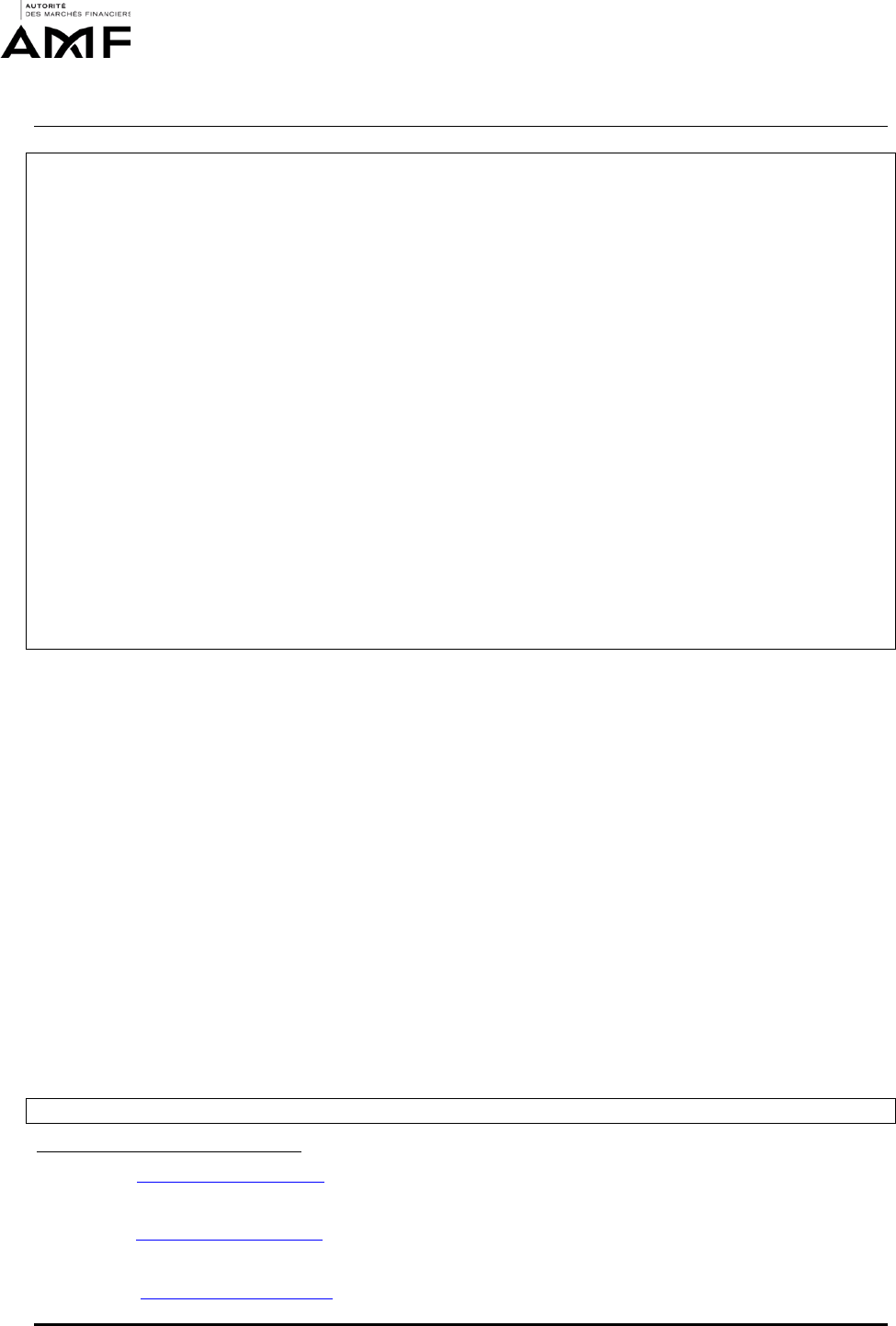

Description of the consideration of non-financial criteria

KIID

Prospectus

Non-financial investment objective X X

Type of approach(es) implemented (e.g. best-in-class, best-in-

universe, best-effort, thematic, etc.)

X X

Description of the process of stock picking and sequencing in

relation to the financial strategy

X

(concise description)

X

(detailed description)

Examples of non-financial criteria

X

(a few examples)

X

Warning on the limits of the approach adopted (see below) X X

Presentation of the investment universe based on which non-

financial analysis is performed

X

Minimum measurable objective (e.g. at least 20% for selectivity

approaches)

X

Minimum rate of non-financial analysis (on at least 90%) X

5.2.1. Investment objective

In accordance with Position-Recommendation DOC-AMF 2011-05 "The investment objective shall be

understandable without reading the rest of the KIID and it shall help investors identify the main purpose and

characteristics of the investment policy implemented by the UCITS [or AIF]."

For example, a thematic collective investment scheme allowing for the three pillars E, S and G may specify in its

investment objective that it will use a selection of securities "complying with Environmental, Social and Governance

(ESG) responsibility criteria and attractive due to their efforts to reduce carbon emissions and foster the energy

transition", or else for a low-carbon thematic collective investment product it may indicate in its management

objective that the portfolio will be "managed in accordance with a socially responsible approach in which the target

carbon intensity objective is to be constantly at a level xx% lower than that of the benchmark indicator".

5.2.2. Investment policy

In line with the aforementioned provisions concerning the materiality for the investment policy of allowing for one

or more non-financial characteristics, the AMF requires a proportionate and balanced presentation of this (these)

characteristic(s) in the regulatory documentation of the collective investment product:

Recommendation 3 applicable to collective investment products making non-financial characteristics a key

aspect of communication

In the KIID, the AMF recommends that a description of the non-financial strategy be given via a presentation of:

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 12/20

- the type of approach(es) used (e.g. best-in-class,

29

best-in-universe,

30

best-effort,

31

thematic, binding and

significant ESG integration, etc.). It is also recommended to define the significance of these various strategies to

ensure that the document can be easily understood, and indicate whether the approach can lead to the selection

of certain sectors or not;

- a summary of the process of consideration of non-financial characteristics (e.g. filters, ratings, etc.) and its

sequencing relative to the financial strategy;

- a few examples of some of the most important non-financial criteria analysed (e.g. two or three examples).

In general, the AMF recommends that in its communication a collective investment scheme should not use

expressions having an environmental, social or governance meaning inappropriate for the investment policy

implemented via the collective investment product. For example, when an approach takes several criteria into

consideration without placing one significantly above the others, the AMF recommends not announcing specific

objectives for a single criterion (e.g. best-in-universe SRI approach making equally weighted consideration for the

E, S and G criteria and announcing solely or primarily a contribution to the mitigation of global warming).

Position 3 applicable to collective investment products making non-financial characteristics a key aspect of

communication

When the KIID mentions consideration of non-financial criteria, it should describe concisely the main

methodological limits to the non-financial strategy implemented when they are significant (within the size limits

stipulated by the KIID and referring to the prospectus for more details when these aspects require detailed

explanations). When the KIID does not provide such information, these explanations should appear in the

prospectus.

This information is designed to enable investors to understand in summary form the non-financial analysis

performed by the asset management company and its limits.

Note that the limits to the non-financial strategy include, in particular:

- For funds of funds: Potential inconsistency between the SRI/ESG strategies of the underlying funds

(criteria, approaches, constraints, etc.), especially when the AMC selects funds that it does not manage

and which have approaches taking various non-financial criteria into consideration (e.g. different criteria,

analyses, weightings or measurable objectives);

- For funds using various approaches taking non-financial criteria into consideration via several investment

pockets: Potential inconsistency regarding the selection of issuers in the various pockets and/or maximum

percentage associated with one or more pockets having different strategies/objectives (e.g. a pocket of

"directly held" equities in "stock picking" with a qualitative and quantitative filter combined with an

investment in green bonds, solidarity companies and SRI-labelled funds).

When a collective investment scheme is considering selecting green bonds, social bonds or sustainability bonds, it

is recommended explaining to what extent the selected bonds will comply with current market standards, in

particular the Green Bond Principles (GBP) and the Social Bond Principles of the International Capital Market

Association (ICMA), or the European standard (EU Green Bond Standard) undergoing discussion.

Recommendation 4: Specificity of investments in green bonds, social bonds or sustainability bonds

29

For example, Novethic defines this approach as: "a type of ESG selection consisting of giving priority to the companies best rated from a

non-financial viewpoint within their sector of activity, without favouring or excluding one sector relative to the stock market index used as a

basis for starting".

30

For example, Novethic defines this approach as: "a type of ESG selection consisting of giving priority to the issuers best rated from a non-

financial viewpoint irrespective of their sector of activity, and accepting sector biases, because the sectors which are considered more virtuous

on the whole will be more heavily represented."

31

For example, Novethic defines this approach as "a type of ESG selection consisting of giving priority to the issuers demonstrating an

improvement in or good prospects for their ESG practices and performance over time."

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 13/20

In the case of green bond, social bond or sustainability bond funds, the AMF recommends inserting in the KIID an

explanation of the criteria to be complied with for the selection of green bonds or social bonds, in particular by

mentioning the asset management company's stance with regard to the application by the issuers of recognised

standards in this area such as the Green Bond Principles or Social Bond Principles, or the future EU Green Bond

Standard. It is also recommended that more detailed explanations concerning these standards be given in the

prospectus.

To ensure a good understanding of the information provided in the KIID, a description of the consideration of non-

financial criteria is required in the prospectus.

Position 4 applicable to collective investment products making non-financial characteristics a key aspect of

communication (and applicable by reference to approaches communicating in a limited manner by reference to

Position n°2 bis)

In order to assess the significantly engaging nature of the approach in the regulatory documentation, at least the

following information should be presented in the prospectus:

- The minimum measurable objectives adopted in accordance with Position No. 2;

- The portfolio's minimum rate of non-financial analysis.

Moreover, a presentation of the investment universe based on which non-financial analysis is performed, if it is

not produced in the KIID, and when the AMC uses such a metric to assess the significance of the approach

employed, should in any case be produced in the prospectus in order to report on the effective reduction in the

initial universe or the significant improvement in the portfolio's non-financial rating relative to said universe. This

paragraph does not apply to approaches not using a comparison with their investment universe as part of their

consideration of non-financial criteria.

Recommendation 5 applicable to collective investment products making non-financial characteristics a key

aspect of communication

The AMF recommends presenting details of the fund's non-financial selection process in the prospectus by

describing:

- the type of approach(es) used;

- a summary of the process of consideration of non-financial characteristics (e.g. filters, ratings, etc.) and its

sequencing relative to the financial strategy. This summary is not intended to be exhaustive, but it should make it

possible to understand the key stages in the investment management process;

- a list of the main non-financial criteria adopted which does not adversely affect the clarity of the non-financial

information presented due to the number of criteria. Where applicable, reference can be made to other documents

(Art. 173 reports, Transparency Code, regular reports, etc.).

This recommendation is especially pertinent when the approach adopted implies using third-party service

providers or when the sequencing is hard to comprehend from the information presented in the KIID. For example,

a strategy employing several approaches in succession could present before the details of each approach an

indication such as: "After a first filter for the exclusion of activities considered by the asset management company

as most harmful for the environment, the investment management process considers the sustainable development

theme via X categories of indicators. It then reduces the universe by taking non-financial criteria into consideration

before performing a financial analysis leading to the construction and management of the portfolio.”

Information relating to the asset management company may be mentioned provided that it contributes to a good

understanding of the investment policy implemented via the fund. The AMF repeats one of the previous

recommendations made in its previous report concerning marketing materials with a view to also applying it to the

regulatory documents.

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 14/20

For funds developing a singular approach, the asset management companies are invited to contact the AMF or

refer to guides dedicated to the most specific approaches:

- Position DOC-2007-19

relating to the non-financial criteria for asset selection and application to CIUs

declaring themselves in compliance with Islamic law;

- AMF Position DOC-2012-15 relating to the criteria applicable to shared return funds;

- Guide on carbon offsetting collective investment undertakings published on 18 March 2019.

5.3. Marketing documents for funds involving a non-financial aspect

The marketing in France of units or shares in UCITS or AIFs is defined

32

as "their presentation by various channels

(advertising, direct marketing, advisory services, etc.) in order to induce an investor to subscribe to or buy them".

Regarding this, as a reminder, "All investment service providers and financial investment advisers must ensure that

all the information, including promotional information, that it sends to retail or professional clients, or that could

possibly reach such clients, meets the requirements for “clear, accurate and non-misleading information”,

regardless of the chosen means of communication, notably including social media".

33

The AMF has observed practices of collective investment schemes, both French and foreign, in which the regulatory

documentation did not provide for consideration of non-financial characteristics but which made it a key aspect in

their marketing materials. In these circumstances, the information disclosed to investors cannot be considered as

clear, accurate and non-misleading in that the investment objectives and investment policies in the prospectus do

not include a "promise" which appears in the marketing materials.

Position 5 applicable to the marketing in France of collective investment products referring to non-financial

criteria

For clear, accurate and non-misleading information, this requires that a non-financial characteristic not present

in the regulatory documentation of a collective investment scheme cannot be mentioned in the marketing

materials. Only clarifications of information already present in the regulatory documentation can be provided

in the marketing materials.

Moreover, it should be noted that the marketing materials must contain a balanced presentation as specified in

Position-Recommendation 2011-24. Accordingly, depending on the type of materials used, the space dedicated to

less favourable features in the documents and the typography used will determine whether the information is

accurate.

Generally, the AMF recommends the utmost transparency and the utmost caution regarding communications

concerning the non-financial nature of collective investment management. It thus reiterates one of the previous

32

AMF Position – DOC-2014-04 - Guide to UCITS, AIF and other investment fund marketing regimes in France.

33

AMF Position-Recommendation DOC-2011-24 - A Guide to drafting collective investment marketing materials and distributing collective

investments

Recommendation 6: Specific case of funds mentioning the existence of a shareholder engagement policy

When the regulatory and marketing documents mention the existence of an engagement policy, the AMF

recommends that theyspecify the procedures for accessing the documents that provide details on these aspects

(voting and dialogue reports).

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 15/20

recommendations concerning the accessibility of non-financial reporting by extending it to all collective investment

products having non-financial characteristics implemented in a significantly engaging manner.

This point is all the more significant in that the AMF regularly asks certain players to revise the communications of

collective investment schemes employing non-engaging non-financial strategies. For this type of collective

investment scheme, the financial characteristics must always be predominant and the non-financial theme limited

to a few factual indications presented in a section designed to report on the non-binding tools made available to

the fund managers.

Recommendation 8:

Given the need to ensure that the information is balanced, the AMF recommends to asset management

companies and distributors of collective investment products that they add warnings in the marketing materials

concerning the potential limits of the non-financial strategy in a manner as visible as the advantageous factors.

Moreover, when asset management companies and distributors of collective investment products choose to

have non-financial factors compared against an indicator (improvement in greenhouse gas emissions relative to

an index, trend of carbon emissions, etc.), it is recommended that said indicator be identical to that mentioned

in the fund's regulatory documents. If other indicators are used, it is recommended to not select them ex post

and to perform comparison of the fund with those indicators on a long-term basis.

When the AMC or the distributor of collective investment products wants to communicate concerning the

contribution of non-financial aspects to the financial performance of a

collective investment, the AMF

recommends that it provide an explanation based on objective factors. Likewise, the AMF recommends that

these firms provide a presentation of the results of these contributions to financial performance that is constant,

consistent over time and uninterrupted.

Lastly, the AMF recommends that asset management companies and distributors of collective investment

products should not state a quantified non-financial objective in a promotional document without including a

warning reminding the subscriber that this objective is based on the realisation of assumptions made by the

asset management company. Funds whose ambition is to comply with a maximum level of greenhouse gas

emissions or predefined climate scenarios are especially concerned by this recommendation.

5.4. Specific case of products referring to « ISR »

In line with the AMF’s increased requirements in its 2015 and 2017 reports and in order to ensure clear, accurate

and non-misleading communication on the use of the term “ISR” for funds that do not benefit from the eponymous

label, the AMF is issuing a position applicable to collective investment scheme using the term “ISR”

Recommendation 7 applicable to collective investment products making non-financial characteristics a key

aspect of communication

The AMF recommends that non-financial reporting (whether incorporated in conventional financial reporting

or not) be easily accessible from web pages dedicated to SRI, ESG or socially responsible thematic funds and

that it be updated at least once a year.

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 16/20

5.5. Shareholder Engagement and Controversy Verification Policies

This section brings together two AMF recommendations on the publication of policies established at the level of

the management company that may have an effect on fund management.

On the one hand, management companies should be particularly vigilant about the presence of issuers subject to

controversy in their portfolios and the compatibility between the non-financial characteristics of these issuers and

the objectives of the collective investment. This point is all the more important for approaches that communicate

centrally on the consideration of non-financial characteristics in management. The AMF therefore makes the

following recommendation.

The list of potential controversies that may have negative effects on the extra-financial characteristics of products

is by nature changing over time and may depend on the sensitivity of investors to certain issues. These may include

issuers violating the UN Global Compact, involved in the production of arms, tobacco, coal, unconventional gas and

oil production, etc.

Furthermore, pursuant to Article L. 533-22 of the Monetary and Financial Code, which transposes the provisions

of Directive (EU) 2017/828 of the European Parliament and of the Council ("SRD2"), portfolio management

companies must publish a shareholder engagement policy describing how they integrate their role as shareholder

into their investment strategies and must publish an annual report on the implementation of this policy

34

. Article

R. 533-16 of the same code specifies the content of this policy.

To encourage the development of best practices in the development of these policies, the AMF makes the following

recommendation.

34

According to this article, AMCs may refrain from such publication if "they publicly state the reasons for doing

so on their website".

Position n°6 :

In order to ensure that the information is clear and accurate and not misleading, commercial documents, DICI

and prospectuses of collective investments using the term "ISR" must indicate that they do not benefit from the

SRI label when they are not labelled.

Recommendation N°9: Controversies audit policy applicable to approaches with a key communication on the

consideration of non-financial criteria

To ensure that the information disclosed on the non-financial characteristics of collective investment schemes

is clear, accurate and not misleading, the AMF recommends that management companies authorised in France

with a key communication on the consideration on non-financial criteria should have policies for preventing and

verifying controversies.

Recommendation 10: Shareholder engagement policy

The AMF recommends that portfolio management companies authorised in France that communicate centrally

or on a reduced basis on the consideration of extra-financial criteria should indicate in their shareholder

engagement policy:

1. extra-financial objectives for shareholder engagement and guidelines for this purpose, broken down by

country where appropriate;

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 17/20

6. MARKETING OF FOREIGN UCITS IN FRANCE

On several occasions, the AMF has drawn the attention of AMCs marketing foreign funds in France to, among other

things, inconsistencies between their name, their investment objective, the presentation of non-financial

objectives and the constraints appearing in the legal documents. In some cases, in order to prevent risks of

misunderstanding of the products in France, the wording of the promotional documents of these UCITS has been

modified at the request of the AMF, in accordance with Article 411-126 of the AMF General Regulation.

Moreover, the AMF has observed several situations in which French funds made the consideration of non-financial

criteria a key aspect of their communication and these funds were then transferred abroad – notably via cross-

border mergers with takeover funds that were created in the six months preceding the transaction. In a number

of situations, these transactions took place with a substantial reduction in the information appearing in the

regulatory documents by comparison with the information that existed for the French funds. For example, as an

illustration, regulatory documentation was removed:

- the coverage rate of the securities in the portfolio by non-financial analysis and the minimum rating below

which securities are excluded by the AMC;

- the indication, for a collective investment scheme presenting itself as "low-carbon", that the scheme does

not aim to reduce its carbon footprint in absolute terms but only relative to its parent index and hence

that the companies in the portfolio will indeed be emitters of greenhouse gases;

- for a collective investment scheme claiming to promote energy transition, several explanations

concerning the methods for weighting "grey and green" companies in the portfolio.

To ensure that investors are well informed in all circumstances, the AMF states the following position.

Position 7 applicable to the marketing in France of UCITS incorporated under foreign law and making non-

financial characteristics a key aspect of communication or adopting for a limited communication

2. their feedback policy explaining the conditions under which the portfolio management company will

strengthen its actions vis-à-vis issuers. After a phase of dialogue with the issuer, the following reinforcement

measures may be considered, for example: ;

a) making public the action taken by the asset management company vis-à-vis the issuer ;

b) specific actions undertaken at general meetings : votes against proposed resolutions, written or oral

questions to the general meeting, filing of resolutions

c) placing the issuer under surveillance with, in particular, the absence of new investments or a reduction

in exposure to the issuer.

In addition, the AMF recommends that portfolio management companies authorised in France with a key

communication on the consideration on non-financial criteria also indicate in this policy

1. the possible link between the fund's non-financial objectives and the commitment made ;

2. priority issuers in terms of shareholder commitment in relation to the fund's non-financial objectives;

3. a section in their reporting policy mentioned in point 2 providing for the sale of the securities of the issuer

in the absence of improvement after a given period (e.g. 2-3 years) in the best interest of the holders and

shareholders of the collective investment schemes. The realisation of new investments may be subject to

the issuer's observation of positive results in relation to the commitment shares.

4.

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 18/20

Without prejudice to the provisions applicable to the drafting of marketing documents, UCITS incorporated under

foreign law which present non-financial characteristics as a key aspect of communication or adopting for a limited

communication but which do not comply with Positions 1 to 4 and 6 may represent risks of misunderstanding of

their non-financial characteristics by investors. These UCITS represent such a risk of inappropriate marketing that

it

would be extremely difficult

to comply with the applicable legislative and regulatory obligations regarding

marketing.

Hence, the marketing materials of such UCITS must include the following indication in very apparent characters

in the beginning of this documents: "Investors should note that, relative to the expectations of the Autorité des

Marchés Financiers, this [UCITS] presents disproportionate communication on the consideration of non-financial

criteria in its investment policy". Where applicable, when the key nature of communication on non-financial

aspects is transcribed solely in the name of the UCITS, the first sentence may be replaced by the following

indication: "Investors should note that, relative to the expectations of the Autorité des Marchés Financiers, the

name of this [UCITS] is disproportionate to the consideration of non-financial criteria in its investment policy ".

7. SPECIFIC CASE OF CERTAIN FEEDER COLLECTIVE INVESTMENT SCHEMES

This section adapts the aforementioned principles to the specific cases of French feeder funds of master funds

incorporated under foreign law. Depending on the case, such master funds may make the consideration of non-

financial criteria a key aspect of communication or adopting a limited communication without the approaches

implemented being engaging or significantly engaging (Positions 1, 2 and 2bis) or without fulfilling the minimum

information requirements (Positions 3 to 5).

In such a situation, and so as not to force the French feeder funds to select in their own regulatory documents the

substrate of the information appearing in the master fund's regulatory documentation which would comply with

these various positions, the AMF states the following position.

Position 8: French feeder collective investment scheme of master UCITS incorporated under foreign law

making non-financial characteristics a key aspect of communication or adopting a limited communication

When the following two conditions combined are met:

a) the master UCITS would be liable to come within the scope of Position 7 if it were marketed in France;

and

b) the feeder collective investment scheme replicat

es the information contained in the regulatory

documents of the master fund making consideration of non-financial criteria a key aspect of the product

or adopting a limited communication ;

then, as an exception to Positions 2 to 4 and 6 mentioned above, these feeder collective investment scheme

must meet the following criteria:

i. The UCITS’s KIID provides for the following indication in very conspicuous characters at the beginning

of the document : "Investors should note that, relative to the expectations of the Autorité des Marchés

Financiers, this [UCITS] presents disproportionate communication on the consideration of non-financial

criteria in its investment policy";

ii. Position 7 is applicable to the marketing of these funds in France.

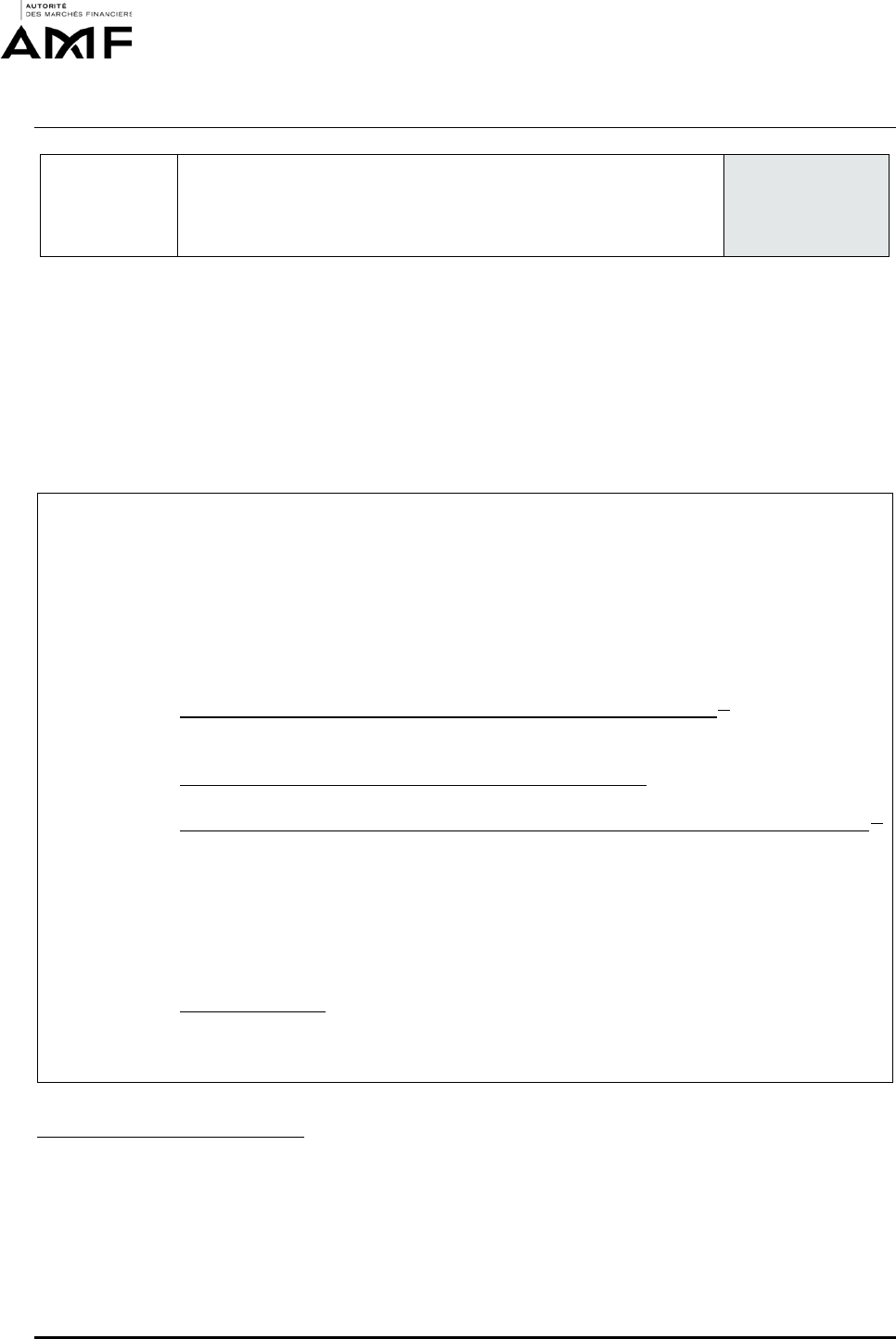

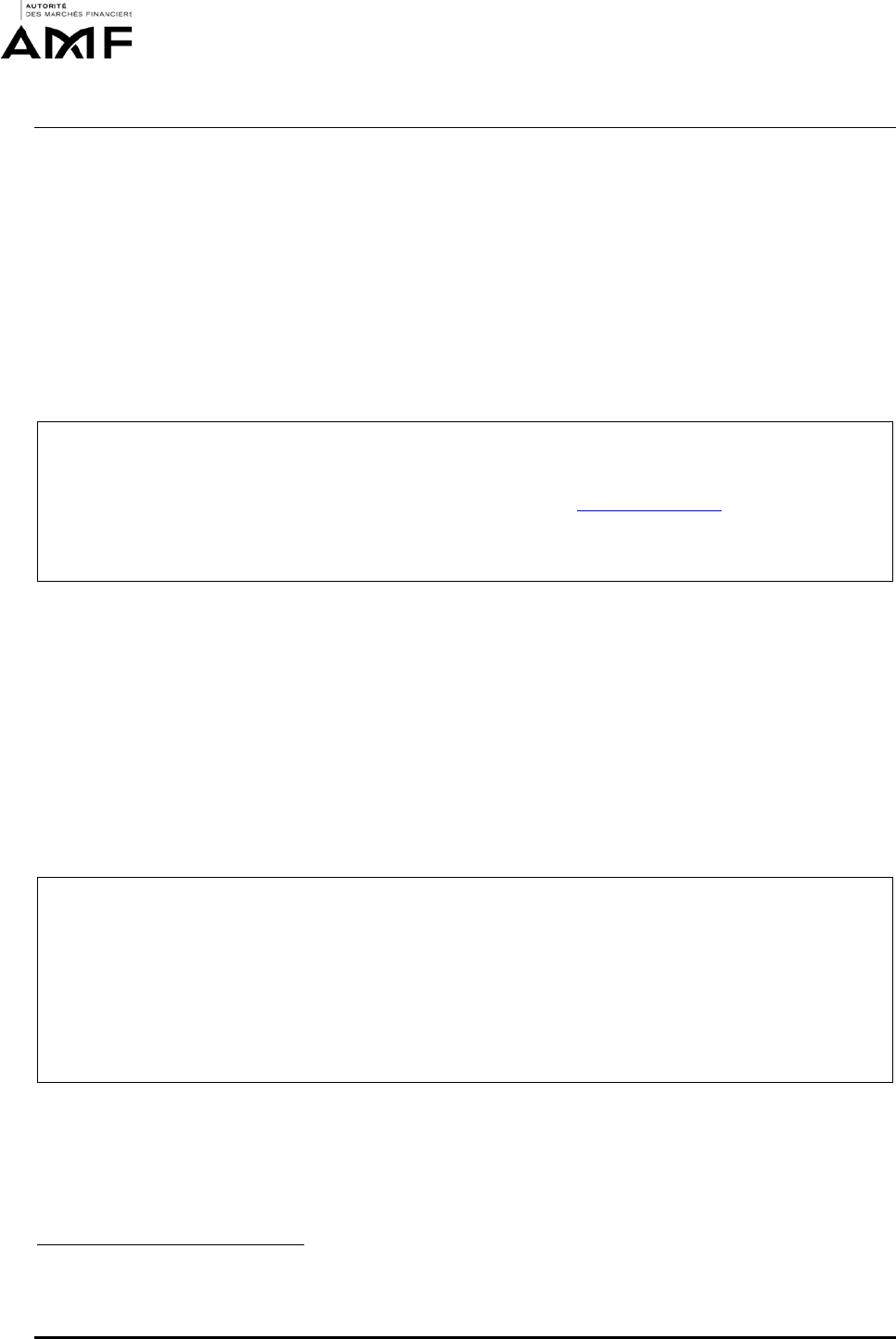

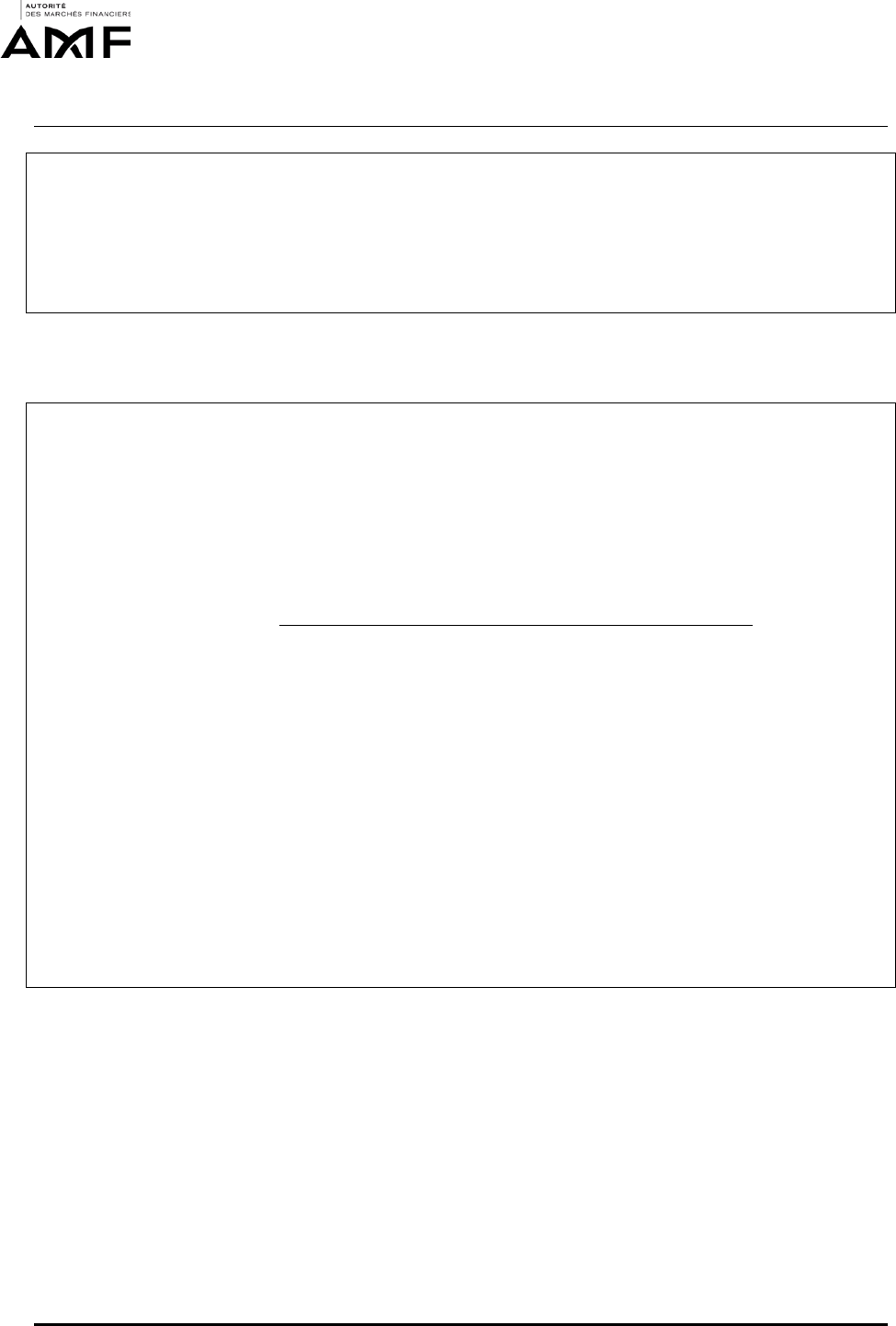

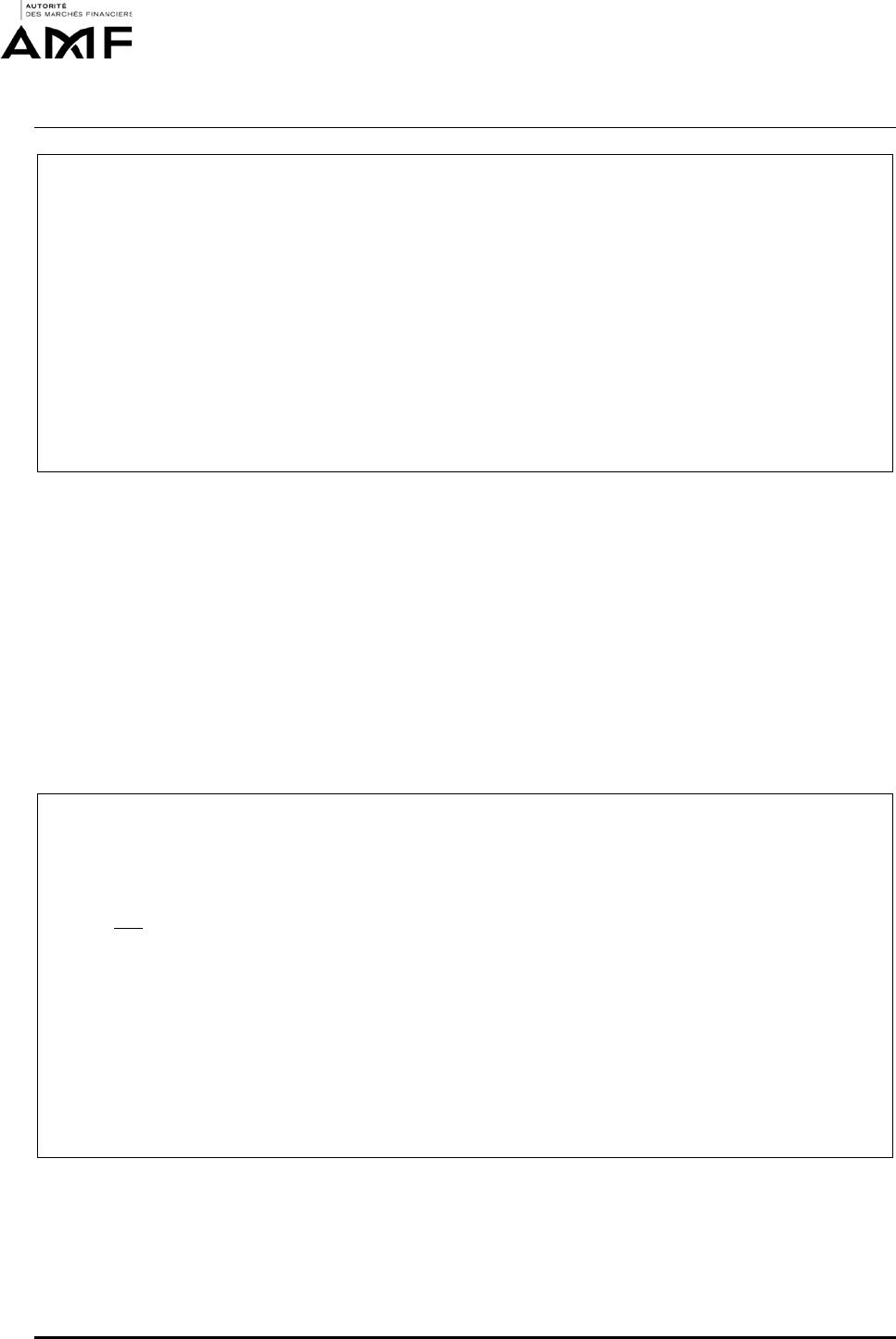

8. SUMMARY

The following table summarises the various applicable policy measures.

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 19/20

Type Positions Recommendations

Principle of

proportion

1

Significantly engaging

approach

2, 3, 4, 5, 6, 7, 8 1, 2, 3, 4, 5, 6, 7, 8, 9, 10

Non-significantly

engaging

2bis, 4, 5, 6, 7, 8 4, 6

Information in the

KIID

3 (main methodological limits)

2 (description of non-financial strategy)

3 (description of non-financial strategy)

4 (Green/Social/Sustainability bonds)

Information in the

marketing documents

5 (consistency of marketing docs/

regulatory docs)

6 (use of the “ISR” term)

7 (marketing disclaimer)

8 (marketing disclaimer)

8 (methodological limits and non-financial

indicators)

6 (engagement policy)

Information in the

prospectus

4 (measurable objectives and non-financial

analysis rate)

2 (description of non-financial strategy)

3 (description of non-financial strategy)

4 (Green/Social/Sustainability bonds)

5 (non-financial selection process)

6 (engagement policy)

Information apart

from regulatory

documents

1 (publication of non-financial information or

adoption of a label, code or charter)

7 (accessibility of non-financial reports)

Shareholder

Engagement and

Controversy

Verification Policies

9 (controversy verification)

10 (shareholder engagement)

AMF Position-Recommendation - DOC-2020-03 - Information to be provided by collective investment schemes incorporating

non-financial approaches

Document created on 11 March 2020, amended on 27 July 2020

This translation is for information purposes only 20/20

APPENDIX: EXAMPLE OF SENTENCES FROM KIID COMPLIANT WITH THE CONCISENESS AND

BALANCE OF THE INFORMATION

The following phrases are examples that respect the concise and balanced nature of the information

communicated in the KIID required for a reduced communication on the consideration of extra-financial criteria.

- Environmental, social and governance (ESG) criteria contribute to, but are not a determining factor in, the

manager's decision making.

- The management team takes environmental, social and governance (ESG) criteria into account in

investment decisions, but not in a preponderant manner. The investment decisions taken may therefore

not comply with ESG criteria.

- Environmental, social and governance (ESG) criteria are one of the components of management but their

weight in the final decision is not defined in advance.

- The positive contribution of environmental, social and governance (ESG) criteria can be taken into account

in investment decisions, without being a determining factor in this decision making.

These standard phrases should be included in the "Other Information" section of the DICI so that communication

in this medium is considered to be limited.