REPORT ON EXAMINATION

OF THE

BERKSHIRE HATHAWAY ASSURANCE CORPORATION

AS OF

DECEMBER 31, 2012

DATE OF REPORT MAY 23, 2014

EXAMINER ADEBOLA AWOFESO

TABLE OF CONTENTS

ITEM NO. PAGE NO.

1 Scope of Examination 2

2. Description of Company 4

A. Management 4

B. Territory and plan of operation 5

C. Reinsurance 7

D. Holding company system 8

E. Significant operating ratios 11

F. Risk management and internal controls 12

3. Financial Statements 13

A. Balance sheet 13

B. Statement of income 14

4. Losses and loss adjustment expenses 15

5. Compliance with prior report on examination 15

6. Summary of comments and recommendations 16

NEW

YORK

STATE

DEPARTMENTof

FINANCIAL SERVICES

Andrew M. Cuomo

Benjamin M. Lawsky

Governor

Superintendent

May 23, 2014

Honorable Benjamin M. Lawsky

Superintendent of Financial Services

Albany, New York 12257

Sir:

Pursuant to the requirements of the New York Insurance Law, and in compliance with the

instructions contained in Appointment Number 30965 dated February 26, 2013, attached hereto, I

have made an examination into the condition and affairs of Berkshire Hathaway Assurance

Corporation as of December 31, 2012, and submit the following report thereon.

Wherever the designation “the Company” appears herein without qualification, it should be

understood to indicate Berkshire Hathaway Assurance Corporation.

Wherever the term “Department” appears herein without qualification, it should be

understood to mean the New York State Department of Financial Services.

The examination was conducted at the Company’s main administrative office located at 3024

Harney Street, Omaha, Nebraska 68131.

(212) 480-6400 | One State Street, New York, NY 10004-2319 | WWW.DFS.NY.GOV

2

1. SCOPE OF EXAMINATION

The Department has performed a coordinated group examination of the Berkshire Hathaway

Assurance Corporation. The examination was conducted in conjunction with the state of Nebraska,

which was the coordinating state of the Berkshire Hathaway Group of Insurance Companies. This is

the first financial examination of the Company after the report on organization, which was conducted

as of December 27, 2007. This examination covered the period from December 28, 2007 through

December 31, 2012. Transactions occurring subsequent to this period were reviewed where deemed

appropriate by the examiner.

The examination was performed concurrently with the examinations of the following insurers:

American Centennial Insurance Company (DE)

Berkshire Hathaway Assurance Corporation (NY)

Berkshire Hathaway Homestate Insurance Company (NE)

Berkshire Hathaway Life Insurance Company of Nebraska (NE)

Brookwood Insurance Company (IA)

Columbia Insurance Company (NE)

Continental Divide Insurance Company (CO)

Cypress Insurance Company (CA)

Finial Reinsurance Company (CT)

National Fire & Marine Insurance Company (NE)

National Indemnity Company (NE)

National Indemnity Company of Mid-America (IA)

National Indemnity Company of the South (FL)

National Liability & Fire Insurance Company (CT)

Oak River Insurance Company (NE)

Redwood Fire and Casualty Insurance Company (NE)

Stonewall Insurance Company (NE)

Unione Italiana Reinsurance Company of America (NY)

Wesco-Financial Insurance Company (NE)

Other states participating in this examination were California, Colorado, Connecticut,

Delaware, Florida, Iowa and Nebraska.

This examination was conducted in accordance with the National Association of Insurance

Commissioners (“NAIC”) Financial Condition Examiners Handbook (“Handbook”), which requires

that we plan and perform the examination to evaluate the financial condition and identify prospective

risks of the Company by obtaining information about the Company including corporate governance,

identifying and assessing inherent risks within the Company and evaluating system controls and

procedures used to mitigate those risks. This examination also includes assessing the principles used

3

and significant estimates made by management, as well as evaluating the overall financial statement

presentation, management’s compliance with Statutory Accounting Principles and annual statement

instructions when applicable to domestic state regulations.

All financially significant accounts and activities of the Company were considered in

accordance with the risk-focused examination process. The examiners also relied upon audit work

performed by the Company’s independent public accountants when appropriate.

This examination report includes a summary of significant findings for the following items as

called for in the Handbook:

Significant subsequent events

Company history

Corporate records

Management and control

Fidelity bonds and other insurance

Territory and plan of operation

Growth of Company

Loss experience

Reinsurance

Accounts and records

Statutory deposits

Financial statements

Summary of recommendations

A review was also made to ascertain what action was taken by the Company with regard to

comments and recommendations contained in the prior report on examination.

This report on examination is confined to financial statements and comments on those matters

that involve departures from laws, regulations or rules, or that are deemed to require explanation or

description.

4

2. DESCRIPTION OF COMPANY

Berkshire Hathaway Assurance Corporation was incorporated under the laws of the State of

New York on December 21, 2007. It became licensed on December 28, 2007 in the State of New

York to engage in financial guaranty and surety insurance business.

The Company operates as a monoline bond insurer and provides insurance for tax-exempt

bonds issued by states, cities and other local entities. The Company insures these securities for

issuers both at the time their bonds are sold to the public (primary transactions) and also provides

insurance for bonds that are already owned by investors in the secondary market.

The Company is 51% owned by Columbia Insurance Company (“CIC”) and 49% owned by

National Indemnity Company (“NICO”), both Nebraska domiciled insurers.

Capital paid in is $15,000,000 consisting of 2,500 shares of $6,000 par value per share

common stock. Effective January 18, 2008, the Company amended its charter to increase the par

value of its common stock from $1,000 per share to $6,000 per share. Gross paid in and contributed

surplus is $990,000,000. The following chart shows the changes to capital stock and gross paid in

and contributed surplus during the examination period:

Common Gross paid in and

Date Description Capital Stock contributed surplus

12/28/2007 Beginning balance $ 2,500,000 $102,500,000

1/18/2008 Increase in par value of common stock 12,500,000 (12,500,000)

3/31/2008 Surplus contribution from parent 0 900,000,000

12/31/2012 Ending balance $15,000,000 $990,000,000

A. Management

Pursuant to the Company’s charter and by-laws, management of the Company is vested in a

board of directors consisting of not less than seven members. At December 31, 2012, the board of

directors was comprised of the following eight members:

Name and Residence Principal Business Affiliation

John Duane Arendt, Insurance Executive,

Stamford, CT National Liability & Fire Insurance Company

5

Name and Residence Principal Business Affiliation

Erika Bunner Duffy, Attorney,

Fairfield, CT National Liability & Fire Insurance Company

Lori Jill Friedman, Attorney,

Armonk, NY National Liability & Fire Insurance Company

Dale David Geistkemper Treasurer and Controller,

Omaha, NE National Indemnity Company

Ajit Jain, Chairman of the Board,

Rye, NY National Liability & Fire Insurance Company

Forrest Nathan Krutter, Attorney, Insurance Executive,

Milyon Mills, NH National Indemnity Company

Brian Gerard Snover, Attorney, Insurance Executive,

Stamford, CT National Liability & Fire Insurance Company

Donald Frederick Wurster, Insurance Executive,

Omaha, NE National Indemnity Company

As of December 31, 2012, the principal officers of the Company were as follows:

Name

Donald Frederick Wurster

Dale David Geistkemper

Erika Bunner Duffy

Title

President

Treasurer

Secretary

B. Territory and Plan of Operation

As of December 31, 2012, the Company was licensed to write business in all fifty states, the

District of Columbia and Puerto Rico.

As of the examination date, the Company was authorized to transact the kinds of insurance as

defined in the following numbered paragraphs of Section 1113(a) of the New York Insurance Law:

Paragraph Line of Business

16 (C)(D)(E)(F)(G)(H)(I) Surety

17 (A) Credit

25 Financial Guaranty

6

Based on the lines of business for which the Company is licensed and the Company’s current

capital structure, and pursuant to the requirements of Articles 41 and 69 of the New York Insurance

Law, the Company is required to maintain a minimum surplus to policyholders in the amount of

$66,400,000.

The following schedule shows the direct premiums written by the Company both in total and

in New York for the period under examination:

Premiums Written in New York State as

Calendar Year New York State Total Premiums a Percentage of Total Premium

2008 $500,859,153 $593,629,919 84.37%

2009 $ 18,862,526 $ 38,814,133 48.60%

2010 $ 0 $ 6,511,350 0.00%

2011 $ 0 $ 5,379,513 0.00%

2012 $ 1,853,850 $ 10,214,551 18.15%

The company operates as a monoline bond insurer and provides insurance for tax-exempt

bonds issued by states, cities and other local entities. The Company insures these securities for

issuers both at the time their bonds are sold to the public (primary transactions) and also provides

insurance for bonds that are already owned by investors in the secondary market.

7

C. Reinsurance

The Company has structured its ceded reinsurance program to limit its maximum to any one

risk through quota share and facultative reinsurance treaties.

The following is a description of the Company’s ceded reinsurance program in effect at

December 31, 2012:

The Company entered into a 49% quota share reinsurance agreement with National Indemnity

Company (“NICO”), an affiliate, whereby the Company may issue and choose to cede to NICO 49%

of the Company’s acceptable risks. During the examination period, no risks were ceded under this

agreement.

The Company entered into a facultative quota share reinsurance agreement with National

Indemnity Company (“NICO”), an affiliate. Under the terms of this agreement NICO agrees to

reinsure 92.5% of a surety bond the Company issued to M&T Bank Corporation.

Reinsurance agreements with affiliates were reviewed for compliance with Article 15 of the

New York Insurance Law. It was noted that all affiliated reinsurance agreements were filed with the

Department pursuant to the provisions of Section 1505(d)(2) of the New York Insurance Law.

Ceded reinsurance agreements in effect as of the examination date were reviewed and found

to contain the required clauses, including an insolvency clause meeting the requirements of Section

1308 of the New York Insurance Law.

Examination review of the Schedule F data reported by the Company in its filed annual

statement was found to accurately reflect its reinsurance transactions

.

Additionally, management has represented that all material ceded reinsurance agreements

transfer both underwriting and timing risk as set forth in SSAP No. 62R. Representations were

supported by appropriate risk transfer analyses and an attestation from the Company's Chief

Executive Officer pursuant to the NAIC Annual Statement Instructions. Additionally, examination

review indicated that the Company was not a party to any finite reinsurance agreements. All ceded

reinsurance agreements were accounted for utilizing reinsurance accounting as set forth in SSAP No.

62R.

8

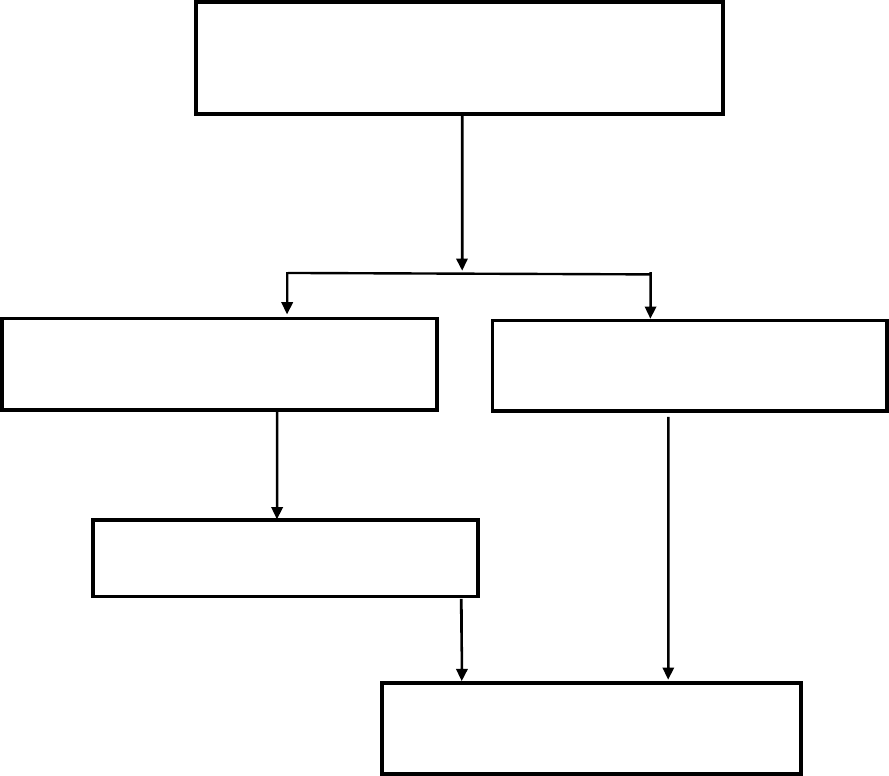

D. Holding Company System

The Company is a member of the Berkshire Hathaway Group. The Company is 51% owned

by Columbia Insurance Company and 49% owned by National Indemnity Company, both Nebraska

domiciled corporations, which are ultimately controlled by Berkshire Hathaway Inc. (34.787%

owned by Warren E. Buffett).

A review of the Holding Company Registration Statements filed with this Department

indicated that such filings were complete and were filed in a timely manner pursuant to Article 15 of

the New York Insurance Law and Department Regulation 52.

The following is an abbreviated chart of the Company’s holding company system at

December 31, 2012:

i

!

,,

.

"

9

Berkshire Hathaway Inc.

(34.787% owned by Warren E. Buffett)

100%

100%

B H Columbia Inc.

National Indemnity Company

100%

49%

Columbia Insurance Company

Berkshire Hathaway Assurance Corporation

51%

10

At December 31, 2012, the Company was party to the following agreements with other

members of its holding company system:

Tax Allocation Agreement

The Company is party to a tax allocation agreement among various affiliated members of its

ultimate parent Berkshire Hathaway Inc. The agreement has an effective date of December 31, 2007.

Pursuant to the terms of the agreement, the parties will file consolidated federal income tax returns.

Said agreement stipulates that the Company’s tax liability on a consolidated basis would not exceed

the liability had the Company filed its tax return on a stand-alone basis. The agreement was filed

with the Department pursuant to Section 1505 of the New York Insurance Law.

Service Agreement with National Indemnity Company

Effective January 1, 2008, the Company and its affiliate, National Indemnity Company

(“NICO”), entered into a service agreement. Under the terms of this agreement, NICO performs

certain administrative and special services on behalf of the Company. The agreement provides that

payment for services provided shall be on an actual cost basis. The agreement was filed with the

Department pursuant to Section 1505 of the New York Insurance Law.

Service Agreement with National Liability & Fire Insurance Company

Effective January 1, 2008, the Company and its affiliate, National Liability & Fire Insurance

Company (“NLF”), entered into a service agreement. Under the terms of this agreement, NLF

performs certain administrative and special services on behalf of the Company. The agreement

provides that payment for services provided shall be on an actual cost basis. The agreement was filed

with the Department pursuant to Section 1505 of the New York Insurance Law.

11

Investment Services Agreement

Effective December 31, 2007, the Company and NICO entered into an Investment Services

Agreement. Pursuant to the agreement, NICO will act as an investment manager of the Company.

The agreement was filed with the Department pursuant to Section 1505 of the New York Insurance

Law.

Inter-Company Service Agreement with FlightSafety International

Effective January 1, 2008, the Company and its affiliate, FlightSafety International

(“FlightSafety”), entered into a service agreement. Under the terms of this agreement, FlightSafety

performs certain administrative and special services on behalf of the Company. The agreement

provides that payment for services provided shall be on an actual cost basis. The agreement was filed

with the Department pursuant to Section 1505 of the New York Insurance Law.

E. Significant Operating Ratios

The following ratios have been computed as of December 31, 2012, based upon the results of

this examination:

Net premiums written to surplus as regards policyholders 1%

Liabilities to liquid assets (cash and invested assets less investments in affiliates) 38%

Premiums in course of collection to surplus as regards policyholders 0%

All of the above ratios fall within the benchmark range set forth in the Insurance Regulatory

Information System (“IRIS”) of the National Association of Insurance Commissioners.

The underwriting ratios presented below are on an earned/incurred basis and encompass the

December 28, 2007 to December 31, 2012 time period covered by this examination:

Amounts Ratios

Losses and loss adjustment expenses incurred $ 0 0.00%

Other underwriting expenses incurred 48,089,161 41.81

Net underwriting gain 66,920,679 58.19

Premiums earned $115,009,840 100.00%

12

F. Risk Management and Internal Control

A review was made of the Company’s internal control with regard to its IT environment. The

review found numerous internal control weaknesses. The Company was provided with a copy of the

IT recommendations, none of which will be considered a serious control deficiency.

It is recommended that the Company address the internal control weaknesses identified during

the review of the Company’s IT environment.

13

3. FINANCIAL STATEMENTS

A. Balance Sheet

The following shows the assets, liabilities and surplus as regards policyholders as of

December 31, 2012 as determined by this examination and as reported by the Company:

Assets

Bonds

Preferred stocks

Common stocks

Property held for sale

Cash, cash equivalents and short-term investm

Investment income due and accrued

Uncollected premiums and agents' balances in

course of collection

Assets

$ 544,335,858

128,000,000

423,032,584

3,750,000

ents 733,699,804

12,067,273

the

101,198

Assets Not

Admitted

$ 0

3,750,000

0

Net Admitted

$

Assets

544,335,858

128,000,000

423,032,584

0

733,699,804

12,067,273

101,198

Total assets $1,844,986,717 $3,750,000 $1,841,236,717

Liabilities, Surplus and Other Funds

Liabilities

Losses and loss adjustment expenses $ 0

Taxes, licenses and fees (excluding federal and foreign income

taxes) 258,892

Current federal and foreign income taxes 4,343,760

Net deferred tax liability 9,859,827

Unearned premiums 534,329,314

Advance premium 2,760,194

Payable to parent, subsidiaries and affiliates 48,831

Contingency reserves

140,339,151

Total liabilities $ 691,939,969

Surplus and Other Funds

Common capital stock $ 15,000,000

Gross paid in and contributed surplus 990,000,000

Unassigned funds (surplus) 144,296,748

Surplus as regards policyholders $1,149,296,748

Total liabilities, surplus and other funds $1,841,236,717

Note: The Internal Revenue Service has completed its audits of the Company’s consolidated Federal

Income Tax returns through tax year 2009. All material adjustments, if any, made subsequent to the

date of examination and arising from said audits, are reflected in the financial statements included in

this report. Audits covering tax years 2010 through 2011 are currently under examination. The

examiner is unaware of any potential exposure of the Company to any tax assessment and no liability

has been established herein relative to such contingency.

14

B. Statement of Income

Surplus as regards policyholders increased $1,044,296,748 during the examination period

December 28, 2007 through December 31, 2012, detailed as follows:

Underwriting Income

Premiums earned $ 115,009,840

Deductions:

Losses and loss adjustment expenses incurred $ 0

Other underwriting expenses incurred 48,089,161

Total underwriting deductions 48,089,161

Net underwriting gain $ 66,920,679

Investment Income

Net investment income earned $ 250,562,739

Net realized capital gain 18,864,173

Net investment gain $ 269,426,912

Other Income

Aggregate write-ins for miscellaneous income $ (193,567)

Total other income $ (193,567)

Net income before federal and foreign income taxes $ 336,154,024

Federal and foreign income taxes incurred 122,262,323

Net income $ 213,891,701

15

Surplus as regards policyholders per report on

organization as of December 27, 2007

Net income

Net unrealized capital gains or (losses)

Change in net deferred income tax

Change in non-admitted assets

Cumulative effect of changes in accounting

Capital transferred from surplus

Surplus paid in

Surplus transferred to capital stock

Increase in contingency reserve

Total gains and losses

Net increase (decrease) in surplus

Surplus as regards policyholders per report on

examination as of December 31, 2012

Gains in

Surplus

$213,891,701

54,830,115

19,664,081

1,203,584

12,500,000

900,000,000

$1,202,089,483

Losses in

Surplus

$

4,953,584

12,500,000

140,339,151

$157,792,735

$105,000,000

$1,044,296,748

$1,149,296,748

4. LOSSES AND CONTINGENCY RESERVES

The examination liabilities for losses and contingency reserves are $0 and $140,339,151,

respectively, as of December 31, 2012. These are the same as the amounts reported by the Company

in its 2012 filed annual statement.

In addition to case reserves, the Company is required to establish and maintain contingency

reserves for the protection of insureds and claimants against the effect of excessive losses occurring

during adverse economic cycles. The amount required for those reserves depends on the types of

bonds being insured and are established pursuant to the provisions of Section 6903(a) of the New

York Insurance Law. New York Insurance Law requires that one-eightieth of required contingency

reserves are accreted every quarter over a twenty year period, however the Company has committed

to the Department it would accrete one fortieth of required contingency reserves each quarter over a

ten year period.

16

5. COMPLIANCE WITH REPORT ON ORGANIZATION

The report on organization did not contain any comments or recommendations.

6. SUMMARY OF COMMENTS AND RECOMMENDATIONS

ITEM PAGE NO.

A. Risk Management and Internal Control

It is recommended that the Company address the internal control 12

weaknesses identified during the review of the Company’s IT

environment.

Respectfully submitted,

/s/

Adebola Awofeso

Senior Insurance Examiner

STATE OF NEW YORK )

)ss:

COUNTY OF NEW YORK )

ADEBOLA AWOFESO being duly sworn, deposes and says that the foregoing report,

subscribed by him, is true to the best of his knowledge and belief.

/s/

Adebola Awofeso

Subscribed and sworn to before me

this day of , 2014.

APPOINTMENT

NO.

30965

NEW

YORK STATE

DEPARTMENT

OF

FINANCIAL SERVICES

I,

BENJAMIN

M.

LAWSKY. Superintendent

of

Financial Services

of

the State

of

New

York,

pursuant

to

the provisions

of

the Financial Services Law

and

the

Insurance Law, do hereby appoint:

Adebola Awofeso

as a proper person

to

examine the affairs

of

the

BERKSHIRE

HATHAWAY

ASSURANCE

CORPORATION

and to make a report

to

me

in

writing

of

the condition

of

said

COMPANY

with such other information

as

he shall deem requisite.

In Witness Whereof, I have hereunto subscribed by name

and

affixed the official Seal

of

the Department

at the City

of

New York

·this 26th day

of

February, 2013

BENJAMIN M LAWSKY

Superintendent

of

Financial Services

By:

Jean Marie Cho

Deputy Superintendent