The Collective

Investment Scheme

Information Guide

COLLG Contents

The Collective Investment Scheme Information Guide

COLLG 1A Overview

1A.1 Introduction

COLLG 2A European Legislation

2A.1 Introduction

COLLG 3A The FCA's responsibilities under the Act

3A.1 Introduction

COLLG 4A The FCA's Responsibilities under the OEIC Regulations

4A.1 Introduction

COLLG 5A The COLL sourcebook

5A.1 Introduction

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLLG–i

The Collective Investment Scheme Information Guide

Chapter 1A

Overview

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLLG 1A/1

COLLG 1A : Overview Section 1A.1 : Introduction

1A

G1A.1.1

G1A.1.2

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLLG 1A/2

1A.1 Introduction

About this guide

.....................................................................................................

(1) This Collective Investment Scheme Information Guide (COLLG)

contains some key facts on the regulation of regulated collective

investment schemes in the United Kingdom. It will be of interest

primarily to those who wish to gain a general understanding of the

regulatory regime governing these schemes.

(2) This guide is intended to complement the rules and guidance in the

Collective Investment Schemes sourcebook (COLL). It also explains

how an authorised firm should go about applying for authorisation

of a scheme under the Act or under the OEIC Regulations.

(3) This guide does not contain information on unregulated collective

investment schemes. Such schemes cannot be marketed to the general

public, are not subject to COLL and are otherwise restricted in their

promotion.

(4) The material in this guide is intended only as a summary of a number

of significant legal provisions affecting regulated collective

investment schemes. It does not constitute guidance under sections

139A and 139B of the Act and does not have the status of the

guidance in the Handbook. This also means that ■ GEN 2.2

(Interpreting the FCA Handbook) does not apply. If you have any

doubt about any legal provision you should seek appropriate legal

advice.

(5) This guide italicises words that are defined in the Glossary that forms

part of the FCA Handbook. For the full definition of the term, the

reader should consult the Glossary and adopt the meaning specified

for COLL.

(6) The guide is current as of November 2012. The guide does not

remove the need for firms to keep up to date with regulatory

developments and to consider the potential impact on business of

proposed changes - for example, the regulatory framework of

changes required by further European Union (EU) initiatives.

Structure of collective investment regulation in the United

Kingdom

.....................................................................................................

(1) There are three broad levels of regulation of collective investment

schemes in the United Kingdom. These can be summarised as EU

regulation, UK legislation and regulation by the FCA.

COLLG 1A : Overview Section 1A.1 : Introduction

1A

G1A.1.3

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLLG 1A/3

(2) EU collective investment scheme product regulation was introduced in

1985 by the Undertakings for Collective Investment in Transferable

Securities Directive (UCITS Directive) and has been updated on several

occasions by amendments to that Directive, with a revised version in

2009. If a scheme is established and authorised in the United

Kingdom and complies with the provisions of the UCITS Directive, it is

a UCITS scheme and is capable of being promoted throughout the

EEA. However, not all regulated collective investment schemes are

UCITS schemes (see ■ COLLG 1A.1.3 G). ■ COLLG 2A (European

legislation) provides more detail on the scope and contents of the

UCITS Directive.

(3) The main UK legislation is the Act (under which AUTs operate) and

the Open-Ended Investment Company Regulations (OEIC Regulations)

(under which ICVCs (also known as OEICs) operate). ■ COLLG 3A (The

FCA's responsibilities under the Act) provides details on the FCA's

responsibilities under the Act; how a firm may go about applying for

authorisation of a unit trust scheme or recognition of an overseas

scheme; and what notifications are required to the FCA in terms of

changes to those schemes. ■ COLLG 4A (The FCA's responsibilities

under the OEIC Regulations) provides details on the FCA's

responsibilities under the OEIC Regulations; how a firm may go about

applying for authorisation of an ICVC; and what notifications are

required to the FCA in respect of changes to the ICVC.

(4) The main FCA requirements are set out in the FCA Handbook, in

particular in COLL. COLL is a specialist sourcebook of the FCA

Handbook and is structured in a way that gives rules and guidance on

specific aspects of AUT and ICVC regulation and on recognised

schemes. ■ COLLG 5A (The COLL sourcebook) provides details of the

structure of COLL.

What are regulated collective investment schemes?

.....................................................................................................

(1) Regulated collective investment schemes are collective investment

schemes which are regulated by the FCA as authorised funds or

recognised by the FCA as recognised schemes:

(a) authorised funds must take the form of an AUT (an authorised

unit trust scheme) or an ICVC (an investment company with

variable capital) (as described in more detail below), must be

established in the United Kingdom and must be:

(i) a UCITS scheme; or

(ii) a qualified investor scheme; or

(iii) a non-UCITS retail scheme; and

(b) recognised schemes must be established outside the United

Kingdom and recognised by the FCA under:

(i) section 264 of the Act (Schemes constituted in other EEA

States) - these are UCITS; or

(ii) section 270 of the Act (Schemes authorised in designated

countries or territories); or

(iii) section 272 of the Act (Individually recognised overseas

schemes).

COLLG 1A : Overview Section 1A.1 : Introduction

1A

G1A.1.4

G1A.1.5

G1A.1.6

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLLG 1A/4

(2) The promotion of regulated collective investment schemes is

restricted by the Act. Under section 238 of the Act (Restrictions on

promotion), regulated collective investment schemes may be

promoted by authorised persons. UCITS schemes, non-UCITS retail

schemes and recognised schemes may be promoted to retail investors.

Qualified investor schemes may only be promoted to certain

prescribed category of investor (see COLLG 5.1.3G(8)).

What is an AUT?

.....................................................................................................

An AUT (or authorised unit trust scheme) is a unit trust scheme which is

authorised by the FCA by making an authorisation order. Under section 237

of the Act (Other definitions), a unit trust scheme is a collective investment

scheme under which the property is held on trust for the participants by the

trustee. An AUT is constituted by a trust deed, entered into by the manager

and trustee. Under section 243(4) of the Act (Authorisation orders) the

manager and trustee must be independent of each other.

What is an ICVC?

.....................................................................................................

(1) An ICVC (or investment company with variable capital) is an open-

ended investment company (or OEIC) as defined by section 236 of the

Act (Open-ended investment companies) which is incorporated under

the OEIC Regulations. Section 262 of the Act (Open-ended investment

companies) empowers HM Treasury to make provisions relating to

open-ended investment companies, which it has done by way of the

OEIC Regulations, including provisions relating to the establishment

of ICVCs. The FCA may authorise an ICVC by making an authorisation

order under regulation 14 of the OEIC Regulations. Paragraph 1(3) of

Schedule 5 to the Act states that an authorised open-ended

investment company is an authorised person. So, an ICVC is an

authorised person.

(2) An ICVC is constituted by an instrument of incorporation. Regulation

15(4) of the OEIC Regulations requires an ICVC to have at least one

director. Where there is only one director, that director must be a

body corporate with the permission of acting as the depositary or

sole director of an open-ended investment company. COLL refers to

this person as an authorised corporate director (ACD). A depositary

must take responsibility for the safekeeping of the scheme property.

The depositary must be independent of the ICVC and each of its

directors.

(3) The directors and the depositary are required to comply with the

OEIC Regulations and the rules in COLL and, in accordance with

paragraph 6(1) of Schedule 2 to the OEIC Regulations, are also bound

by the provisions of the instrument of incorporation.

Authorisation to carry on regulated activities

.....................................................................................................

(1) No person may carry on a regulated activity by way of business in the

United Kingdom, or purport to do so, unless he is an authorised

person (or an exempt person). This prohibition is referred to in the

Act as the general prohibition. Guidance for persons considering

carrying on regulated activities in the United Kingdom can be found

in PERG. The FCA website page

COLLG 1A : Overview Section 1A.1 : Introduction

1A

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLLG 1A/5

"Apply for authorisation": https://www.fca.org.uk/firms/authorisation/

apply-authorisation gives guidance on how to apply to the FCA for a

Part 4A permission. This authorisation is different to the authorisation

of an AUT or an ICVC, as referred to in ■ COLLG 1A.1.4 G and

■ COLLG 1A.1.5 G respectively.

(2) The following constitute regulated activities:

(a) establishing, operating or winding up a collective investment

scheme;

(b) acting as trustee of an authorised unit trust scheme; and

(c) acting as the depositary or sole director of an open-ended

investment company.

(3) The FCA maintains a public register of persons who have a permission

to carry on a regulated activity. The register also contains details of all

regulated collective investment schemes and it can be consulted on

the FCA's website at www.fca.org.uk/firms/financial-services-register .

COLLG 1A : Overview Section 1A.1 : Introduction

1A

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLLG 1A/6

The Collective Investment Scheme Information Guide

Chapter 2A

European Legislation

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLLG 2A/1

COLLG 2A : European Legislation Section 2A.1 : Introduction

2A

G2A.1.1

G2A.1.2

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLLG 2A/2

2A.1 Introduction

Background and scope

.....................................................................................................

(1) This section summarises the scope and content of the UCITS Directive

as amended ("the Directive") as it applies in the United Kingdom. The

Directive establishes a degree of harmonisation of EEA States' laws

governing:

(a) the activities of management companies;

(b) the UCITS they manage; and

(c) how units of the UCITS they manage are sold to the public.

(2) The main topics governed by the Directive and summarised in this

section concern:

(a) the general scope of the Directive;

(b) the obligations of the management company and the depositary;

(c) investment and borrowing powers and limits;

(d) information for investors,

(e) how the management company passport works; and

(f) marketing requirements.

(3) The Directive also covers other topics which are not summarised in

this section. These include:

(a) the ability to establish master-feeder UCITS, with the master

UCITS and feeder UCITS either in the same or different EEA

States; and

(b) a procedure for the merger of UCITS where the UCITS involved

are established in different EEA States, or market their units in an

EEA State other than the one in which they are established.

General scope of the UCITS Directive

.....................................................................................................

(1) The Directive applies to any open-ended collective investment

undertaking that is established and authorised as a UCITS in an EEA

State, regardless of whether it is promoted in any other EEA State.

However, the Directive applies only to collective investment

undertakings that are promoted to the general public within the EEA,

so collective investment undertakings that are restricted in their

promotion fall outside the Directive's scope.

COLLG 2A : European Legislation Section 2A.1 : Introduction

2A

G2A.1.3

G2A.1.4

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLLG 2A/3

(2) Furthermore, the Directive does not cover collective investment

schemes that are authorised in an EEA State with different

investment and borrowing powers to those covered by the Directive.

So, schemes that invest in (for example) real property or commodities

are not within the Directive's scope.

Obligations on the management company and depositary

.....................................................................................................

(1) The Directive assigns certain functions and requirements to a

management company and a depositary. As a result, a UK firm which

wishes to operate UCITS schemes or act as a depositary must first seek

authorisation from the FCA. A UK firm operating a UCITS scheme (a

UK management company) is referred to as the authorised fund

manager (AFM).

(2) In addition, the Directive imposes certain conduct of business and

financial resources requirements on the UCITS management company.

(3) The Directive states that the depositary must be subject to 'public

control' and provide 'sufficient financial and professional guarantees'.

The depositary is responsible for the safe keeping of a UCITS' assets,

and for ensuring that the issue, sale, redemption and cancellation of

units and the calculation of the value of units are effected in

accordance with the law and constituting document of the UCITS.

(4) Two main principles govern the relationship between the UCITS

management company and the depositary of a UCITS. First, no single

company may act in both capacities. Second, they must act

independently of each other and, apart from management of a

UCITS, a UCITS management company cannot engage in any activities

other than:

(a) management of other collective investment undertakings;

(b) managing investments; and

(c) advising on investments and safeguarding and administering

investments, but in either case only where it also has permission

to manage investments.

Investment and borrowing powers and limits

.....................................................................................................

(1) The Directive states the types of assets a UCITS can invest in. These

include:

(a) transferable securities;

(b) approved money-market instruments;

(c) deposits;

(d) derivatives and forwards; and

(e) units in other collective investment schemes.

(2) The UCITS eligible assets Directive, which came into effect in July

2008, clarifies the definition of terms used in the Directive by setting

out criteria for determining which types of transferable securities,

approved money-market instruments and derivatives are eligible to

be held by a UCITS.

COLLG 2A : European Legislation Section 2A.1 : Introduction

2A

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLLG 2A/4

(3) Within this range of investment assets there are some detailed spread

and concentration rules in the Directive. The main requirements can

be summarised as follows:

(a) no more than 5% may be invested in transferable securities or

approved money-market instruments with one issuer - this can be

raised to 10% but only in respect of a maximum of 40% of the

UCITS value;

(b) no more than 20% may be invested in deposits with one body;

(c) 100% may be invested in other collective investment

undertakings provided:

(i) no more than 30% is invested in total in units in collective

investment undertakings which are not UCITS and then only

in collective investment undertakings that offer equivalent

protection to investors;

(ii) the collective investment undertaking being invested into is

not permitted to invest more than 10% in other collective

investment undertakings; and

(iii) no more than 10% is invested in any one UCITS (which may

be raised to 20% at the discretion of the Member State and

has been raised to 20% for UK UCITS), except where a feeder

UCITS is investing in a master UCITS (see ■ COLL 5.8

(Investment powers and borrowing limits for feeder UCITS));

(d) no more than 20% may be invested in transferable securities and

approved money-market instruments issued by one group;

(e) no more than 20% may be invested in any combination of

transferable securities, approved money-market instruments,

deposits, or OTC derivatives from a single body; and

(f) no more than 5% may be invested in OTC derivative exposure to

one counterparty, or 10% where the counterparty is an approved

bank.

(4) Where a UCITS has the investment objective of replicating the

composition of a qualifying index, it may have an exposure of up to

20% in any issuer or exceptionally up to 35% (but only for one

issuer). A qualifying index is one which has a sufficiently diversified

composition, is a representative benchmark for that market, and is

published in an appropriate manner.

(5) The management company must employ a specific risk management

process to monitor the risk of all investment positions. Where

derivatives are to be used within a UCITS, the management company

must notify details of this risk management process and any

significant change to it to its competent authority. The exposure to all

derivative transactions must not exceed the current net asset value of

the UCITS. The underlying assets representing any derivative position

must be taken into account in applying the spread of limits above.

This does not apply in the case of any derivative which is on a

qualifying index.

(6) A UCITS may borrow up to 10% in value of its assets, provided the

borrowing is on a temporary basis.

COLLG 2A : European Legislation Section 2A.1 : Introduction

2A

G2A.1.5

G2A.1.6

G2A.1.7

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLLG 2A/5

Information to investors

.....................................................................................................

(1) The Directive sets out which documents must be made available or

offered to investors. The three main documentary requirements are:

(a) the prospectus;

(b) the key investor information document; and

(c) the annual and half-yearly reports and accounts.

(2) The full prospectus requirements are included in Annex A of the

Directive and provide detailed information on the main parties

involved in operating the UCITS, the investment objectives and policy

of the UCITS, and general day-to-day operating matters such as

dealing times and income allocation.

(3) In addition to the prospectus, the management company must

publish a key investor information document for each UCITS. This is

intended to be a standardised document used for selling UCITS

throughout the EEA. It must be provided to any prospective investor

free of charge so that they can take investment decisions on an

informed basis. The required contents for the key investor

information document are set out in the KII Regulation, which is

directly applicable in each Member State.

(4) Reports and accounts must be prepared on a half-yearly and annual

basis and the latest report must be supplied to investors free of

charge. They must also be available at the place specified in the

prospectus. The required contents for the report and accounts are set

out in Schedule B of the Directive.

The management company passport

.....................................................................................................

(1) Chapter III of the Directive provides the framework for a UCITS

management company to provide services in another EEA State by

way of a branch or cross border services.

(2) UK firms which are UCITS management companies can operate UCITS

established in other EEA states (see ■ SUP 13 (Exercise of passport

rights by UK firms) and ■ COLL 12 (Management company and product

passports under the UCITS Directive) for more information).

(3) A non-UK management company may operate a UK UCITS by way of

branch or cross border services in accordance with the provision of

Schedule 3 to the Act and if so it is defined in the FCA Handbook as

an EEA UCITS management company.

Marketing requirements

.....................................................................................................

(1) Chapter XI of the Directive provides the framework for a UCITS to be

marketed in another EEA State. A UCITS is required to comply with

the marketing and advertising rules in the relevant Host State (Article

91) and is also required to maintain facilities in the Host State (Article

92).

(2) Certain documents must be provided to the Host State regulator in

the relevant EEA State at the same time as notification of the

proposal to market there. Before a UCITS can begin marketing in a

COLLG 2A : European Legislation Section 2A.1 : Introduction

2A

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLLG 2A/6

Host State, it must submit a notification letter to the Home State

regulator, together with the instrument constituting the scheme, the

prospectus, key investor information document and the most recent

annual and half-yearly reports. The Home State regulator has ten

working days in which to process the notification and transmit it to

the Host State regulator. The UCITS may begin accessing the market

immediately following transmission of the notification (Article 93).

(3) The relevant information and documents distributed in the Host State

are required to be the same as those that the UCITS provides in its

Home State. In addition, the key investor information document must

be published in an official language of the Host State or another

language if approved by the relevant Host State regulator (Article

94). The other documents may either be translated in the same way,

or published in a language customary in the sphere of international

finance (English is accepted to be such a language).

(4) A UK UCITS may access the market in another EEA State using the

procedure set out in Schedule 3 to the Act.

(5) A UCITS from another EEA State may access the market in the United

Kingdom in accordance with the procedure set out in section 264 of

the Act.

The Collective Investment Scheme Information Guide

Chapter 3A

The FCA's responsibilities

under the Act

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLLG 3A/1

COLLG 3A : The FCA's Section 3A.1 : Introduction

responsibilities under the Act

3A

G3A.1.1

G3A.1.2

G3A.1.3

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLLG 3A/2

3A.1 Introduction

Part 17 of the Act deals specifically with collective investment schemes. The

main features and practical effects of Part 17, and how the FCA exercises its

responsibilities, are described below. References to sections are to the

numbered sections of Part 17.

Promotion of schemes in the United Kingdom (section 238)

.....................................................................................................

(1) Before a scheme can be promoted to the public in the United

Kingdom, it must be authorised or recognised by the FCA as a

regulated collective investment scheme (see ■ COLLG 1A.1.3 G).

(2) A regulated collective investment scheme may be promoted to the

public by an authorised person.

Application for authorisation as an authorised unit trust

(sections 242 and 243)

.....................................................................................................

(1) The FCA requires an application for authorisation of a unit trust

scheme to be made jointly by the manager and trustee, both of

which must be:

(a) authorised persons under the Act with the appropriate Part 4A

permissions; and

(b) independent of each other (see ■ COLL 6.9.2 G (Independence of

depositaries and scheme operators) which provides guidance on

independence).

(2) The application must contain details of the manager and trustee, of

the scheme itself, and of other persons to whom functions are to be

delegated (e.g. the registrar and the investment adviser).

(3) Application forms are available free of charge from the forms page at

https://www.handbook.fca.org.uk/form .

(4) A fee is payable and must be submitted with the application (see

■ FEES 3 Annex 2 R (Application and notification fees payable in relation

to collective investment schemes)).

(5) The following items must be provided with the application:

(a) a copy of the trust deed;

(b) a solicitor's certificate stating that the trust deed complies with

the rules made under section 247 (Trust scheme rules);

COLLG 3A : The FCA's Section 3A.1 : Introduction

responsibilities under the Act

3A

G3A.1.4

G3A.1.5

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLLG 3A/3

(c) a copy of the prospectus, with a checklist indicating the location

of the information required by COLL to be contained in it;

(d) in the case of an application relating to the authorisation of a

UCITS scheme, a copy of the key investor information document;

and

(e) if applicable, documents evidencing any guarantee arrangement.

(6) The name of the scheme must not be undesirable or misleading and

its purpose must be reasonably capable of being successfully carried

into effect. ■ COLL 6.9 (Independence, names and UCITS business

restrictions) provides guidance on what the FCA considers undesirable

or misleading names.

Determining and refusing applications (sections 244 and 245)

.....................................................................................................

(1) Under section 244 (Determination of applications), the FCA has:

(a) up to 2 months in the case of a proposed UCITS; or

(b) up to 6 months in the case of any other proposed scheme;

in which to consider a completed application following its receipt

and must inform the manager and trustee of its decision within that

timescale. In practice, the FCA aims to process 75% of completed

applications relating to a UCITS scheme within 6 weeks. If the FCA is

satisfied with the application, an authorisation order is issued for the

scheme.

(2) If the FCA proposes to refuse an application, it must give a warning

notice which will contain the reasons for the refusal. If, having given

the warning notice, it decides to refuse the application, a decision

notice will be sent and the applicant may refer the matter to the

Tribunal.

Revocation of authorisation (section 254)

.....................................................................................................

(1) The FCA can revoke an authorisation order if:

(a) the requirements of authorisation are no longer satisfied; or

(b) the manager or trustee has contravened any provision of the Act

or any rules or regulations made under it, or has given false or

misleading information to the FCA; or

(c) no regulated activity is being carried on in relation to the scheme

and the period of that inactivity began at least twelve months

earlier; or

(d) it is undesirable for investors or potential investors that the

authorised unit trust scheme should continue.

(2) The FCA may refuse to revoke an authorisation order if it considers

that:

(a) any matter should be investigated prior to revocation; or

(b) revocation would not be in the interests of investors; or

(c) revocation would be incompatible with the UCITS Directive.

COLLG 3A : The FCA's Section 3A.1 : Introduction

responsibilities under the Act

3A

G3A.1.6

G3A.1.7

G3A.1.8

G3A.1.9

G3A.1.10

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLLG 3A/4

(3) If the FCA proposes to revoke an authorisation order, a separate

warning notice will be sent to the manager and trustee. The same

procedures as stated for refusal of authorisation, in relation to the

warning notice and decision notice, will apply.

Notification of changes to unit trusts (sections 251 and 252A)

.....................................................................................................

(1) The manager must give written notice to the FCA when:

(a) an alteration to the authorised unit trust scheme is proposed; or

(b) it is proposed that the trustee should retire and be replaced.

(2) Any proposal that involves a change in the trust deed must be

accompanied by a solicitor's certificate stating that the change will

not affect the compliance of the trust deed with the rules.

(3) The trustee must give written notice to the FCA of a proposal to

replace the manager.

(4) The FCA has one month following receipt of notice under section 251

(Alteration of schemes and changes or manager or trustee) to

consider whether or not to refuse the proposal. In the case of a

notice under section 252A (Proposal to convert a non-feeder UCITS)

the period available to the FCA is 15 working days.

Powers of intervention (sections 257 and 281)

.....................................................................................................

The FCA has powers of intervention if there is a breach of the Act or COLL,

or if it is in the interests of Unitholders or potential Unitholders in a scheme.

In respect of an AUT, directions can be made for the manager to suspend the

issue and redemption of units or to wind up the scheme.

Scheme particulars (section 248)

.....................................................................................................

The Act empowers the FCA to require a manager to publish scheme

particulars. ■ COLL 4 (Investor relations) which refers to the scheme particulars

as a prospectus, sets out details of the required contents, the timing of

publication, and how and when the prospectus must be offered to

prospective investors.

Recognition of overseas schemes

.....................................................................................................

Recognition by the FCA enables overseas schemes to be marketed to the

public in the United Kingdom.

Recognition of schemes constituted in other EEA states

(section 264)

.....................................................................................................

(1) Section 264 covers schemes constituted in another EEA State that are

certified by their Home State regulator as meeting the requirements

of the UCITS Directive (EEA UCITS schemes). The scheme becomes

recognised as soon as its Home State regulator has transmitted to the

FCA the notification of the scheme operator's intention to access the

market in the United Kingdom, together with the documents

COLLG 3A : The FCA's Section 3A.1 : Introduction

responsibilities under the Act

3A

G3A.1.11

G3A.1.12

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLLG 3A/5

prescribed in Article 93 of the Directive that the scheme operator has

filed with its Home State regulator.

(2) If there is a change in the information supplied to the FCA in

accordance with ■ COLL 9.2 (Section 264 recognised schemes)

following initial recognition, the FCA should be notified by the

operator before the change is implemented.

Recognition of schemes authorised in designated territories

(section 270)

.....................................................................................................

(1) Section 270 covers schemes that are managed in and authorised

under the law of a country or territory outside the United Kingdom

that has been designated for this purpose by an order made by HM

Treasury ("the Designation Order"). These include Jersey, Guernsey

and the Isle of Man. It should be noted that HM Treasury:

(a) retains responsibility for the designation of countries or

territories and must be satisfied that their laws and practices

relating to the authorisation and regulation of their collective

investment schemes provide a level of protection at least

equivalent to that provided under the Act;

(b) must be content that adequate arrangements exist for co-

operation between regulators in each country or territory and

the FCA; and

(c) may request the FCA provide a report on the regimes of

regulation in existing or prospective designated territories.

(2) Notification forms are available, free of charge, at the FCA website

and ■ COLL 9.3 (Section 270 and 272 recognised schemes) provides

further information on the documents to be supplied to the FCA. The

scheme becomes recognised on the FCA's written approval, or

automatically after two months from notification.

Recognition of individual overseas schemes (section 272)

.....................................................................................................

(1) Section 272 covers overseas schemes that are not recognised by virtue

of section 264 or section 270. The FCA may make an order declaring

the scheme to be recognised if it is satisfied that the scheme will

afford adequate protection (i.e. a similar level of protection to that

provided under the Act) for investors, and the arrangements for the

scheme's constitution and management, and the powers and duties

of the operator and of any trustee or depositary, are also

"adequate". In deciding what is adequate, the FCA will consider the

rules applicable to AUTs or ICVCs.

(2) A section 272 application requires detailed and rigorous analysis of all

aspects of the scheme and the level of investor protection provided

by the regime under which the scheme operates, so the FCA has 6

months in which to determine a completed application. Details of the

information and documents required for a section 272 application can

be found in ■ COLL 9.3 (Section 270 and 272 recognised schemes).

COLLG 3A : The FCA's Section 3A.1 : Introduction

responsibilities under the Act

3A

G3A.1.13

G3A.1.14

G3A.1.15

G3A.1.16

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLLG 3A/6

Subsequent notification in respect of schemes recognised

under section 272 of the Act

.....................................................................................................

(1) The FCA wishes to be informed of changes in the information

supplied by the operator of a section 272 scheme under ■ COLL 9.3.1 D

(Information and documents to be supplied for a section 270

notification or section 272 application).

(2) Any revised documents sent under (1) should be certified as true

copies of the originals and accompanied, where relevant, by written

evidence of the approval of the overseas regulator to the change.

Refusal of approval: schemes recognised under sections 270

and 272 of the Act

.....................................................................................................

The FCA's power to refuse recognition and the procedures for this are set

out in section 271 (Procedure) for schemes recognised under section 270, and

section 276 (Procedure when refusing an application) for schemes recognised

under section 272.

Revocation of recognition of overseas schemes

.....................................................................................................

(1) If the operator of a scheme recognised under section 264 gives

written notice to the FCA under section 264(6) that it desires the

scheme to no longer be recognised, then the scheme ceases to be

recognised.

(2) Under section 279 (Revocation of recognition), the FCA may direct

that a scheme shall cease to be recognised under section 270, or

revoke its recognition under section 272, on similar grounds to those

provided for in the revocation of authorised funds under section 254

(Revocation of authorisation order otherwise than by consent).

(3) If the FCA proposes to give a direction under section 279 or to revoke

a scheme's recognition, it will give a warning notice. Should the FCA

decide to give a direction or revoke recognition, it will issue a

decision notice. Thereafter, the matter may be referred to the

Tribunal.

Scheme facilities in the United Kingdom (section 283)

.....................................................................................................

This section enables the FCA to make rules requiring recognised schemes to

maintain scheme facilities in the United Kingdom and to provide certain

information to be supplied on request. Details are contained in ■ COLL 9.4

(Facilities in the United Kingdom).

The Collective Investment Scheme Information Guide

Chapter 4A

The FCA's Responsibilities

under the OEIC Regulations

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLLG 4A/1

COLLG 4A : The FCA's Section 4A.1 : Introduction

Responsibilities under the OEIC

Regulations

4A

G4A.1.1

G4A.1.2

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLLG 4A/2

4A.1 Introduction

Section 262 (Open-ended investment companies) of the Act provides for HM

Treasury to make regulations governing the establishment and regulation of

ICVCs. Rather than merely adopting various parts of UK company law, HM

Treasury chose a 'stand alone' approach for its OEIC Regulations. The main

features and practical effects of those regulations are outlined below.

Applications for authorisation (Regulations 12-17)

.....................................................................................................

(1) The FCA requires an application for authorisation of an ICVC to be

made jointly by the ACD and depositary, both of which must be:

(a) authorised persons under the Act with the appropriate Part 4A

permissions; and

(b) independent of each other (see ■ COLL 6.9.2 G (Independence of

depositaries and scheme operators) which provides guidance on

independence).

(2) The application must contain details of the ACD and depositary, and

any other person proposed as a director of the ICVC, of the scheme

itself, and of other persons to whom functions are to be delegated

(e.g. the registrar and the investment adviser).

(3) Application forms are available free of charge from the forms page at

https://www.handbook.fca.org.uk/form .

(4) A fee is payable and must be submitted with the application (see

■ FEES 3 Annex 2 R (Application and notification fees payable in relation

to collective investment schemes)).

(5) The following items must be provided with the application:

(a) a copy of the proposed ICVC's instrument of incorporation;

(b) a solicitor's certificate stating that the instrument of

incorporation complies with Schedule 2 to the OEIC Regulations

and with COLL;

(c) a copy of the prospectus, with a checklist indicating the location

of the information required by COLL to be contained in it;

(d) in the case of an authorisation application relating to a UCITS

scheme, a copy of the key investor information document; and

(e) if applicable, documents evidencing any guarantee arrangement.

(6) The name of the ICVC must not be undesirable or misleading and

must not be the same as that of an existing company. Regulation 19

COLLG 4A : The FCA's Section 4A.1 : Introduction

Responsibilities under the OEIC

Regulations

4A

G4A.1.3

G4A.1.4

G4A.1.5

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLLG 4A/3

includes a list of words and expressions that are prohibited from

inclusion within the name of an ICVC and further guidance can be

found in ■ COLL 6.9 (Independence, names and UCITS business

restrictions). As with an AUT, the aim of the ICVC must be reasonably

capable of being achieved.

(7) As with an AUT, the FCA has:

(a) in the case of a proposed UCITS up to 2 months; or

(b) in the case of any other proposed scheme up to 6 months;

to determine a completed application, but aims to process 75% of

applications for UCITS schemes within six weeks. If the FCA is satisfied with

the application, an authorisation order is issued. The ICVC becomes

incorporated when the authorisation order is issued.

Notification of changes to ICVCs (Regulations 21 and 22A)

.....................................................................................................

(1) The FCA's approval is required before the following changes can take

place:

(a) any alteration to the instrument of incorporation;

(b) any significant alteration to the prospectus;

(c) any reconstruction or amalgamation involving the ICVC;

(d) any proposal to wind up the ICVC or a sub-fund of an ICVC

otherwise than by the court;

(e) any proposal to replace a director, appoint an additional director,

or decrease the number of directors in post; and

(f) any proposal to replace the depositary.

(2) Any notice proposing to change the instrument of incorporation must

be accompanied by a solicitor's certificate confirming that the change

will not affect compliance of the instrument with Schedule 2 to the

OEIC Regulations and COLL as they relate to the contents of the

instrument.

(3) The FCA has one month following written notification under

Regulation 21 (The Authority's approval for certain changes in respect

of a company) to consider whether or not to refuse the proposal. In

the case of a notice under Regulation 22A (The Authority's approval

for conversion of a feeder UCITS) the period available to the FCA is 15

working days.

Revocation of authorisation (Regulation 23)

.....................................................................................................

The FCA can revoke or refuse to revoke an authorisation order on similar

grounds to those for an AUT. If it proposes to do so, similar procedures for

warning notices and decision notices as for AUTs apply (see

■ COLLG 3A.1.5 G (2)).

Power of intervention (Regulation 25)

.....................................................................................................

The FCA has a power of intervention if it appears there is a breach of the

Act or a rule of COLL, or if it is desirable to give a direction to protect the

interests of investors in the ICVC. Directions can be given to cease the issue

COLLG 4A : The FCA's Section 4A.1 : Introduction

Responsibilities under the OEIC

Regulations

4A

G4A.1.6

G4A.1.7

G4A.1.8

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLLG 4A/4

or redemption of units or any class of unit in the ICVC or for the winding up

of the ICVC.

Corporate Code

.....................................................................................................

(1) Certain provisions of the Companies Acts will apply to ICVCs, as they

are incorporated bodies (especially, but not exclusively, regarding the

holding of meetings).

(2) Regulations 34 to 70 lay down the corporate code for ICVCs. The code

contains provisions dealing with the operation of ICVCs and includes

a number of general company law provisions, for example personal

liability for contracts and deeds and punishment for fraudulent

trading. The operation of an ICVC is also governed by COLL.

The FCA's registration function

.....................................................................................................

In accordance with Part IV of the OEIC Regulations, the FCA is required to

maintain a register of ICVCs, allocate to each a registered number, and carry

out certain other registration functions.

Sub-funds of umbrella ICVC

.....................................................................................................

Regulations 11A, 11B and 33C implement a protected cell regime for sub-

funds of umbrella ICVCs. As a result a Unitholder in a solvent sub-fund of an

umbrella ICVC receives protection in respect of liabilities of and claims

against: (i) the umbrella company; and (ii) any other sub-fund. COLL provides

for:

(1) disclosure requirements in respect of the limited recourse to the

assets and liabilities of a particular sub-fund in the instrument

constituting the scheme (see ■ COLL 3.2.6 R (Table: contents of the

instrument constituting the scheme) paragraph 22A) and the

prospectus (see ■ COLL 4.2.5 R (Table: contents of the prospectus)

paragraph 2A);

(2) limitations on cross sub-fund investment (see ■ COLL 5.2 (General

investment powers and limits for UCITS schemes) for UCITS schemes

and ■ COLL 5.6 (Investment powers and borrowing limits for non-UCITS

retail schemes) for non-UCITS retail schemes); and

(3) duties on the ACD to take appropriate action in relation to foreign

law contracts which after prompt investigation appear to be

inconsistent with the principle of limited recourse (see ■ COLL 6.6.5A R

(Duties of the ACD of an ICVC: umbrella schemes)).

The Collective Investment Scheme Information Guide

Chapter 5A

The COLL sourcebook

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLLG 5A/1

COLLG 5A : The COLL Section 5A.1 : Introduction

sourcebook

5A

G5A.1.1

G5A.1.2

G5A.1.3

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLLG 5A/2

5A.1 Introduction

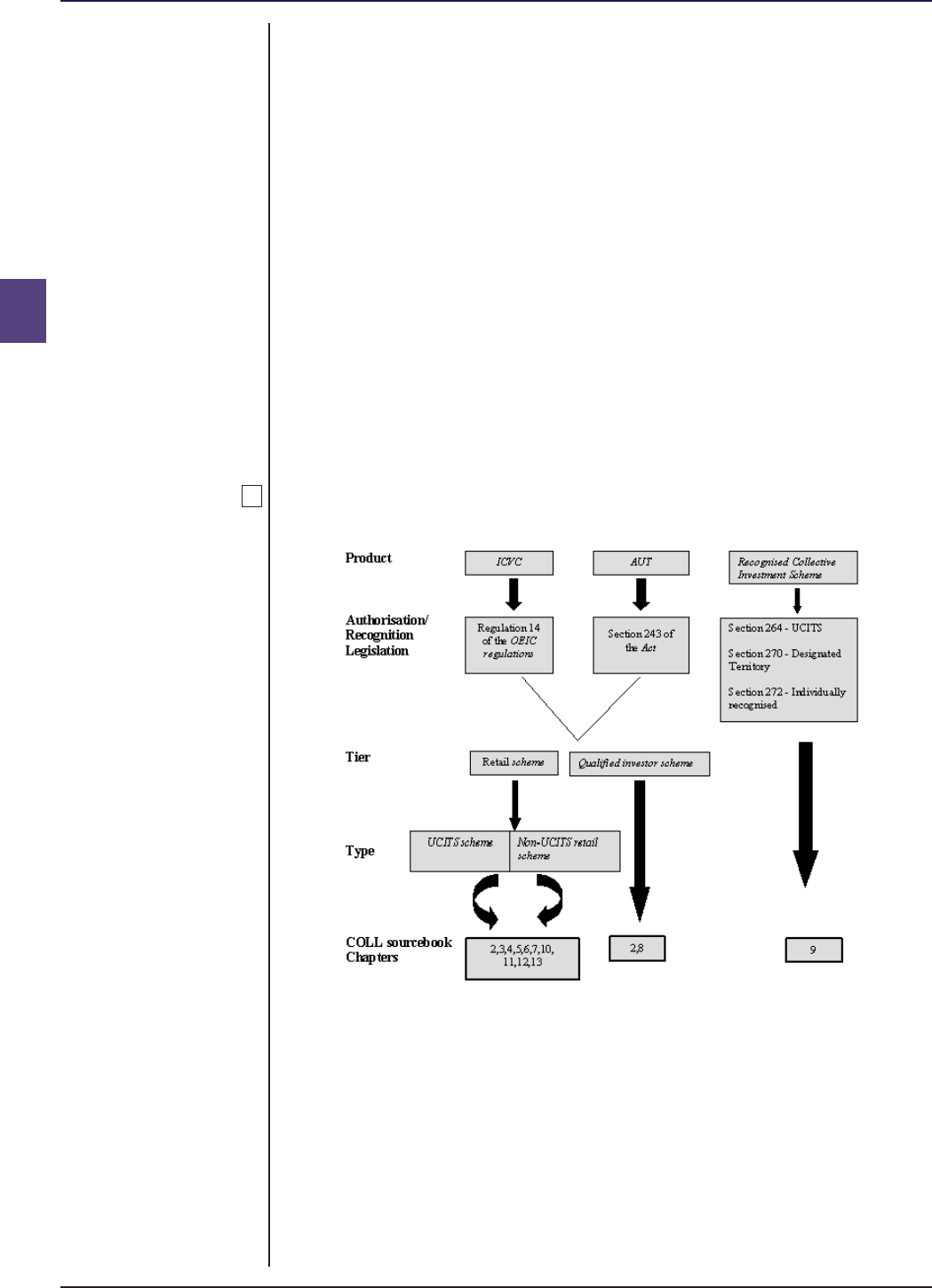

(1) COLL is a specialist sourcebook that sits in Block 6 (Specialist

Sourcebooks) of the FCA Handbook. It provides the detailed

framework within which authorised funds operate and includes

requirements relating to recognised schemes.

(2) The material in COLL (excluding chapter 9) forms a major part of the

product regulation regime for ICVCs and AUTs, supplementing the

material in the OEIC Regulations (for ICVCs) and chapter III of Part 17

of the Act (for AUTs) and giving effect to the relevant parts of the

UCITS Directive. This is shown in the diagram at ■ COLLG 5A.1.5 G.

(3) The sourcebook is designed as a two-tier approach, depending on

whether the authorised fund is capable of being promoted to the

general public (a retail scheme) or is sold to sophisticated investors (a

qualified investor scheme).

Definition of terms in COLL

.....................................................................................................

Some parts of COLL relate only to ICVCs and some parts only to AUTs.

However, most of COLL covers both ICVCs and AUTs, so some of the defined

terms included relate equally to both ICVCs and AUTs (together defined as

"authorised funds"). Other key terms are:

(1) "authorised fund manager", which refers to both the ACD of an ICVC

and the manager of an AUT;

(2) "depositary", which when used for an authorised fund refers to both

the depositary of an ICVC and the trustee of an AUT; and

(3) "unit", which according to the context can refer to a "share" in an

ICVC, a "unit" in an AUT, and the rights or interests of participants in

other types of collective investment scheme.

Outline of the content of COLL

.....................................................................................................

The contents of COLL are outlined below.

(1) ■ COLL 1 (Introduction) sets out which firms COLL applies to and gives

an overview of the types of authorised fund.

(2) ■ COLL 2 (Authorised fund applications) sets out the initial application

requirements for authorised funds and the rules concerning

notifications which need to be made to the FCA in its role as registrar

of ICVCs.

COLLG 5A : The COLL Section 5A.1 : Introduction

sourcebook

5A

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLLG 5A/3

(3) ■ COLL 3 (Constitution) includes requirements regarding the contents

of the instrument constituting the scheme for authorised funds that

are retail schemes and other matters relating to their constitutional

features, such as classes of units.

(4) ■ COLL 4 (Investor relations) includes consumer-facing material relating

to authorised funds that are retail schemes. So, material on the

prospectus, key investor information document, simplified prospectus

(for non-UCITS retail schemes or feeder NURS, where the authorised

fund manager opts to produce this), and reports and accounts is

included in that chapter, together with rules relating to when

Unitholders must be notified of events and when meetings of

Unitholders, are required. The chapter also includes the information

to be given to Unitholders of a feeder UCITS in certain circumstances.

(A key investor information document is not required for a non-UCITS

retail scheme or feeder NURS. However, an authorised fund manager

of such a scheme can choose to produce an equivalent document to

the key investor information document, which is referred to as a

NURS-KII document, by applying for a modification by consent (see

www.fca.org.uk/firms/waivers-modifications/consent). If an authorised

fund manager of such a scheme does not choose to produce a NURS-

KII document it must produce a key features document, in accordance

with the provisions of ■ COBS 13.3 (Contents of a key features

document), or opt to produce a simplified prospectus).

(5) ■ COLL 5 (Investment and borrowing powers) requires authorised

funds that are retail schemes, their authorised fund managers and

depositaries, to comply with rules on the investment composition of

the scheme. It is divided up as follows:

(a) ■ ■ COLL 5.2 to ■ COLL 5.3 implement the UCITS Directive

requirements which require quality, spread and counterparty

limits to be imposed on the assets of funds within the scope of

the Directive (as set out in ■ COLLG 2A.1.4 G);

(b) ■ COLL 5.4 provides rules on stock lending;

(c) ■ COLL 5.5 provides rules on holding cash and near cash,

borrowing and lending;

(d) ■ COLL 5.6 provides investment rules for non-UCITS retail schemes;

(e) ■ COLL 5.7 provides a regime for a non-UCITS retail scheme that is

to be operated as a fund of alternative investment funds (FAIF).

The authorised fund manager of such a fund must carry out

certain additional due diligence procedures in relation to the

funds in which the FAIF is to invest;

(f) ■ ■ COLL 5.8 sets out investment powers and limits for a UCITS

scheme that is to be operated as a feeder UCITS. It also sets out

what other provisions in ■ COLL 5 are applicable to a feeder

UCITS; and

(g) ■ COLL 5.9 specifies the permitted investments for a UCITS scheme

or a non-UCITS retail scheme operating as a money market fund

or a short-term money market fund. These restrictions reflect

CESR's guidelines on a common definition of European money

market funds.

COLLG 5A : The COLL Section 5A.1 : Introduction

sourcebook

5A

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLLG 5A/4

(6) ■ COLL 6 (Operating duties and responsibilities) contains rules on the

day-to-day operation of authorised funds that are retail schemes. In

particular:

(a) ■ COLL 6.2 sets out rules relating to dealing in units, including the

issue and cancellation of units;

(b) ■ COLL 6.3 sets out how authorised funds must be valued and

prices of units calculated and published;

(c) ■ COLL 6.4 provides requirements relating to the register of

Unitholders in an AUT (see the OEIC Regulations for ICVCs) and

any plan register;

(d) ■ COLL 6.5 sets out rules relating to the appointment and

replacement of the authorised fund manager and depositary;

(e) ■ COLL 6.6 imposes certain powers and duties on the authorised

fund manager and the depositary and ■ COLL 6.6A imposes certain

powers and duties on the authorised fund managers of UCITS

schemes and on a UK UCITS management company of an EEA

UCITS scheme;

(f) ■ COLL 6.7 lays down conditions concerning charges and expenses

that may be taken when investors buy or sell units, and what

payments may be made out of the scheme property;

(g) ■ COLL 6.8 provides rules and guidance on the calculation and

distribution of income;

(h) ■ COLL 6.9 gives guidance relating to independence of the

depositary and management company, scheme names and the

restrictions on the business of the UCITS;

(i) ■ COLL 6.10 sets out the oversight responsibilities of senior

personnel in relation to a UCITS scheme;

(j) ■ COLL 6.11 and ■ COLL 6.12 set out more detail about the risk

controls and risk management policy that must be employed in

relation to a UCITS scheme; and

(k) ■ COLL 6.13 sets out record-keeping requirements in relation to a

UCITS scheme.

(7) ■ COLL 7 (Suspension of dealings and termination of authorised funds)

includes the requirements for suspension of dealing in the units of

authorised funds and how they may be wound up (including

termination of sub-funds). ■ COLL 7.7 provides rules in relation to

mergers subject to the UCITS Directive.

(8) ■ COLL 8 (Qualified Investor Schemes) provides a framework of rules

for a scheme which restricts subscription to certain prescribed

categories of investor (principally professional clients and

sophisticated investors). For such a scheme, the FCA considers that not

all the detailed product rule protections that apply to retail schemes

are necessary. This type of scheme, called a qualified investor scheme,

satisfies the essential features of an authorised product and so

distinguishes itself from an unregulated collective investment scheme,

but otherwise is allowed more flexibility in its operation compared to

the framework for retail schemes. ■ COLL 2 (Authorised fund

applications) contains details of the application procedure for

qualified investor schemes.

COLLG 5A : The COLL Section 5A.1 : Introduction

sourcebook

5A

G5A.1.4

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLLG 5A/5

(9) ■ COLL 9 (Recognised Schemes) applies to collective investment

schemes established outside the United Kingdom. It brings together

the material relating to the admission to marketing of such schemes

in the United Kingdom, supplementing material in chapter V of Part

17of the Act (Recognised overseas schemes).

(10) ■ COLL 10 (Fees) is no longer used as the provisions are set out in FEES.

(11) ■ COLL 11 (Master-feeder arrangements under the UCITS Directive) sets

out various Directive requirements applicable to feeder UCITS and

master UCITS, including the arrangements for co-ordination and

information-sharing between the UCITS management companies,

depositaries and auditors of each scheme.

(12) ■ COLL 12 (Management company and product passports under the

UCITS Directive) provides more information about the rules that are

applicable to the use of the UCITS management company passport

and the UCITS product passport. It sets out which rules in COLL are

applicable to an EEA UCITS management company that wishes to

operate a UCITS scheme in the UK through the exercise of

passporting rights.

(13) ■ COLL 13 (Operation of a feeder NURS) sets out requirements relating

to the operation of a feeder NURS and certain types of qualifying

master scheme. Such operational obligations concern, for example,

information which is to be obtained and/or provided pre-investment,

and the treatment of a charge made to a feeder NURS for acquisition

or disposal of units in a qualifying master scheme.

Related Sourcebooks

.....................................................................................................

(1) There are a number of other parts of the Handbook that are

particularly relevant to those having a responsibility in relation to

authorised funds. These include:

(a) PRIN (The Principles for Businesses);

(b) SYSC (Senior Management Arrangements, Systems and Controls);

(c) APER (The Statements of Principle and Code of Practice for

Approved Persons);

(d) FEES (the Fees manual), which includes details of the application

and periodic fees payable for authorised funds and recognised

schemes;

(e) COBS (the Conduct of Business sourcebook);

(f) CASS (the Client Assets sourcebook);

(g) SUP (the Supervision manual);

(h) DEPP (the Decision Procedure and Penalties manual);

(i) DISP (Dispute resolution: complaints); and

(j) COMP (Compensation).

(2) UPRU (the Prudential sourcebook for UCITS firms) sets out the

financial resources requirements for an authorised fund manager of a

UCITS scheme where that manager is undertaking only scheme

management activity. BIPRU (the Prudential sourcebook for Banks,

COLLG 5A : The COLL Section 5A.1 : Introduction

sourcebook

5A

G5A.1.5

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLLG 5A/6

Building Societies and Investment Firms) applies certain requirements

to the authorised fund manager of a UCITS scheme where that

manager is a UCITS investment firm. Both sourcebooks include certain

requirements of the UCITS Directive.

(3) IPRU(INV) (the Interim Prudential sourcebook for Investment

Businesses) sets out the financial resources requirements for an

authorised fund manager of a qualified investor scheme or a non-

UCITS retail scheme, unless the authorised fund manager is a BIPRU

investment firm, in which case BIPRU (the Prudential sourcebook for

Banks, Building Societies and Investment Firms) sets out the financial

resources requirements.

(4) In addition to the listed sourcebooks, Regulatory Guides may also be

of relevance. For example ■ EG link 14 (Collective Investment Schemes)

sets out the FCA's policies and procedures concerning the use of its

enforcement powers in relation to regulated collective investment

schemes.

Regulated schemes: explanatory diagram

.....................................................................................................

This diagram provides a general description of the products covered by COLL

and the relevant legislation and sections of COLL.