Collective Investment

Schemes

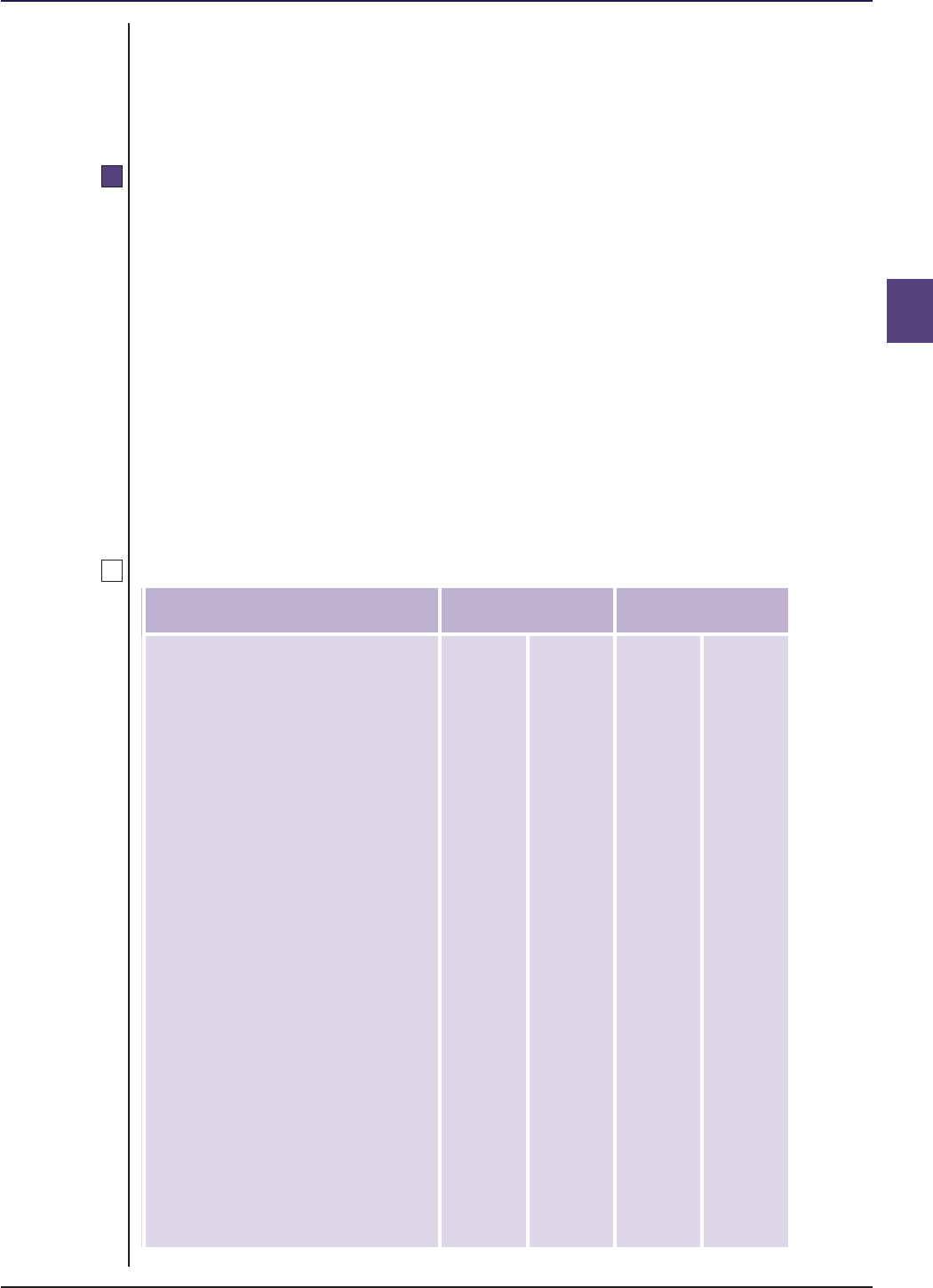

COLL Contents

Collective Investment Schemes

COLL 1 Introduction

1.1 Applications and purpose

1.2 Types of authorised fund

COLL 2 Authorised fund applications

2.1 Authorised fund applications

COLL 3 Constitution

3.1 Introduction

3.2 The instrument constituting the fund

3.3 Units

COLL 4 Investor Relations

4.1 Introduction

4.2 Pre-sale notifications

4.3 Approvals and notifications

4.4 Meetings of Unitholders and service of notices

4.5 Reports and accounts

4.6 Simplified Prospectus provisions [deleted]

4.7 Key investor information and marketing communications

4.8 Notifications for UCITS master-feeder arrangements

4 Annex 1 Total expense ratio calculation [deleted]

4 Annex 2 Portfolio turnover calculation [deleted]

COLL 5 Investment and borrowing powers

5.1 Introduction

5.2 General investment powers and limits for UCITS schemes

5.3 Derivative exposure

5.4 Stock lending

5.5 Cash, borrowing, lending and other provisions

5.6 Investment powers and borrowing limits for non-UCITS retail schemes

5.7 Investment powers and borrowing limits for NURS operating as FAIFs

5.8 Investment powers and borrowing limits for feeder UCITS

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL–i

COLL Contents

COLL 6 Operating duties and responsibilities

6.1 Introduction and Application

6.2 Dealing

6.3 Valuation and pricing

6.4 Title and registers

6.5 Appointment and replacement of the authorised fund manager and the

depositary

6.6 Powers and duties of the scheme, the authorised fund manager, and the

depositary

6.6A Duties of AFMs in relation to UCITS schemes

6.6B UCITS depositaries

6.7 Payments

6.8 Income: accounting, allocation and distribution

6.9 Independence, names and UCITS business restrictions

6.10 Senior personnel responsibilities

6.11 Risk control and internal reporting

6.12 Risk management policy and risk measurement

6.13 Record keeping

6 Annex 2 UK UCITS management company of UCITS schemes: Derivative Use

Report (FSA042: UCITS)

6 Annex 3 Guidance notes on UK UCITS management company of UCITS schemes:

Derivative Use Report (FSA042: UCITS)

COLL 7 Suspension of dealings, termination of authorised funds and side

pockets

7.1 Introduction

7.2 Suspension and restart of dealings

7.3 Winding up a solvent ICVC and terminating or winding up a sub-fund of

an ICVC

7.4 Winding up an AUT and terminating a sub-fund of an AUT

7.4A Winding up a solvent ACS and terminating a sub-fund of a co-ownership

scheme

7.5 Schemes or sub-funds that are not commercially viable

7.6 Schemes of arrangement

7.7 UCITS mergers

7.8 Side pockets

7 Annex 1 Matters to be considered by the authorised fund manager before

creating a side pocket class

COLL 8 Qualified investor schemes

8.1 Introduction

8.2 Constitution

8.3 Investor relations

8.4 Investment and borrowing powers

8.5 Powers and responsibilities

8.6 Termination, suspension, and schemes of arrangement

8 Annex 2 ACS Qualified Investor Schemes: eligible investors

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL–ii

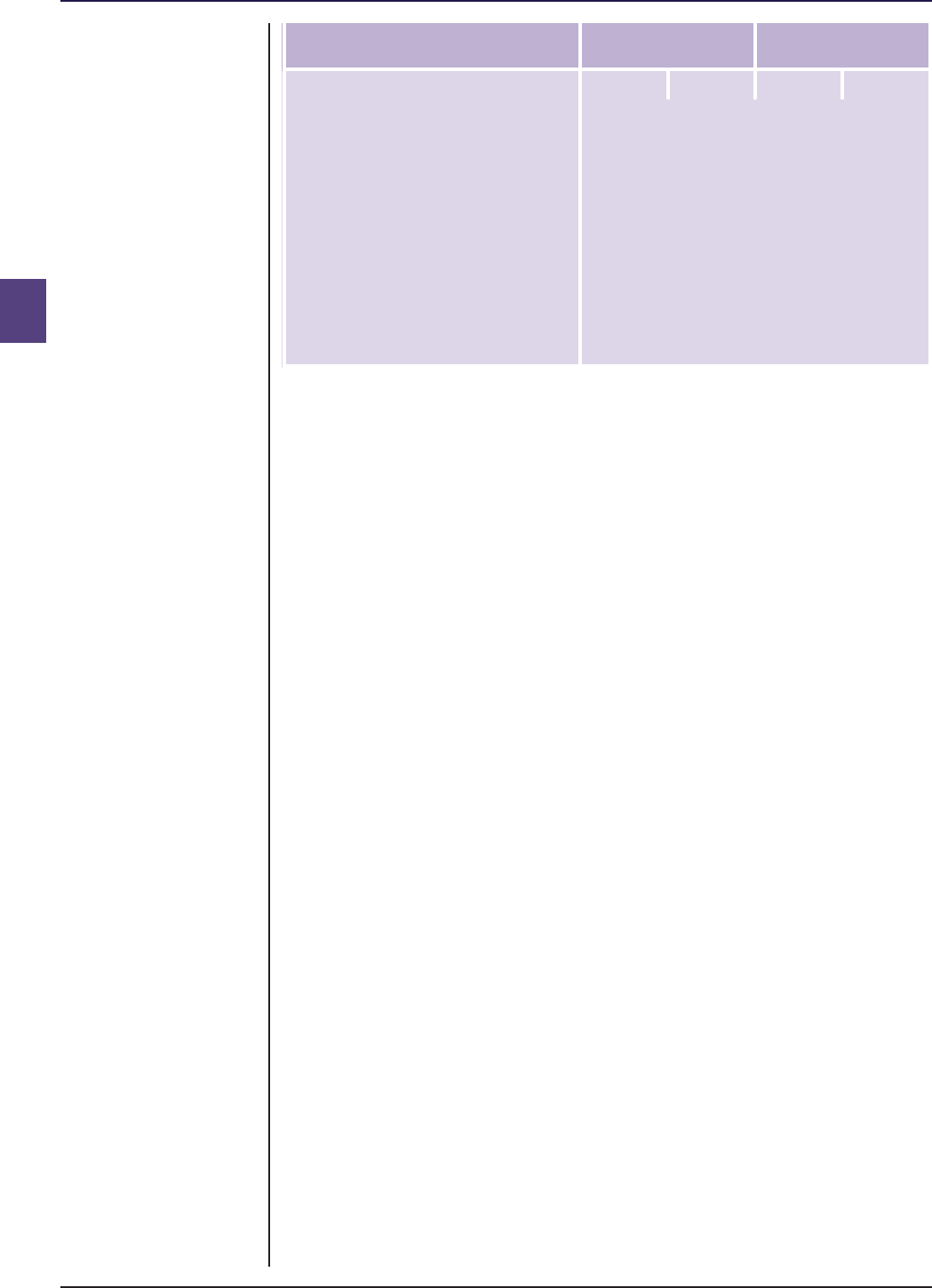

COLL Contents

COLL 9 Recognised schemes

9.1 Application and general information

9.3 Section 272 recognised schemes

9.4 Facilities in the United Kingdom for schemes recognised under section

272 of the Act

9.5 OFR recognised schemes

COLL 10 Fees

COLL 11 Master-feeder arrangements for UCITS schemes

11.1 Introduction

11.2 Approval of a feeder UCITS

11.3 Co-ordination and information exchange for master and feeder UCITS

11.4 Depositaries

11.5 Auditors

11.6 Winding up, merger and division of master UCITS

11 Annex 1 Contents of the standard master-feeder agreement

11 Annex 2 Contents of the internal conduct of business rules

COLL 12 Management company and product passports under the UCITS

Directive [deleted]

COLL 13 Operation of feeder NURS

13.1 Introduction

13.2 Operational requirements for feeder NURS

COLL 14 Charity authorised investment funds

14.1 Introduction

14.2 Registration with the Charity Commission

14.3 Advisory committee

14.4 Income allocation and distribution

COLL 15 Long-term asset funds

15.1 Introduction

15.2 Eligibility to act as the authorised fund manager

15.3 Constitution

15.4 Prospectus and other pre-sale notifications

15.5 Annual report and investor relations

15.6 Investment and borrowing powers

15.7 Powers and responsibilities of the authorised fund manager and the

depositary

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL–iii

COLL Contents

15.8 Valuation, pricing, dealing and income

15.9 Operational requirements for feeder LTAFs

15.10 Termination, suspension, and schemes of arrangement

15 Annex 1 ACS Long-term asset funds: Eligible investors

COLL

Appendix KII Regulation

Appendix 1UK

KII Regulation

COLL

Appendix 2 Modifications to the KII Regulation for KII-compliant NURS

Appendix 2 Modifications to the KII Regulation for KII-compliant NURS

Transitional provisions and Schedules

TP 1 Transitional Provisions

Sch 1 Record keeping requirements

Sch 2 Notification requirements

Sch 3 Fees and other required payments

Sch 4 Powers exercised

Sch 5 Rights of action for damages

Sch 6 Rules that can be waived

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL–iv

COLL Contents

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL–v

Collective Investment Schemes

Chapter 1

Introduction

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 1/1

COLL 1 : Introduction Section 1.1

1

G1.1.1

R1.1.1A

R1.1.1B

G1.1.1C

G1.1.2

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 1/2

1.1 Applications and purpose

Application

.....................................................................................................

(1) This sourcebook, except for ■ COLL 9 (Recognised schemes), applies to:

(a) investment companies with variable capital (ICVCs);

(b) ACDs, other directors and depositaries of ICVCs;

(c) managers and trustees of authorised unit trust schemes (AUTs);

and

(cA) authorised fund managers, depositaries and nominated partners

of authorised contractual schemes (ACSs).

(d) [deleted]

(2) ■ COLL 9 applies to operators of schemes that are recognised schemes

and to those seeking to secure recognised status for such schemes.

(3) ■ COLL 11.5 (Auditors) also applies to auditors of master UCITS and

feeder UCITS which are UCITS schemes.

(4) [deleted]

(5) ■ COLL TP 1.1(48) contains transitional provisions that apply in relation

to any scheme that will need to become a regulated money market

fund in accordance with the Money Market Funds Regulation, and

which operates as a scheme prior to 21 July 2018.

[deleted]

[deleted]

[deleted]

Purpose

.....................................................................................................

(1) The general purpose of this sourcebook is to contribute to the FCA

meeting its statutory objectives of the protection of consumers. It

provides a regime of product regulation for authorised funds, which

sets appropriate standards of protection for investors by specifying a

number of features of those products and how they are to be

operated.

COLL 1 : Introduction Section 1.1

1

G1.1.2A

G1.1.3

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 1/3

(2) In addition, this sourcebook implemented part of the requirements of

the UCITS Directive relevant to authorised funds and management

companies, along with other requirements implemented in other

parts of the Handbook.

UCITS management company and product passport

.....................................................................................................

[deleted]

The Collective Investment Schemes Information Guide

.....................................................................................................

The Collective Investment Schemes Information Guide COLLG provides some

general background material on the regulatory structure surrounding

scheme regulation in the UK.

COLL 1 : Introduction Section 1.2 : Types of authorised fund

1

R1.2.1

G1.2.1A

G1.2.2

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 1/4

1.2 Types of authorised fund

Types of authorised fund

.....................................................................................................

An application for an authorisation order must propose that the scheme be

one of the following types:

(1) a UCITS scheme;

(2) a non-UCITS retail scheme, including:

(a) a non-UCITS retail scheme operating as a fund of alternative

investment funds (FAIF); and

(b) a non-UCITS retail scheme which is an umbrella with sub-funds

operating as:

(i) FAIFs;

(ii) standard non-UCITS retail schemes; or

(iii) a mixture of (i) and (ii);

(3) a qualified investor scheme; or

(4) a long-term asset fund.

Umbrella schemes

.....................................................................................................

Any authorised fund, except for an ACS that is a limited partnership scheme,

may be structured as an umbrella with separate sub-funds.

[Note: article 1(2) second paragraph of the UCITS Directive]

Types of authorised fund - explanation

.....................................................................................................

(1) UCITS schemes must in particular comply with:

(a) ■ COLL 3.2.8 R (UCITS obligations); and

(b) the investment and borrowing powers rules for UCITS schemes set

out in ■ COLL 5.2 to ■ COLL 5.5 .

(2) (a) Non-UCITS retail schemes are schemes that do not comply with all

the conditions necessary to be a UCITS scheme.

(b) A non-UCITS retail scheme is an AIF and must be managed by an

AIFM.

(c) The UK may, under the legislation which implemented article 43

of AIFMD, impose stricter requirements on

COLL 1 : Introduction Section 1.2 : Types of authorised fund

1

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 1/5

an AIFM or an AIF marketed to retail clients than the

requirements that apply to an AIF marketed only to professional

clients.

(d) This sourcebook contains the stricter requirements for an AIF

which is a non-UCITS retail scheme.

(e) A full-scope UK AIFM must also comply with the requirements in

FUND and any other applicable provisions of AIFMD.

(f) Non-UCITS retail schemes could become UCITS schemes, provided

they are changed, so as to comply with the necessary conditions.

(g) Non-UCITS retail schemes operating as FAIFs have wider powers

to invest in collective investment schemes than other non-UCITS

retail schemes.

(2A) A non-UCITS retail scheme may also be structured as an umbrella with

sub-funds operating as:

(a) FAIFs;

(b) standard non-UCITS retail schemes; or

(c) a mixture of (a) and (b).

In these cases, rules relating to investment powers and

borrowing limits apply to each sub-fund as they would to a

scheme.

(3) (a) Qualified investor schemes may be promoted only to:

(i) professional clients; and

(ii) retail clients who are sophisticated investors,

on the same terms as non-mainstream pooled investments (see

■ COBS 4.12B (Promotion of non-mass market investments)).

(b) A qualified investor scheme is an AIF and must be managed by an

AIFM.

(c) [deleted]

(d) This sourcebook contains the stricter requirements for an AIF

which is a qualified investor scheme.

(e) A full-scope UK AIFM must also comply with the requirements in

FUND and any other applicable provisions of AIFMD.

(f) Qualified investor schemes could change to become non-UCITS

retail schemes or UCITS schemes.

(3A) (a) A long-term asset fund may be promoted only to:

(i) professional clients; and

(ii) retail clients who are sophisticated investors, certified high

net worth investors, and those other retail clients to whom

units in long-term asset funds can be promoted without

contravening the rules in ■ COBS 4.12A (Promotion of

restricted mass market investments).

(b) A long-term asset fund is an AIF and must be managed by a full-

scope UK AIFM (see ■ COLL 15.2.2R (Authorised fund manager to

be a full-scope UK AIFM)).

COLL 1 : Introduction Section 1.2 : Types of authorised fund

1

R1.2.3

R1.2.4

G1.2.5

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 1/6

(c) Under the Act and the UK AIFM regime, the FCA is able to

impose stricter requirements on an AIFM or an AIF marketed to

retail clients than the requirements that apply to an AIF

marketed only to professional clients. This sourcebook contains

stricter requirements for an AIF which is a long-term asset fund.

(d) A full-scope UK AIFM must also comply with the requirements in

FUND and any other applicable provisions of the UK AIFM

regime.

(e) A long-term asset fund could change to become a qualified

investor scheme, a non-UCITS retail scheme or a UCITS scheme,

provided it complies with the necessary conditions. The

authorised fund manager of an LTAF may need to make

significant changes to the LTAF’s constitution, objectives and

investment powers for it to become a UCITS scheme or a non-

UCITS retail scheme.

(f) A qualified investor scheme could become authorised as a long-

term asset fund if the authorised fund manager operates, or

proposes to operate, the scheme in accordance with the rules in

■ COLL 15 (Long-term asset funds).

(g) The nature of the assets that are held (or expected to be held) by

a long-term asset fund means that it will not be able to seek

authorisation as a regulated money market fund, or to have the

characteristics of such a fund without significant changes to its

constitution, objectives and investment powers. See also article 6

of the Money Market Funds Regulation.

(4) The changes referred to in (2), (3) and (3A) require approval by the

FCA.

UCITS schemes

.....................................................................................................

A UCITS scheme is deemed to be established in the United Kingdom,

irrespective of whether it has been established under the laws of England

and Wales, Scotland or Northern Ireland.

[Note: article 4 of the UCITS Directive]

Master UCITS

.....................................................................................................

A master UCITS that has two or more feeder UCITS as its only unitholders

satisfies the requirement that a UCITS scheme must invest capital raised from

the public.

[Note: article 58(4) of the UCITS Directive]

Pension feeder funds

.....................................................................................................

(1) Except for (2), all provisions of the Handbook that apply:

(a) to a feeder UCITS are also applicable to a pension feeder fund

that is constituted as a UCITS scheme; and

COLL 1 : Introduction Section 1.2 : Types of authorised fund

1

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 1/7

(b) to a feeder NURS are also applicable to a pension feeder fund

that is constituted as a non-UCITS retail scheme.

(2) A pension feeder fund may not invest in units of an EEA UCITS

scheme unless that scheme is a recognised scheme (see ■ COLL 5.6.27R

and ■ COLL 5.8.2AR).

COLL 1 : Introduction Section 1.2 : Types of authorised fund

1

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 1/8

Collective Investment Schemes

Chapter 2

Authorised fund applications

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 2/1

COLL 2 : Authorised fund Section 2.1 : Authorised fund applications

applications

2

R2.1.1

G2.1.2

G2.1.3

D2.1.4

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 2/2

2.1 Authorised fund applications

Application

.....................................................................................................

This chapter applies to any person seeking to arrange for the authorisation

of a scheme.

Purpose

.....................................................................................................

This chapter helps in achieving the statutory objectives of protecting

consumers by ensuring that any application for authorisation of a fund

meets certain standards.

Explanation

.....................................................................................................

(1) This chapter sets out the requirements that a person must follow in

applying for an authorisation order for a scheme under regulation 12

of the OEIC Regulations (Applications for authorisation), section 242

of the Act (Applications for authorisation of unit trust schemes) or

section 261C of the Act (Applications for authorisation of contractual

schemes).

(2) ■ COLLG 3A (The FCA’s responsibilities under the Act) and ■ COLLG 4A

(The FCA’s responsibilities under the OEIC Regulations) provide more

information on what the Act and the OEIC Regulations require in

relation to ongoing notifications to the FCA.

Specific requirements on application

.....................................................................................................

An application for an authorisation order in respect of an authorised fund

must be:

(1) in writing in the manner directed and contain the information

required in the application form available from the FCA;

(2) addressed for the attention of a member of FCA staff responsible for

collective investment scheme authorisation matters; and

(3) delivered to the FCA'saddress by one of the following methods:

(a) posting; or

(b) leaving it at the FCA's address and obtaining a time-stamped

receipt; or

(c) delivery by hand to a member of FCA staff responsible for

collective investment scheme authorisation matters.

COLL 2 : Authorised fund Section 2.1 : Authorised fund applications

applications

2

G2.1.5

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 2/3

[deleted]

COLL 2 : Authorised fund Section 2.1 : Authorised fund applications

applications

2

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 2/4

Collective Investment Schemes

Chapter 3

Constitution

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 3/1

COLL 3 : Constitution Section 3.1 : Introduction

3

R3.1.1

G3.1.2

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 3/2

3.1 Introduction

Application

.....................................................................................................

This chapter applies to:

(1) an authorised fund manager of an AUT, ACS or an ICVC;

(2) any other director of an ICVC;

(3) a depositary of an AUT, ACS or an ICVC; and

(4) an ICVC,

where the AUT, ACS or ICVC is a UCITS scheme or a non-UCITS retail scheme.

Purpose

.....................................................................................................

This chapter assists in achieving the statutory objective of protecting

consumers. In particular:

(1) ■ COLL 3.2 (The instrument constituting the fund) contains

requirements about provisions which must be included in the

instrument constituting the fund to give a similar degree of

protection for investors in an ICVC, AUT or ACS; and

(2) ■ COLL 3.3 (Units) provides rules and guidance which deal with the

classes of units to ensure that investors in each class are treated

equally.

COLL 3 : Constitution Section 3.2 : The instrument constituting the

fund

3

R3.2.1

R3.2.2

R3.2.3

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 3/3

3.2 The instrument constituting the

fund

Application

.....................................................................................................

This section applies to:

(1) an authorised fund manager of an AUT, ACS or ICVC;

(2) any other director of an ICVC;

(3) a depositary of an AUT, ACS or an ICVC;

(4) an ICVC; and

(5) a nominated partner;

except ■ COLL 3.2.8 R(UCITS obligations), which applies only to an ICVC or to

the authorised fund manager of an AUT or ACS where the ICVC, AUT or ACS

is a UCITS scheme.

Relationship between the instrument constituting the fund and

the rules

.....................................................................................................

(1) The instrument constituting the fund must not contain any provision

that:

(a) conflicts with any applicable rule;

(b) prevents units in the scheme being marketed in the United

Kingdom; or

(c) is unfairly prejudicial to the interests of unitholders generally or

to the unitholders of any class of units.

(2) Any power conferred by the rules on the ICVC, the authorised fund

manager, any other director of the ICVC, or the depositary, whether

in a sole or joint capacity, is subject to any restriction in the

instrument constituting the fund.

The trust deed for AUTs

.....................................................................................................

An AUT must be constituted by a trust deed made between the manager

and the trustee.

COLL 3 : Constitution Section 3.2 : The instrument constituting the

fund

3

R3.2.3A

R3.2.4

G3.2.5

R3.2.6

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 3/4

The contractual scheme deed for ACSs

.....................................................................................................

An ACS must be constituted by a contractual scheme deed made between

the authorised contractual scheme manager and:

(1) the depositary, in the case of a co-ownership scheme; or

(2) the nominated partner, in the case of a limited partnership scheme.

Matters which must be included in the instrument constituting

the fund

.....................................................................................................

The statements and provisions required by ■ COLL 3.2.6 R (Table: contents of

the instrument constituting the fund) must be included in the instrument

constituting the fund, where appropriate.

The instrument constituting the fund: OEIC Regulations,

Contractual Scheme Regulations and trust law requirements

.....................................................................................................

(1) Several of the matters set out in ■ COLL 3.2.6 R are required to be

included in the instrument constituting the fund under the OEIC

Regulations, Contractual Scheme Regulations or as a consequence of

relevant trust law. In addition, further statements are required if the

scheme or the authorised fund manager are to take advantage of the

powers under the rules in this sourcebook.

(2) Additional matters which are not contained in ■ COLL 3.2.6 R may be

required to be included in the instrument constituting the fund in

order to comply with the OEIC Regulations, (particularly Schedule 2 -

Instrument of Incorporation), Contractual Scheme Regulations and for

the purposes of making the scheme eligible under relevant tax,

pensions, or charities legislation.

Table: contents of the instrument constituting the fund

.....................................................................................................

This table belongs to ■ COLL 3.2.4 R (Matters which must be included in the

instrument constituting the fund).

Name of scheme

1 A statement of:

(1) the name of the authorised fund; and

(2) whether the authorised fund is a UCITS scheme or a non-UC-

ITS retail scheme.

Investment powers in eligible markets

2 A statement that, subject to any restriction in the rules in this

sourcebook or the instrument constituting the fund, the scheme

has the power to invest in any eligible securities market or deal on

any eligible derivatives market to the extent that power to do so is

conferred by COLL 5 (Investment and borrowing powers).

Unitholder's liability to pay

3 A provision that a unitholder in an AUT, ICVC or co-ownership

scheme is not liable to make any further payment after he has

paid the price of his units and that no further liability can be im-

posed on him in respect of the units which he holds.

COLL 3 : Constitution Section 3.2 : The instrument constituting the

fund

3

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 3/5

3A A provision that a unitholder in a limited partnership scheme is

not liable for the debts or obligations of the limited partnership

scheme beyond the amount of the scheme property which is avail-

able to the authorised contractual scheme manager to meet such

debts or obligations, provided that the unitholder does not take

part in the management of the partnership business.

3B A provision that the exercise of rights conferred on limited part-

ners by FCA rules does not constitute taking part in the manage-

ment of the partnership business.

Base currency

4 A statement of the base currency of the scheme.

Valuation and pricing

5 A statement setting out the basis for the valuation and pricing of

the scheme.

Duration of the scheme

6 If the scheme is to be wound up after a particular period expires, a

statement to that effect.

Object of the scheme

7 A statement:

(1) as to the object of the scheme, in particular the types of in-

vestments and assets in which it and each sub-fund (where

applicable) may invest; and

(2) that the object of the scheme is to invest in property of

that kind with the aim of spreading investment risk and giv-

ing unitholders the benefits of the results of the manage-

ment of that property.

7A Where the authorised fund is a qualifying money market fund, a

statement to that effect and a statement that the authorised

fund's investment objectives and policies will meet the conditions

specified in the definition of qualifying money market fund.

[deleted]

Government and public securities: investment in one issuer

8 Where relevant, for a UCITS scheme, a statement in accordance

with COLL 5.2.12 R (Spread: government and public securities) with

the names of the individual states, local authorities or public inter-

national bodies issuing or guaranteeing the transferable securities

or approved money-market instruments in which more than 35%

in value of the scheme property may be invested.

Classes of unit

9 A statement:

(1) specifying the classes of unit that may be issued, and for a

scheme which is an umbrella, the classes that may be issued

in respect of each sub-fund; and

(2) if the rights of any class of unit differ, a statement describ-

ing those differences in relation to the differing classes.

Authorised fund manager's charges and expenses

10 A statement setting out the basis on which the authorised fund

manager may make a charge and recover expenses out of the

scheme property.

Issue or cancellation directly through the ICVC or depositary of an

AUT or ACS

COLL 3 : Constitution Section 3.2 : The instrument constituting the

fund

3

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 3/6

11 Where relevant, a statement authorising the issue or cancellation

of units to take place through the ICVC or depositary of an AUT or

ACS directly.

In specie issue and cancellation

12 Where relevant, a statement authorising payment for the issue or

cancellation of units to be made by the transfer of assets other

than cash.

Restrictions on sale and redemption

13 Where relevant, the restrictions which will apply in relation to the

sale and redemption of units under COLL 6.2.16 R (Sale and re-

demption).

Voting at meetings

14 The manner in which votes may be given at a meeting of unithold-

ers under COLL 4.4.8 R (Voting rights).

Certificates

15 A statement authorising the person responsible for the register to

charge for issuing any document recording, or for amending, an

entry on the register, other than on the issue or sale of units.

Income

16 A statement setting out the basis for the distribution or re-invest-

ment of income.

Income equalisation

17 Where relevant, a provision for income equalisation.

Redemption or cancellation of units on breach of law or rules

18 A statement that where any holding of units by a unitholder is (or

is reasonably considered by the authorised fund manager to be) an

infringement of any law, governmental regulation or rule, those

units must be redeemed or cancelled.

ICVCs: larger and smaller denomination shares

19 A statement of the proportion of a larger denomination share rep-

resented by a smaller denomination share for any relevant unit

class.

ICVCs: resolution to remove a director

20 A statement that the ICVC may (without prejudice to the require-

ments of regulation 21 of the OEIC Regulations (The Authority's ap-

proval for certain changes in respect of a company), by a resolu-

tion passed by a simple majority of the votes validly cast for and

against the resolution at a general meeting of unitholders, remove

a director before his period of office expires, despite anything else

in the ICVC's instrument of incorporation or in any agreement be-

tween the ICVC and that director.

ICVCs: unit transfers

21 A statement that the person designated for the purposes of para-

graph 4 of Schedule 4 to the OEIC Regulations (Share transfers) is

the person who, for the time being, is the ACD of the ICVC.

ICVCs and ACSs: Charges and expenses

22 A statement that charges or expenses of the ICVCor ACS may be

taken out of the scheme property.

COLL 3 : Constitution Section 3.2 : The instrument constituting the

fund

3

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 3/7

ICVCs: Umbrella schemes - principle of limited recourse

22A For an ICVC which is an umbrella, a statement that the assets of a

sub-fund belong exclusively to that sub-fund and shall not be used

to discharge directly or indirectly the liabilities of, or claims

against, any other person or body, including the umbrella, or any

other sub-fund, and shall not be available for any such purpose.

Co-ownership schemes: umbrella schemes - principle of limited

recourse

22B For a co-ownership scheme which is an umbrella, a statement that

the property subject to a sub-fund is beneficially owned by the par-

ticipants in that sub-fund as tenants in common (or, in Scotland, is

the common property of the participants in that sub-fund) and

must not be used to discharge any liabilities of, or meet any claims

against, any person other than the participants in that sub-fund.

AUTs: governing law for a trust deed

23 A statement that the trust deed is made under and governed by

the law of England and Wales, Wales or Scotland or Northern

Ireland.

AUTs: trust deed to be binding and authoritative

24 A statement that the trust deed:

(1) is binding on each unitholder as if it had been a party to it

and that it is bound by its provisions; and

(2) authorises and requires the trustee and the manager to do

the things required or permitted of them by its terms.

AUTs: declaration of trust

25 A declaration that, subject to the provisions of the trust deed and

all rules made under section 247 of the Act (Trust scheme rules)

and for the time being in force:

(1) the scheme property (other than sums standing to the

credit of the distribution account) is held by the trustee on

trust for the unitholders according to the number of units

held by each unitholder or, where relevant, according to

the number of undivided shares in the scheme property rep-

resented by the units held by each unitholder; and

(2) the sums standing to the credit of the distribution account

are held by the trustee on trust to distribute or apply them

in accordance with COLL 6.8 (Income: accounting, allocation

and distribution).

AUTs: trustee's remuneration

26 Where relevant, a statement authorising payments to the trustee

by way of remuneration for its services to be paid (in whole or in

part) out of the scheme property.

AUTs: responsibility for the register

27 A statement identifying the person responsible under the rules for

the maintenance of the register.

ACSs: governing law for a contractual scheme deed

27A A statement that the contractual scheme deed is made under and

governed by the law of England and Wales, or Scotland or North-

ern Ireland.

ACSs: contractual scheme deed to be binding and authoritative

27B A statement that the contractual scheme deed:

(1) is binding on each unitholder as if it had been a party to it

and that it is bound by its provisions; and

COLL 3 : Constitution Section 3.2 : The instrument constituting the

fund

3

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 3/8

(2) authorises and requires the depositary and the authorised

contractual manager to do the things required or permitted

of them by its terms.

ACSs: ownership of scheme property

27C A statement that, subject to the provisions of the contractual

scheme deed and all rules made under section 261I of the Act (Con-

tractual scheme rules) and for the time being in force:

(1) the scheme property (other than sums standing to the

credit of the distribution account) is held by, or to the order

of, the depositary for and on behalf of the unitholders ac-

cording to the number of units held by each unitholder or,

where relevant, according to the number of undivided

shares in the scheme property represented by the units held

by each unitholder;

(2) the sums standing to the credit of the distribution account

are held by the depositary to distribute or apply them in ac-

cordance with COLL 6.8 (Income: accounting, allocation and

distribution); and

(3) the scheme property of a co-ownership scheme is benefi-

cially owned by the participants as tenants in common (or,

in Scotland, is the common property of the participants).

ACSs: responsibility for the register

27D A statement identifying the person responsible under the rules for

the maintenance of the register.

ACSs: UCITS and NURS eligible investors

27E For an ACS which is a UCITS scheme or a non-UCITS retail scheme,

a statement that units may not be issued to a person other than a:

(1) professional ACS investor;

(2) large ACS investor; or

(3) person who already holds units in the scheme.

27F A statement that the authorised contractual scheme manager must

redeem units as soon as practicable after becoming aware that

those units are vested in anyone (whether as a result of subscrip-

tion or transfer of units) other than a person meeting the criteria

in paragraph 27E.

ACSs: UCITS and NURS transfer of units

27G (1) A statement whether the transfer of units in the ACS

scheme is either:

(a) prohibited; or

(b) allowed

(2) Where transfer of units is allowed in accordance with (1)(b),

a statement that units may only be transferred in accord-

ance with the conditions specified by FCA rules, including

that units may not be transferred to a person other than a:

(a) professional ACS investor;

(b) large ACS investor; or

(c) person who already holds units in the scheme.

(3) For a co-ownership scheme which is an umbrella, a state-

ment in accordance with (1)(a) or (1)(b) and, where appro-

priate, a statement in accordance with (2), must also be

made for the sub-funds. Where individual sub-funds have

differing policies in relation to transfer of units, separate

statements are required.

COLL 3 : Constitution Section 3.2 : The instrument constituting the

fund

3

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 3/9

Co-ownership schemes: constitution

27H For a co-ownership scheme, a statement that the arrangements

constituting the scheme are intended to constitute a co-ownership

scheme as defined in section 235A(2) of the Act.

Co-ownership schemes: operator's powers

27I A statement that the operator of a co-ownership scheme is au-

thorised to:

(1) acquire, manage and dispose of the scheme property; and

(2) enter into contracts which are binding on unitholders for

the purposes of, or in connection with, the acquisition, man-

agement or disposal of scheme property.

Co-ownership schemes: winding-up

27J A statement that the operator and depositary of a co-ownership

scheme are required to wind up the scheme if directed to do so by

the FCA in exercise of its power under section 261X (Directions) or

section 261Z (Winding up or merger of master UCITS) of the Act.

Limited partnership schemes: participants

27K A statement that the limited partners, other than the nominated

partner, are to be the participants in the scheme.

Limited partnership schemes: resignation of limited partners

27L A statement that the scheme is not dissolved on any person ceas-

ing to be a limited partner or nominated partner provided that

there remains at least one limited partner.

Limited partnership schemes: inability to operate as an umbrella

27M A statement that the limited partnership scheme prohibits pooling

as is mentioned in section 235(3)(a) of the Act in relation to separ-

ate parts of the scheme property, with the effect that the scheme

cannot be an umbrella.

Investment in overseas property through an intermediate holding

vehicle

28 If investment in an overseas immovable is to be made through an

intermediate holding vehicle or a series of intermediate holding

vehicles, a statement that the purpose of that intermediate hold-

ing vehicle or series of intermediate holding vehicles will be to en-

able the holding of overseas immovables by the scheme.

Transfers to a dormant asset fund operator

29 (1) Where relevant, a statement that the authorised fund man-

ager and (if applicable) the depositary may transfer an eli-

gible CIS amount which is a dormant asset to a dormant as-

set fund operator, specifying the particular types of eligible

CIS amounts which may be so transferred.

(2) Where relevant, a statement detailing the power of the au-

thorised fund manager and (if applicable) the depositary to

convert one or more units into a right to payment of an

amount for transfer to a dormant asset fund operator, and

a description of a person’s right to make a repayment claim

in relation to the amount transferred.

(3) Where relevant, a statement that the authorised fund man-

ager and (if applicable) the depositary may transfer un-

wanted asset money to a dormant asset fund operator, and

a description of the circumstances in which such money

may be transferred.

[Note: In relation to transfers to a dormant asset fund oper-

ator, see COLL 3.2.6AR.]

COLL 3 : Constitution Section 3.2 : The instrument constituting the

fund

3

R3.2.6A

R3.2.7

R3.2.8

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 3/10

Transfers to a dormant asset fund operator

.....................................................................................................

If the authorised fund manager or (where relevant) the depositary intends to

make transfers of eligible CIS amounts that are dormant assets or unwanted

asset money to a dormant asset fund operator, or intends to take a power of

the type referred to in ■ COLL 3.2.6R(29)(2), the applicable statements in

■ COLL 3.2.6R(29)(1), ■ (2) and ■ (3) must be included.

[deleted]

UCITS obligations

.....................................................................................................

(1) The instrument constituting a UCITS scheme may not be amended in

such a way that it ceases to be a UCITS scheme.

(2) [deleted]

(3) [deleted]

COLL 3 : Constitution Section 3.3 : Units

3

R3.3.1

G3.3.2

G3.3.3

R3.3.4

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 3/11

3.3 Units

Application

.....................................................................................................

This section applies to an authorised fund manager, an ICVC and the

depositary of an AUT or ACS.

Classes of units

.....................................................................................................

(1) The instrument constituting the fund may provide for different classes

of unit to be issued in an authorised fund and, for a scheme which is

an umbrella, provide that classes of units may be issued for each sub-

fund.

(2) In order to be satisfied that ■ COLL 3.2.2 R (Relationship between the

Instrument constituting the fundand the rules) is complied with, the

FCA will take into account the principles in (a) to (c) when

considering proposals for unit classes:

(a) a unit class should not provide any advantage for that class if

that would result in prejudice to unitholders of any other class;

(b) the nature, operation and effect of the new unit class should be

capable of being explained clearly to prospective investors in the

prospectus; and

(c) the effect of the new unit class should not appear to be contrary

to the purpose of any part of this sourcebook.

Currency class units

.....................................................................................................

A currency class unit differs from other units mainly in that its price, having

been calculated initially in the base currency, will be quoted, and normally

paid for, in the currency of the designation of the class. Income distributions

will also be paid in the currency of designation of the class.

Currency class units: requirements

.....................................................................................................

For a currency class unit:

(1) the currency of the class concerned must not be the base currency (or,

in the case of a sub-fund which, in accordance with a statement in

the prospectus, is to be valued in some other currency, the currency of

the class may be in the base currency, but must not be in that other

currency);

(2) the price must be expressed in the currency of the class concerned;

COLL 3 : Constitution Section 3.3 : Units

3

R3.3.5

R3.3.5A

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 3/12

(3) any distribution must be paid in the currency of the class concerned;

and

(4) statements of amounts of money or values included in statements

and in tax certificates must be given in the currency of the class

concerned (whether or not also given in the base currency).

Rights of unit classes

.....................................................................................................

(1) If any class of units in an authorised fund has different rights from

another class of units in that fund, the instrument constituting the

fund must provide how the proportion of the value of the scheme

property and the proportion of income available for allocation

attributable to each such class must be calculated.

(2) For an authorised fund which is not an umbrella, the instrument

constituting the fund must not provide for any class of units in

respect of which:

(a) the extent of the rights to participate in the capital property,

income property or distribution account would be determined

differently from the extent of the corresponding rights for any

other class of units; or

(b) payments or accumulation of income or capital would differ in

source or form from those of any other class of units.

(3) For a scheme which is an umbrella, the provisions in (2)(a) apply to

classes of units in respect of each sub-fund as if each sub-fund were a

separate scheme.

(4) Paragraphs (2) and (3) do not prohibit a difference between the

rights attached to one class of units and to another class of units that

relates solely to:

(a) the accumulation of income by way of periodical credit to capital

rather than distribution; or

(b) charges and expenses that may be taken out of the scheme

property or payable by the unitholders; or

(c) the currency in which prices or values are expressed or payments

made; or

(d) the use of derivatives and forward transactions entered into for

the purpose of reducing the effect of fluctuations in the rate of

exchange between the currency of a class of units and either the

base currency of the scheme or any currency in which all or part

of the scheme property is denominated or valued (in this section

referred to as a " class hedging transaction").

Hedging of unit classes

.....................................................................................................

A class hedging transaction must:

(1) be undertaken in accordance with the requirements of ■ COLL 5

(Investment and borrowing powers); and

COLL 3 : Constitution Section 3.3 : Units

3

G3.3.5B

R3.3.6

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 3/13

(2) (for the purposes of valuing scheme property and calculating the

price of units in accordance with ■ COLL 6.3 (Valuation and pricing)) be

attributed only to the class of units for which it is undertaken.

Guidance on hedging of unit classes

.....................................................................................................

(1) Before undertaking a class hedging transaction for a class of units,

the authorised fund manager should:

(a) ensure that the relevant prospectus clearly:

(i) states that such a transaction may be undertaken for the

relevant class of units; and

(ii) explains the nature of the risks that such a transaction may

pose to investors in all classes;

(b) consult the depositary about the adequacy of the systems and

controls it uses to ensure compliance with ■ COLL 3.3.5A R

(Hedging of unit classes); and

(c) consult the scheme auditor and, where appropriate, depositary to

determine how:

(i) the transaction will be treated in the scheme's accounts; and

(ii) any consequential tax liability will be met;

(in each case) without prejudice to unitholders of classes other

than the relevant hedged class.

(2) Class hedging transactions should be entered into for the purpose of

reducing risk by limiting the effect of movements in exchange rates

on the value of a unit. Such transactions are not limited to currency

class units. The authorised fund manager should ensure that the total

value of the hedged position does not exceed the value of the

relevant class of units unless there is adequate cover and it is

reasonable for it to do so on a temporary basis for reasons of

efficiency (for example, to avoid the need to make small and

frequent adjusting transactions). In such cases, the difference

between the value of the hedged position and the value of the class

of units should not be so large as to be speculative or to constitute an

investment strategy.

Requirement: larger and smaller denomination shares in an

ICVC

.....................................................................................................

(1) This rule applies whenever the instrument of incorporation of an ICVC

provides, in relation to any class, for smaller denomination shares and

larger denomination shares.

(2) Whenever a registered holding includes a number of smaller

denomination shares that can be consolidated into a larger

denomination share of the same class, the ACD must consolidate the

relevant number of those smaller denomination shares into a larger

denomination share.

(3) The ACD may, to effect a transaction in shares, substitute for a larger

denomination share the relevant number of smaller denomination

shares, in which case (2) does not apply to the resulting smaller

COLL 3 : Constitution Section 3.3 : Units

3

G3.3.7

R3.3.8

R3.3.9

G3.3.10

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 3/14

denomination shareholding or holdings until immediately after the

completion of the transaction.

Characteristics of larger and smaller denomination shares in

an ICVC

.....................................................................................................

Regulation 45 of the OEIC Regulations (Shares) allows the rights attached to

a share in an ICVC of any class to be expressed in two denominations, in

which case the 'smaller' denomination must be such proportion of the

'larger' denomination (a standard share) as is fixed by the ICVC's instrument

of incorporation as described in ■ COLL 3.2.6R (19). This will enable holdings to

consist of more or less than a complete number of larger denomination

shares.

Sub-division and consolidation of units

.....................................................................................................

(1) The directors of an ICVC or the authorised fund manager of an AUT

or ACS may, unless expressly forbidden to do so by the instrument

constituting the fund, determine that:

(a) each unit of any class is to be subdivided into two or more units;

or

(b) units of any class are to be consolidated.

(2) The ICVC or theauthorised fund manager of an AUT or ACS must

(unless it has done so before the sub-division or consolidation became

effective) immediately give notice to each unitholder (or the first

named of joint unitholders) of any sub-division or consolidation

under (1).

Guarantees and capital protection

.....................................................................................................

If there is any arrangement intended to result in a particular capital or

income return from a holding of units in an authorised fund, or any

investment objective of giving protection to the capital value of, or income

return from, such a holding:

(1) that arrangement or protection must not be such as to cause the

possibility of a conflict of interest as between:

(a) unitholders and the authorised fund manager or depositary; or

(b) unitholders intended and not intended to benefit from the

arrangement; and

(2) where, in accordance with any statement required by

■ COLL 4.2.5R (27)(c)(iv) (Table: contents of the prospectus), action is

required by the unitholders to obtain the benefit of any guarantee,

the authorised fund manager must provide reasonable notice in

writing to unitholders before such action is required.

Switching rights: umbrella schemes

.....................................................................................................

(1) In accordance with section 235(4) of the Act (Collective investment

schemes), the participants in a scheme which is an umbrella are

entitled to exchange rights in one sub-fund for rights in another sub-

fund of the umbrella.

COLL 3 : Constitution Section 3.3 : Units

3

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 3/15

(2) To satisfy (1), where any sub-fund in a scheme which is an umbrella

has provisions in its prospectus limiting the issue of units in that sub-

fund, the authorised fund manager should ensure that at least two

sub-funds are able to issue units at any time. In the case of an

umbrella consisting of a single sub-fund that limits the issue of units,

where the ICVC or the authorised fund manager of an AUT or co-

ownership scheme of such an umbrella intends to offer additional

sub-funds, it should ensure that unitholders will have the right to

switch at all times between two or more sub-funds in that umbrella.

COLL 3 : Constitution Section 3.3 : Units

3

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 3/16

Collective Investment Schemes

Chapter 4

Investor Relations

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 4/1

COLL 4 : Investor Relations Section 4.1 : Introduction

4

R4.1.1

G4.1.2

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 4/2

4.1 Introduction

Application

.....................................................................................................

This chapter applies to:

(1) an authorised fund manager of an AUT, ACS or an ICVC;

(2) any other director of an ICVC;

(3) a depositary of an AUT, ACS or an ICVC; and

(4) an ICVC,

where such AUT, ACS or ICVC is a UCITS scheme or a non-UCITS retail scheme.

Purpose

.....................................................................................................

This chapter helps in achieving the statutory objective of protecting

consumers by ensuring consumers have access to up-to-date detailed

information about an authorised fund particularly before buying units and

thereafter an appropriate level of investor involvement exists by providing a

framework for them to:

(1) participate in the decisions on key issues concerning the authorised

fund; and

(2) be sent regular and relevant information about the authorised fund.

COLL 4 : Investor Relations Section 4.2 : Pre-sale notifications

4

R4.2.1

R4.2.2

R4.2.3

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 4/3

4.2 Pre-sale notifications

Application

.....................................................................................................

This section applies to an authorised fund manager, an ICVC and any other

director of an ICVC

Publishing the prospectus

.....................................................................................................

(1) A prospectus must be drawn up in English and published as a

document by the authorised fund manager and, for an ICVC, it must

be approved by the directors.

(2) The authorised fund manager must ensure that the prospectus:

(a) contains the information required by ■ COLL 4.2.5 R (Table:

contents of the prospectus);

(aa) for a non-UCITS retail scheme managed by a full-scope UK AIFM,

contains the information required by:

(i) ■ FUND 3.2.2R and ■ FUND 3.2.3R (Prior disclosure of

information to investors); and

(ii) ■ FUND 3.2.5R and ■ FUND 3.2.6R (Periodic disclosure), unless

the up-to-date information has been published in the

scheme’s most recent annual report or half-yearly report;

(b) does not contain any provision which is unfairly prejudicial to the

interests of unitholders generally or to the unitholders of any

class of units;

(c) does not contain any provision that conflicts with any applicable

rule; and

(d) is kept up-to-date and that revisions are made to it, whenever

appropriate.

Provision and filing of the prospectus

.....................................................................................................

(1) The authorised fund manager of an AUT, ACS or an ICVC must:

(a) provide a copy of the scheme's most recent prospectus drawn up

and published in accordance with ■ COLL 4.2.2 R (Publishing the

prospectus) free of charge to any person on request; and

(b) file a copy of the scheme's original prospectus, together with all

revisions thereto, with the FCA.

(1A) Except where an investor requests a paper copy or the use of

electronic communications is not appropriate, the prospectus may be

COLL 4 : Investor Relations Section 4.2 : Pre-sale notifications

4

R4.2.3A

R4.2.3B

R4.2.4

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 4/4

provided in a durable medium or by means of a website that meets

the website conditions.

(2) [deleted]

(3) An authorised fund manager must, upon the request of a unitholder

in a UCITS scheme that it manages, provide information

supplementary to the prospectus of that scheme relating to:

(a) the quantitative limits applying to the risk management of that

scheme;

(b) the methods used in relation to (a); and

(c) any recent development of the risk and yields of the main

categories of investment.

[Note: articles 74, 75(1) and 75(2) of the UCITS Directive]

Provision and filing of the prospectus of a master UCITS

.....................................................................................................

(1) The authorised fund manager of a UCITS scheme that is a feeder

UCITS must:

(a) where requested by an investor, provide a copy of the prospectus

of its master UCITS free of charge; and

(b) file a copy of the prospectus of its master UCITS and any

amendments thereto with the FCA.

(2) Except where an investor requests a paper copy or the use of

electronic communications is not appropriate, the prospectus of the

master UCITS may be provided in a durable medium other than paper

or by means of a website that meets the website conditions.

[Note: articles 63(3), 63(5), 75(1) and 75(2) of the UCITS Directive]

Feeder NURS: provision of the prospectus of the qualifying

master scheme

.....................................................................................................

(1) The authorised fund manager of a feeder NURS must, where

requested by an investor or the FCA , provide such person with a copy

of the prospectus of its qualifying master scheme free of charge.

(2) Except where an investor requests a paper copy or the use of

electronic communications is not appropriate, the prospectus of the

qualifying master scheme may be provided in a durable medium

other than paper, or by means of a website that meets the website

conditions.

False or misleading prospectus

.....................................................................................................

(1) The authorised fund manager:

(a) must ensure that the prospectus of the authorised fund does not

contain any untrue or misleading statement or omit any matter

required by the rules in this sourcebook to be included in it; and

COLL 4 : Investor Relations Section 4.2 : Pre-sale notifications

4

R4.2.5

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 4/5

(b) is liable to pay compensation to any person who has acquired any

units in the authorised fund and suffered loss in respect of them

as a result of such statement or omission; this is in addition to

any liability incurred apart from under this rule.

(2) The authorised fund manager is not in breach of (1)(a) and is not

liable to pay compensation under (1)(b) if, at the time when the

prospectus was made available to the public, it had taken reasonable

care to determine that the statement was true and not misleading, or

that the omission was appropriate, and that:

(a) it continued to take such reasonable care until the time of the

relevant acquisition of units in the scheme; or

(b) the acquisition took place before it was reasonably practicable to

bring a correction to the attention of potential purchasers; or

(c) it had already taken all reasonable steps to ensure that a

correction was brought to the attention of potential purchasers;

or

(d) the person who acquired the units was not materially influenced

or affected by that statement or omission in making the decision

to invest.

(3) The authorised fund manager is also not in breach of (1)(a) and is not

liable to pay compensation under (1)(b) if:

(a) before the acquisition a correction had been published in a

manner calculated to bring it to the attention of persons likely to

acquire the units in question; or

(b) it took all reasonable steps to secure such publication and had

reasonable grounds to conclude that publication had taken place

before the units were acquired.

(4) The authorised fund manager is not liable to pay compensation under

(1)(b) if the person who acquired the units knew at the time of the

acquisition that the statement was untrue or misleading or knew of

the omission.

(5) For the purposes of this rule a revised prospectus will be treated as a

different prospectus from the original one.

(6) References in this rule to the acquisition of units include references to

contracting to acquire them.

Table: contents of the prospectus

.....................................................................................................

This table belongs to ■ COLL 4.2.2 R (Publishing the prospectus).

Document status

1 A statement that the document is the prospectus of the authorised

fund valid as at a particular date (which shall be the date of the

document).

Authorised fund

2 A description of the authorised fund including:

(a) its name;

(aa) its FCA product reference number (PRN);

COLL 4 : Investor Relations Section 4.2 : Pre-sale notifications

4

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 4/6

(b) whether it is an ICVC, ACS or an AUT;

(ba) whether it is a UCITS scheme or a non-UCITS retail scheme;

(bb) a statement that unitholders in an AUT, ICVC or co-ownership

scheme are not liable for the debts of the authorised fund;

(bc) a statement that the scheme property of a co-ownership

scheme is beneficially owned by the participants as tenants in

common (or, in Scotland, is the common property of the par-

ticipants);

(bd) a statement that a unitholder in a limited partnership scheme

is not liable for the debts or obligations of the limited part-

nership scheme beyond the amount of the scheme property

which is available to the authorised contractual scheme man-

ager to meet such debts or obligations, provided that the un-

itholder does not take part in the management of the part-

nership business;

(be) a statement that the exercise of rights conferred on limited

partners by FCA rules does not constitute taking part in the

management of the partnership business;

(c) for an ICVC, the address of its head office and the address of

the place in the United Kingdom for service on the ICVC of

notices or other documents required or authorised to be

served on it;

(ca) for an ACS that is a limited partnership scheme, the address

of the proposed principal place of business of the limited

partnership scheme;

(d) the effective date of the authorisation order made by the

FCA and relevant details of termination, if the duration of

the authorised fund is limited;

(e) its base currency;

(f) for an ICVC, the maximum and minimum sizes of its capital;

(g) the circumstances in which it may be wound up under the

rules and a summary of the procedure for, and the rights of

unitholders under, such a winding up; and

(h) if it is not an umbrella, a statement that it is a feeder UCITS,

a feeder NURS, a fund of alternative investment funds or a

property authorised investment fund, where that is the case.

Umbrella ICVCs or co-ownership schemes

2A The following statements for an ICVC or a co-ownership scheme

which is an umbrella:

(a) for an ICVC, a statement thatits sub-funds are segregated

portfolios of assets and, accordingly, the assets of a sub-fund

belong exclusively to that sub-fund and shall not be used to

discharge directly or indirectly the liabilities of, or claims

against, any other person or body, including the umbrella, or

any other sub-fund, and shall not be available for any such

purpose;

(aa) for a co-ownership scheme, a statement that the property

subject to a sub-fund is beneficially owned by the particip-

ants in that sub-fund as tenants in common (or, in Scotland, is

the common property of the participants in that sub-fund)

and must not be used to discharge any liabilit

COLL 4 : Investor Relations Section 4.2 : Pre-sale notifications

4

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 4/7

ies of, or meet any claims against, any person other than the

participants in that sub-fund; and

(b) for an ICVC or a co-ownership scheme, a statement that

while the provisions of the OEIC Regulations, and section

261P (Segregated liability in relation to umbrella co-owner-

ship schemes) of the Act in the case of co-ownership schemes,

provide for segregated liability between sub-funds, the con-

cept of segregated liability is relatively new. Accordingly,

where claims are brought by local creditors in foreign courts

or under foreign law contracts, it is not yet known how those

foreign courts will react to regulations 11A and 11B of the

OEIC Regulations or, as the case may be, section 261P of the

Act.

Umbrella Schemes

2B For a UCITS scheme or non-UCITS retail scheme which is an

umbrella:

(a) a statement detailing whether each specific sub-fund

is a feeder UCITS, a feeder NURS, a fund of alternat-

ive investment funds or a property authorised invest-

ment fund, as appropriate; and

(b) the FCA product reference number (PRN) of each sub-

fund.

Investment objectives and policy

3 The following particulars of the investment objectives and policy of

the authorised fund:

(a) the investment objectives, including its financial objectives;

(b) the authorised fund's investment policy for achieving those in-

vestment objectives, including the general nature of the port-

folio and, if appropriate, any intended specialisation;

(c) an indication of any limitations on that investment policy;

(c-b) where:

(i) a target for a scheme’s performance has been set, or

a payment out of scheme property is permitted, by

reference to a comparison of one or more aspects of

the scheme property or price with fluctuations in the

value or price of an index or indices or any other sim-

ilar factor (a “target benchmark”); or

(ii) without being a target benchmark, arrangements are

in place in relation to the scheme according to which

the composition of the portfolio of the scheme is, or

is implied to be, constrained by reference to the

value, the price or the components of an index or in-

dices or any other similar factor (a “constraining

benchmark”); or

(iii) without being a target benchmark or a constraining

benchmark, the scheme’s performance is compared

against the value or price of an index or indices or

any other similar factor (a “comparator benchmark”),

a statement providing sufficient information for investors to

understand the choice and use of any target benchmark, con-

straining benchmark or comparator benchmark in relation to

the scheme;

COLL 4 : Investor Relations Section 4.2 : Pre-sale notifications

4

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 4/8

(c-a) where no target benchmark, constraining benchmark or com-

parator benchmark is used, a statement to that effect and an

explanation of how investors can assess the performance of

the scheme;

(ca) for an authorised fund that has indicated in its name, invest-

ment objectives or fund literature (including in any financial

promotions for the fund), through use of descriptions such as

'absolute return', 'total return' or similar, an intention to de-

liver positive returns in all market conditions (and where

there is no actual guarantee of such returns), additional state-

ments in the authorised fund's investment objectives

specifying:

(i) that capital is in fact at risk;

(ii) the investment period over which the authorised

fund aims to achieve a positive return; and

(iii) there is no guarantee that this will be achieved over

that specific, or any, time period;

(d) the description of assets which the capital property may con-

sist of;

(e) the proportion of the capital property which may consist of

an asset of any description;

(f) the description of transactions which may be effected on be-

half of the authorised fund and an indication of any tech-

niques and instruments or borrowing powers which may be

used in the management of the authorised fund;

(g) a list of the eligible markets through which the authorised

fund may invest or deal in accordance with COLL 5.2.10 R (2)(b)

(Eligible markets: requirements);

(h) for an ICVC, a statement as to whether it is intended that the

scheme will have an interest in any immovable property or

movable property ((in accordance with COLL 5.6.4 R (2) (Invest-

ment powers: general) or COLL 5.2.8 R (2) (UCITS schemes: gen-

eral)) for the direct pursuit of the ICVC's business;

(i) where COLL 5.2.12 R (3) (Spread: government and public securit-

ies) applies:

(i) a prominent statement as to the fact that more than

35% in value of the scheme property is or may be in-

vested in transferable securities or approved money-

market instruments issued or guaranteed by a single

state, local authority or public international body;

and

(ii) the names of the individual states, local authorities

or public international bodies issuing or guaran-

teeing the securities in which more than 35% in

value of the scheme property may be invested;

(k) for an authorised fund which may invest in other schemes,

the extent to which the scheme property may be invested in

the units of schemes which are managed by the authorised

fund manager or by its associate;

COLL 4 : Investor Relations Section 4.2 : Pre-sale notifications

4

■ Release 39 ● Aug 2024 www.handbook.fca.org.uk COLL 4/9

(ka) where a scheme is a feeder scheme (other than a feeder UC-

ITS or a feeder NURS), which (in respect of investment in un-

its in collective investment schemes) is dedicated to units in a

single collective investment scheme, details of the master

scheme and the minimum (and, if relevant, maximum) invest-

ment that the feeder scheme may make in it;

(l) where a scheme invests principally in scheme units, deposits

or derivatives, or replicates an index in accordance with COLL

5.2.31 R or COLL 5.6.23 R (Schemes replicating an index), a prom-

inent statement regarding this investment policy;

(m) where derivatives transactions may be used in a scheme, a

prominent statement as to whether these transactions are for

the purposes of efficient portfolio management (includ-

inghedging) or meeting the investment objectives or both

and the possible outcome of the use of derivatives on the risk

profile of the scheme;

(n) information concerning the profile of the typical investor for

whom the scheme is designed;

(o) information concerning the historical performance of the

scheme, comparing in particular its historical performance

against each target benchmark and each constraining

benchmark used in relation to the scheme, presented in ac-

cordance with COBS 4.6.2R (the rules on past performance);

(p) for a non-UCITS retail scheme which invests in immovables, a

statement of the countries or territories of situation of land

or buildings in which the authorised fund may invest;

(pa) for a fund investing in inherently illiquid assets at least the

following (see FUND 3.2.2R(8) (Prior disclosure of information

to investors)):

(i) an explanation of the risks associated with the

scheme investing in inherently illiquid assets and how

those risks might crystallise;

(ii) a description of the tools and arrangements the au-

thorised fund manager would propose using, includ-

ing those required by FCA rules, to mitigate the risks

referred to in (i); and

(iii) an explanation of the circumstances in which those

tools and arrangements would typically be deployed

and the likely consequences for investors;

(q) for a UCITS scheme which invests a substantial portion of its

assets in other schemes, a statement of the maximum level of

management fees that may be charged to that UCITS scheme

and to the schemes in which it invests;

(qa) where the authorised fund is a qualifying money market

fund, a statement identifying it as such a fund and a state-

ment that the authorised fund's investment objectives and

policies will meet the conditions specified in the definition of

qualifying money market fund;

(r) where the net asset value of a UCITS scheme is likely to have

high volatility owing to its portfolio composition or the port-

folio management techniques that may be used, a prominent

statement to that effect;

(s) for a UCITS scheme, a statement that any unitholder may ob-

tain on request the types of information (which must be

listed) referred to in COLL 4.2.3R (3) (Availability of prospectus

and long report); and

COLL 4 : Investor Relations Section 4.2 : Pre-sale notifications

4

■ Release 39 ● Aug 2024www.handbook.fca.org.ukCOLL 4/10

(t) for a UCITS scheme that is or is intended to be a master UC-

ITS, a statement that it is not a feeder UCITS and will not

hold units of a feeder UCITS.

Reporting, distributions and accounting dates

4 Relevant details of the reporting, accounting and distribution in-

formation which includes:

(a) the accounting and distribution dates;

(b) procedures for:

(i) determining and applying income (including how any

distributable income is paid);

(ii) unclaimed or unwanted distributions, including any

arrangements for the transfer of:

(A) an unclaimed eligible distribution of income

that is a dormant asset (see COLL 6.8.4R (Un-

claimed, de minimis and joint unitholder dis-

tributions)); or

(B) unwanted asset money (see COLL 6.8.4AR (Un-

wanted asset money)); and

(iii) if relevant, calculating, paying and accounting for in-

come equalisation; and

(c) the accounting reference date and when the long report will

be published in accordance with COLL 4.5.14 R (Publication and

availability of annual and half-yearly long report).

(d) [deleted]

Characteristics of the units

5 Information as to:

(a) where there is more than one class of unit in issue or avail-

able for issue, the name of each such class and the rights at-

tached to each class in so far as they vary from the rights at-

tached to other classes;

(b) [deleted]

(c) how unitholders may exercise their voting rights and what

these amount to;